Rising Mortgage Rates: Positive Economic News Impacts Borrowers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Mortgage Rates: A Silver Lining for Borrowers? Positive Economic Impacts Explained

The recent surge in mortgage rates has understandably caused anxiety for many prospective homebuyers. Images of unattainable dream homes and shrinking budgets fill headlines. But a closer look reveals a more nuanced picture, one where rising rates, while challenging, also reflect positive underlying economic strength that could ultimately benefit borrowers in the long run. Let's delve into the complexities of this situation.

The Current Mortgage Rate Landscape:

Mortgage rates have indeed climbed significantly in recent months, largely due to the Federal Reserve's efforts to combat inflation. Higher rates make borrowing more expensive, leading to higher monthly payments and potentially cooling down the previously red-hot housing market. This increase, while initially unsettling, is a symptom of a stronger economy. The Fed's actions are designed to curb inflation, a crucial factor impacting everyone's purchasing power. [Link to a reputable source on current mortgage rates]

Why Rising Rates Might Be Good News:

While the immediate impact on affordability is undeniable, several long-term economic benefits could emerge from this trend:

-

Stabilization of the Housing Market: The rapid escalation of home prices in recent years has priced many potential buyers out of the market. Rising rates help slow this price growth, creating a more balanced and sustainable market. This means more stability for existing homeowners and a potentially more attainable market for future buyers.

-

Curbing Inflation: The primary goal of the Fed's rate hikes is to tame inflation. By making borrowing more expensive, they aim to reduce consumer spending and cool down the economy, leading to lower inflation rates. Lower inflation ultimately benefits everyone by preserving the purchasing power of their income. [Link to a reputable source on current inflation rates]

-

Improved Long-Term Economic Outlook: A controlled reduction in inflation, coupled with a more stable housing market, contributes to a healthier and more predictable economic climate. This predictability is crucial for long-term economic planning and investment.

Navigating the Challenges:

It's crucial to acknowledge the challenges presented by higher mortgage rates. First-time homebuyers, in particular, may find it harder to afford a home. However, the current situation presents an opportunity for more strategic planning.

- Saving More: With higher rates, saving for a larger down payment becomes even more critical to secure a favorable mortgage.

- Improved Credit Score: A strong credit score is crucial for securing the best possible interest rate. Improving your creditworthiness is a proactive step towards navigating higher rates.

- Exploring Alternative Financing Options: Consider exploring options like FHA loans or government-backed programs that might offer more flexibility.

Looking Ahead:

While rising mortgage rates pose immediate challenges, they are also indicative of a broader economic picture. By understanding the underlying economic factors and adopting a proactive approach, both buyers and sellers can better navigate this dynamic market. The key is to maintain a long-term perspective and leverage the opportunities that emerge from a more stable and sustainable economic environment.

Call to Action: Consult with a financial advisor to discuss your personal circumstances and develop a tailored plan for navigating the current mortgage rate environment. Remember, informed decision-making is key to success in any market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Mortgage Rates: Positive Economic News Impacts Borrowers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nick Sirianni Eagles Head Coach Agrees To Contract Extension After Super Bowl Lvii

May 19, 2025

Nick Sirianni Eagles Head Coach Agrees To Contract Extension After Super Bowl Lvii

May 19, 2025 -

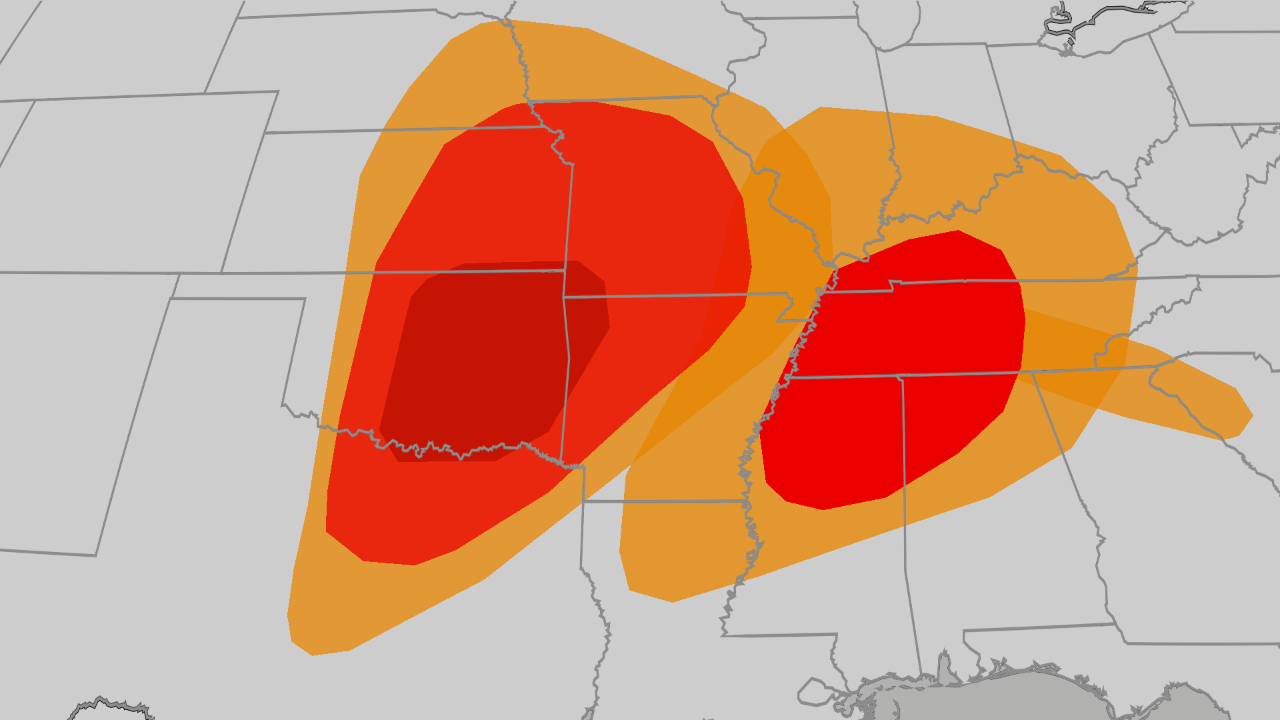

Tornado Watch Severe Weather Outbreak Targets Central United States

May 19, 2025

Tornado Watch Severe Weather Outbreak Targets Central United States

May 19, 2025 -

Nick Siriannis Eagles Reign Continues Coach Agrees To Multi Year Extension

May 19, 2025

Nick Siriannis Eagles Reign Continues Coach Agrees To Multi Year Extension

May 19, 2025 -

Character Found How Souceks Presence Revived West Ham Vs Tottenham And Man Utd

May 19, 2025

Character Found How Souceks Presence Revived West Ham Vs Tottenham And Man Utd

May 19, 2025 -

Super Bowl Champions Nick Sirianni Gets Contract Extension With Philadelphia Eagles

May 19, 2025

Super Bowl Champions Nick Sirianni Gets Contract Extension With Philadelphia Eagles

May 19, 2025