Robinhood Asset Surge: $255B In Assets, 108% Trading Volume Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Rides High: $255 Billion Asset Surge and Exploding Trading Volume

Robinhood, the popular commission-free trading app, is experiencing a significant surge in both assets under custody and trading activity, signaling a potential resurgence in retail investor interest. The company recently reported holding $255 billion in assets, a substantial increase that reflects a renewed confidence in the platform and potentially broader market optimism. Furthermore, trading volume has seen a remarkable 108% increase, highlighting a dramatic uptick in user engagement. This news has sent ripples through the financial world, prompting analysts to reassess the platform's future and its impact on the overall market.

What's Driving the Robinhood Rally?

Several factors likely contribute to this impressive growth. The recent market recovery, after a period of volatility, has undoubtedly boosted investor sentiment. Many believe that Robinhood's user-friendly interface and commission-free trading model continue to attract new users, particularly among younger, tech-savvy investors. The company's ongoing efforts to expand its product offerings, including crypto trading and options, are also likely playing a role.

However, it's important to consider potential contributing factors beyond simple market trends. Recent improvements to the platform’s reliability and customer service, following past criticisms, might be contributing to increased user trust and retention. Additionally, targeted marketing campaigns and social media engagement could be driving new user acquisition and boosting trading volumes.

A Closer Look at the Numbers:

- $255 Billion in Assets: This represents a significant milestone for Robinhood, highlighting its growing influence in the retail brokerage sector. This figure underscores the increasing trust placed in the platform by a considerable number of investors.

- 108% Trading Volume Increase: This dramatic increase is a clear indicator of heightened activity on the platform. It suggests that investors are not only holding assets but are actively engaging in trading, potentially driving higher transaction fees for Robinhood.

The Future of Robinhood:

While the current figures are undeniably positive, it's crucial to maintain a balanced perspective. The market remains volatile, and future performance is never guaranteed. The company will need to continue innovating and adapting to the ever-changing landscape of the financial technology industry to sustain this momentum. Competition from established brokerage firms and emerging fintech companies remains fierce.

Is this a Sustainable Trend?

The long-term sustainability of this growth remains a key question for investors and analysts. While the recent surge is impressive, it's important to consider the cyclical nature of the stock market and the potential impact of future economic downturns. Continued innovation, improved customer service, and strategic expansion will be crucial for Robinhood to maintain its upward trajectory. Further analysis of user demographics and trading patterns will provide a clearer picture of the longevity of this positive trend.

Call to Action: Stay informed about the evolving financial landscape by regularly checking reputable financial news sources. Understanding market trends and company performance is crucial for making informed investment decisions. Remember to consult with a financial advisor before making any investment choices.

Keywords: Robinhood, asset surge, trading volume, retail investors, commission-free trading, fintech, stock market, investment, financial technology, market volatility, economic downturn, brokerage, crypto trading, options trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Asset Surge: $255B In Assets, 108% Trading Volume Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Top Golfer Robert Mac Intyre Highlights Scottish Courses Difficulty

