Rigetti (RGTI) Q1 Earnings Miss Sends Stock Into Freefall

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rigetti (RGTI) Q1 Earnings Miss Sends Stock into Freefall: What Went Wrong?

Rigetti Computing (RGTI), a prominent player in the burgeoning quantum computing industry, saw its stock plummet following a disappointing first-quarter earnings report. The news sent shockwaves through the market, raising questions about the company's future and the overall stability of the quantum computing sector. This article delves into the specifics of the earnings miss, explores potential contributing factors, and analyzes the implications for investors.

Q1 Earnings: A Deep Dive into the Disappointment

Rigetti's Q1 2024 earnings release revealed a significant shortfall in expectations, triggering a sharp decline in its stock price. The company missed revenue projections, reporting substantially lower figures than analysts had predicted. This underperformance was attributed to several factors, including slower-than-anticipated customer adoption of its quantum computing services and challenges in scaling production. The detailed financial results, including specifics on revenue, net loss, and cash burn, highlighted a tougher-than-expected operating environment. [Link to Rigetti's official Q1 earnings report].

Key Factors Contributing to the Stock's Freefall

Several contributing factors contributed to the negative market reaction:

- Revenue Miss: The most significant factor was the substantial miss on revenue projections. This suggests challenges in securing and delivering contracts, potentially indicating a slower-than-expected market uptake of quantum computing solutions.

- Increased Competition: The quantum computing landscape is becoming increasingly competitive, with established tech giants and emerging startups vying for market share. Rigetti faces stiff competition from companies like IBM, Google, and IonQ, all of which are making significant advancements in the field.

- Higher-Than-Expected Operating Costs: The company's operating costs may have been higher than anticipated, further impacting profitability and contributing to the disappointing financial results. Increased R&D spending, necessary for innovation in a rapidly evolving technology, could also play a role.

- Investor Sentiment: The overall negative sentiment surrounding the tech sector, combined with the specific challenges faced by Rigetti, likely amplified the impact of the earnings miss on the stock price.

Implications for Investors and the Future of RGTI

The stock's sharp decline raises concerns for investors. While the long-term potential of quantum computing remains significant, the short-term outlook for Rigetti appears challenging. Investors will be closely monitoring the company's strategic initiatives, including its efforts to secure new contracts, streamline operations, and control costs. The company's ability to address these challenges will be crucial in restoring investor confidence.

Looking Ahead: Potential Recovery Strategies

Rigetti needs to focus on several key areas to navigate this challenging period:

- Accelerated Customer Acquisition: A renewed focus on securing and delivering contracts is paramount. This may involve targeted marketing campaigns and partnerships to demonstrate the value proposition of its quantum computing solutions.

- Cost Optimization: Streamlining operations and reducing costs without compromising innovation is crucial for improving profitability.

- Technological Advancements: Continued investment in R&D is essential for maintaining a competitive edge in this rapidly evolving field. Announcing breakthroughs or milestones in their quantum computing technology could significantly boost investor confidence.

The future of Rigetti remains uncertain, but its response to this setback will be critical in determining its long-term success. The quantum computing sector holds immense potential, but navigating the challenges of early-stage development and fierce competition is a significant hurdle. This earnings miss serves as a stark reminder of the risks involved in investing in this emerging technology.

Disclaimer: This article provides general information and analysis and does not constitute financial advice. Investing in stocks carries inherent risks, and it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rigetti (RGTI) Q1 Earnings Miss Sends Stock Into Freefall. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

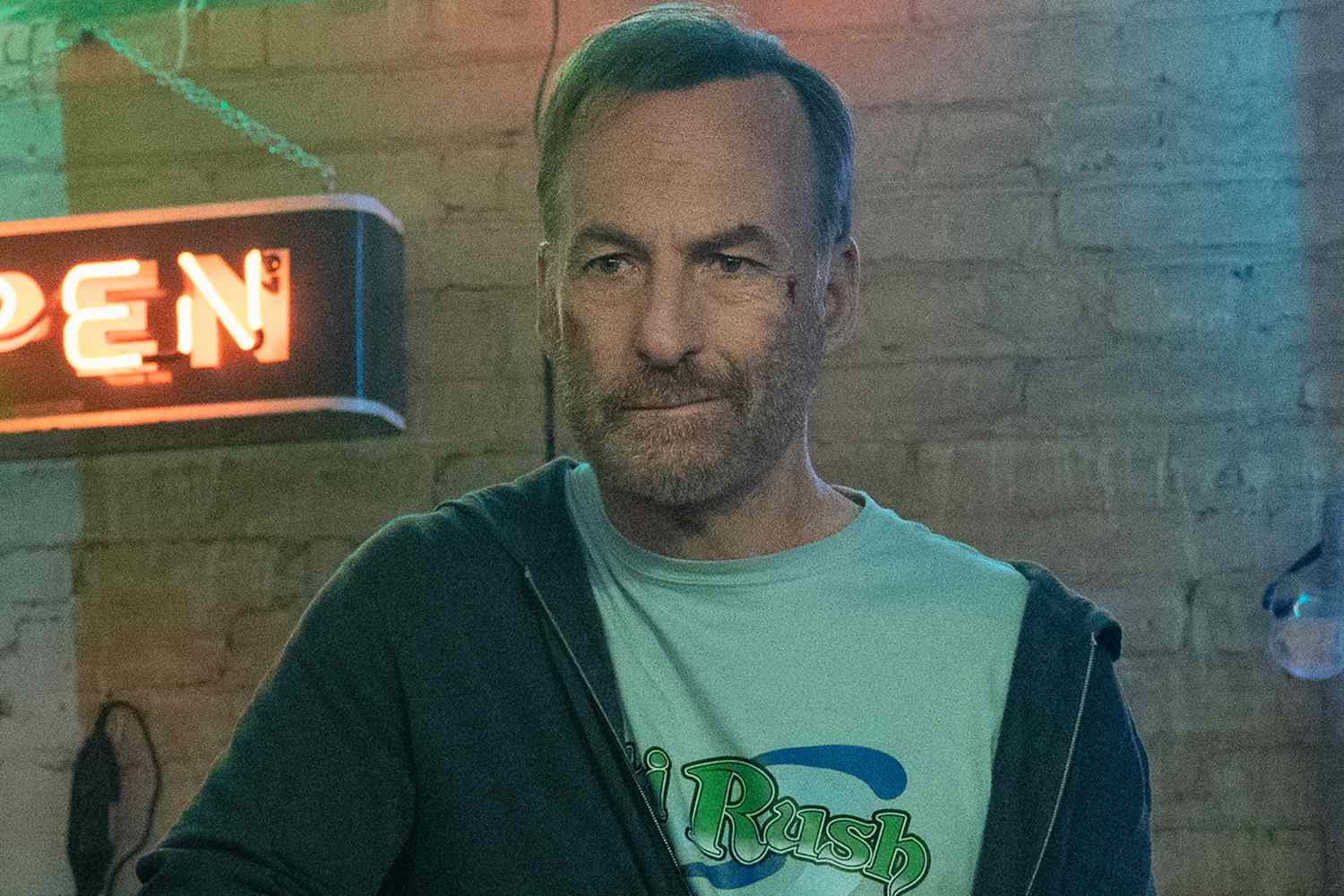

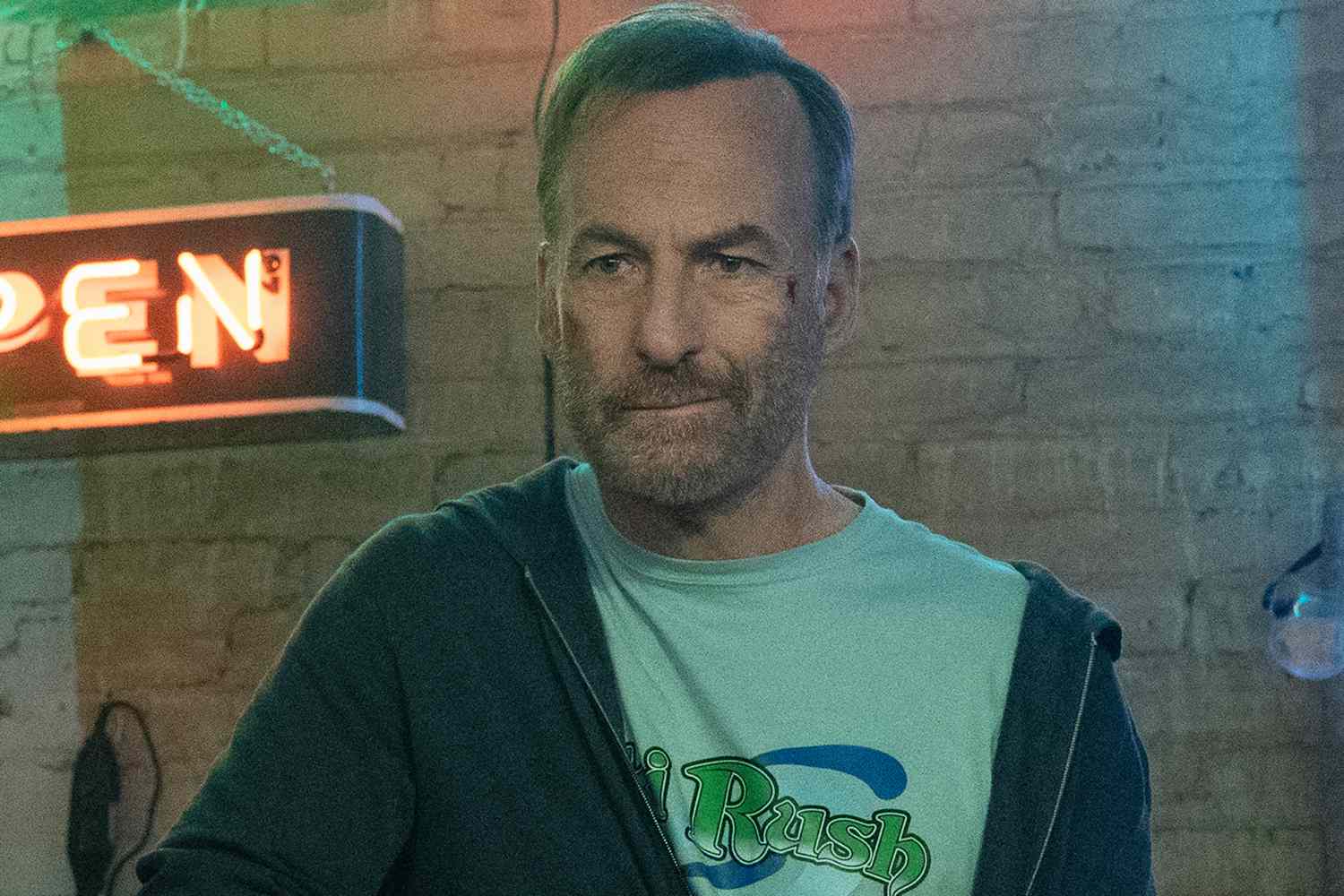

Action Packed Nobody 2 Trailer Bob Odenkirk Unleashes Fury

May 14, 2025

Action Packed Nobody 2 Trailer Bob Odenkirk Unleashes Fury

May 14, 2025 -

Nobody 2 Trailer Bob Odenkirk Faces Peril During A Family Getaway

May 14, 2025

Nobody 2 Trailer Bob Odenkirk Faces Peril During A Family Getaway

May 14, 2025 -

Court Hands Down Sentence In Case Of Teen Sexual Abuse By Mother Figure