Jun 14, 2025

Top Golfer Robert Mac Intyre Highlights Scottish Courses Difficulty

Jun 14, 2025 -

Whats Fueling The Northern Ireland Unrest Three Nights Of Petrol Bomb Attacks

Jun 14, 2025

Whats Fueling The Northern Ireland Unrest Three Nights Of Petrol Bomb Attacks

Jun 14, 2025 -

49ers Kittle Speaks Out Supporting Deebo Samuel After Viral Video Criticism

Jun 14, 2025

49ers Kittle Speaks Out Supporting Deebo Samuel After Viral Video Criticism

Jun 14, 2025 -

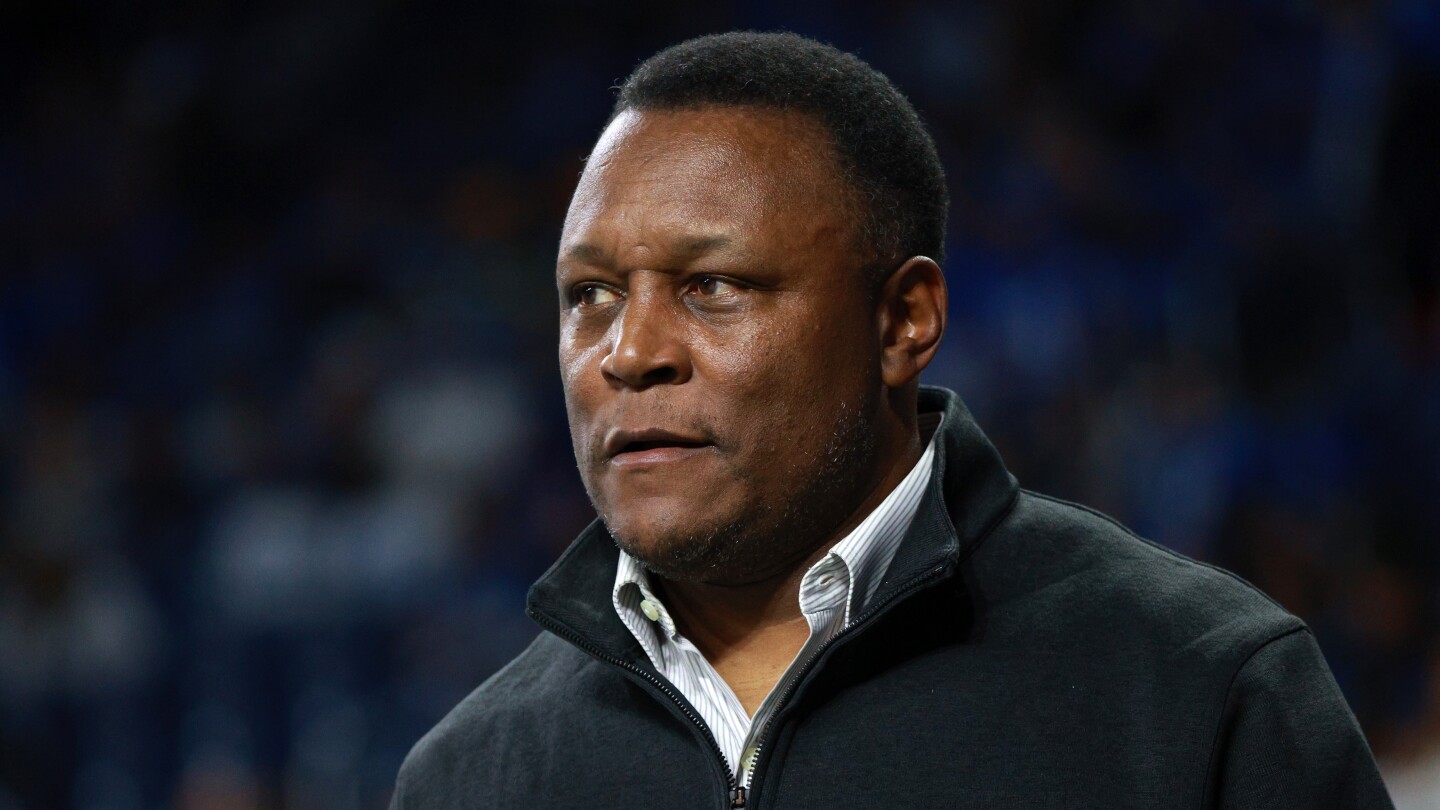

Heart Attack Survivor Barry Sanders Champions Cardiac Care Awareness

Jun 14, 2025

Heart Attack Survivor Barry Sanders Champions Cardiac Care Awareness

Jun 14, 2025 -

Crypto Trading Fuels Robinhoods Success 255 Billion In Assets Massive Volume Surge

Jun 14, 2025

Crypto Trading Fuels Robinhoods Success 255 Billion In Assets Massive Volume Surge

Jun 14, 2025