May 14, 2025

Court Hands Down Sentence In Case Of Teen Sexual Abuse By Mother Figure

May 14, 2025 -

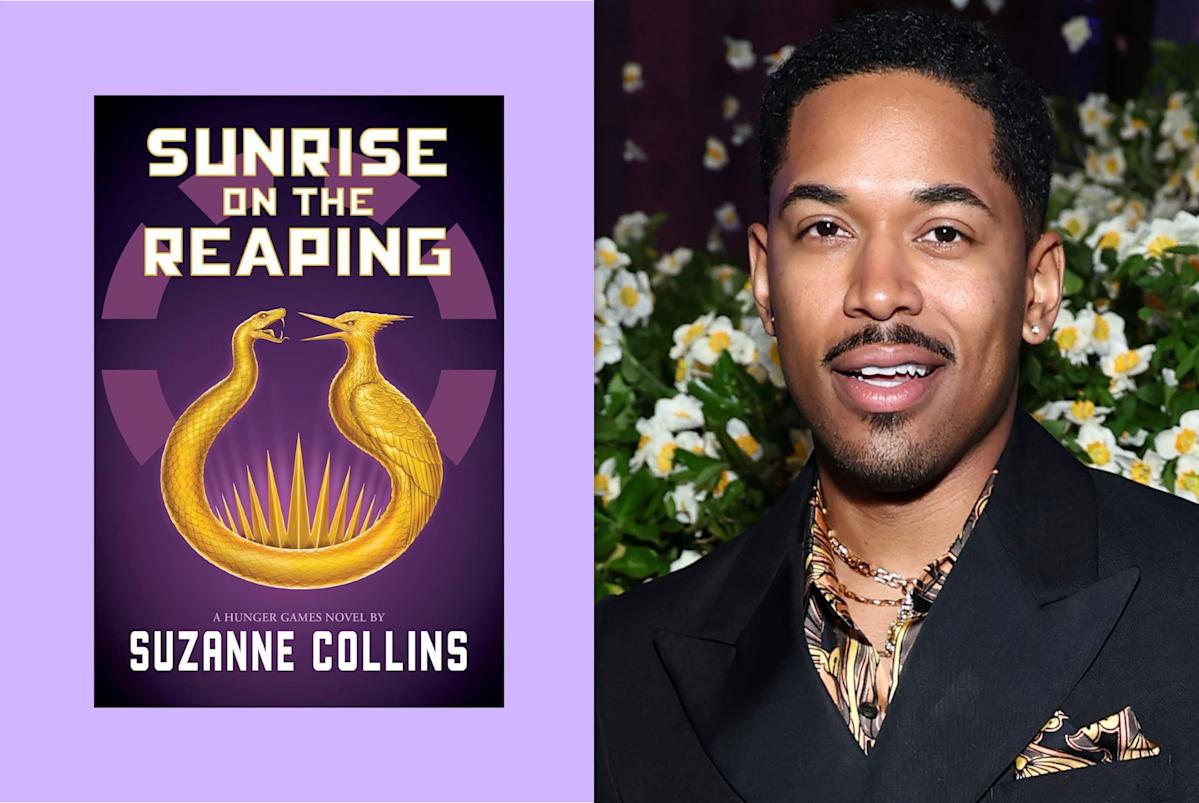

Meet The Actors The Hunger Games Sunrise On The Reaping Full Cast List

May 14, 2025

Meet The Actors The Hunger Games Sunrise On The Reaping Full Cast List

May 14, 2025 -

Bob Odenkirks Nobody 2 A Violent Family Vacation In The New Trailer

May 14, 2025

Bob Odenkirks Nobody 2 A Violent Family Vacation In The New Trailer

May 14, 2025