Rigetti Computing (RGTI) Stock Plunges Post-Q1 Earnings Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rigetti Computing (RGTI) Stock Plunges Post-Q1 Earnings Report: What Went Wrong?

Rigetti Computing (RGTI) stock took a significant dive following the release of its Q1 2023 earnings report, leaving investors reeling and prompting questions about the future of the quantum computing company. The dramatic drop highlights the inherent risks and volatility within the burgeoning quantum computing sector, a field still in its nascent stages despite significant technological advancements. This article delves into the key factors contributing to RGTI's stock plunge and analyzes the implications for both the company and the broader quantum computing market.

Q1 Earnings Miss Expectations: A Deep Dive into the Numbers

Rigetti's Q1 earnings report revealed a wider-than-expected loss, significantly impacting investor confidence. While the company showcased progress in its quantum computing technology, the financial performance failed to meet market expectations. Key figures, including revenue and operating expenses, fell short of analysts' projections, leading to a sell-off. The company also provided a less-than-optimistic outlook for the remainder of the year, further contributing to the negative sentiment. Specific details regarding the revenue shortfall and increased operational costs should be analyzed from the official report for a complete understanding. [Link to Rigetti Computing's Q1 2023 Earnings Report]

Beyond the Numbers: Underlying Concerns for Investors

The disappointing financial results weren't the only factor contributing to RGTI's stock plummet. Several underlying concerns weighed heavily on investor sentiment:

-

Competition: The quantum computing landscape is becoming increasingly competitive. Established tech giants like Google, IBM, and Microsoft are heavily investing in the field, creating a challenging environment for smaller players like Rigetti. This intense competition increases the pressure to deliver tangible results quickly, a challenge exacerbated by the long-term nature of quantum computing research and development.

-

Cash Burn Rate: Rigetti's substantial cash burn rate remains a significant concern. The company's continued reliance on external funding raises questions about its long-term sustainability, especially in light of the current economic climate and tighter investor scrutiny.

-

Technological Hurdles: Despite significant advancements, quantum computing technology still faces considerable technological hurdles. Achieving fault tolerance and scalability remains a major challenge, potentially delaying widespread commercial adoption for longer than initially anticipated. This uncertainty contributes to the inherent risk associated with investing in quantum computing companies.

-

Market Sentiment: The broader market's negative sentiment towards technology stocks, particularly those in the speculative growth sector, also played a role in RGTI's stock decline. This general market downturn amplified the impact of the company's disappointing earnings report.

Looking Ahead: The Future of Rigetti Computing and Quantum Computing

While the recent stock plunge is undoubtedly a setback, it's crucial to consider the long-term potential of quantum computing. The technology holds immense promise across various sectors, from drug discovery and materials science to financial modeling and artificial intelligence. Rigetti, despite its current challenges, remains a significant player in this promising field. The company's future success hinges on its ability to overcome technological challenges, manage its cash burn rate effectively, and navigate the increasingly competitive landscape. Continued innovation and strategic partnerships will be crucial in determining its long-term viability.

Investor Takeaway: The volatility of RGTI stock underscores the high-risk, high-reward nature of investing in early-stage technology companies. Thorough due diligence and a long-term investment horizon are crucial for investors considering exposure to this sector. Keeping abreast of industry developments and regulatory changes is also vital for informed decision-making.

Disclaimer: This article provides general information and does not constitute financial advice. Investing in stocks involves inherent risks, and readers should conduct their own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rigetti Computing (RGTI) Stock Plunges Post-Q1 Earnings Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bayer Leverkusen Weist Geruechte Um Wirtz Transfer Zu Man City Zurueck

May 15, 2025

Bayer Leverkusen Weist Geruechte Um Wirtz Transfer Zu Man City Zurueck

May 15, 2025 -

Weak Q1 Results Send Rigetti Computing Rgti Stock Lower

May 15, 2025

Weak Q1 Results Send Rigetti Computing Rgti Stock Lower

May 15, 2025 -

Trumps Middle East Tour A Lavish Start In First Country Visited

May 15, 2025

Trumps Middle East Tour A Lavish Start In First Country Visited

May 15, 2025 -

Betis Apuesta Por Isco Antony Y Cucho Ciss De Vuelta En La Medular Del Rayo

May 15, 2025

Betis Apuesta Por Isco Antony Y Cucho Ciss De Vuelta En La Medular Del Rayo

May 15, 2025 -

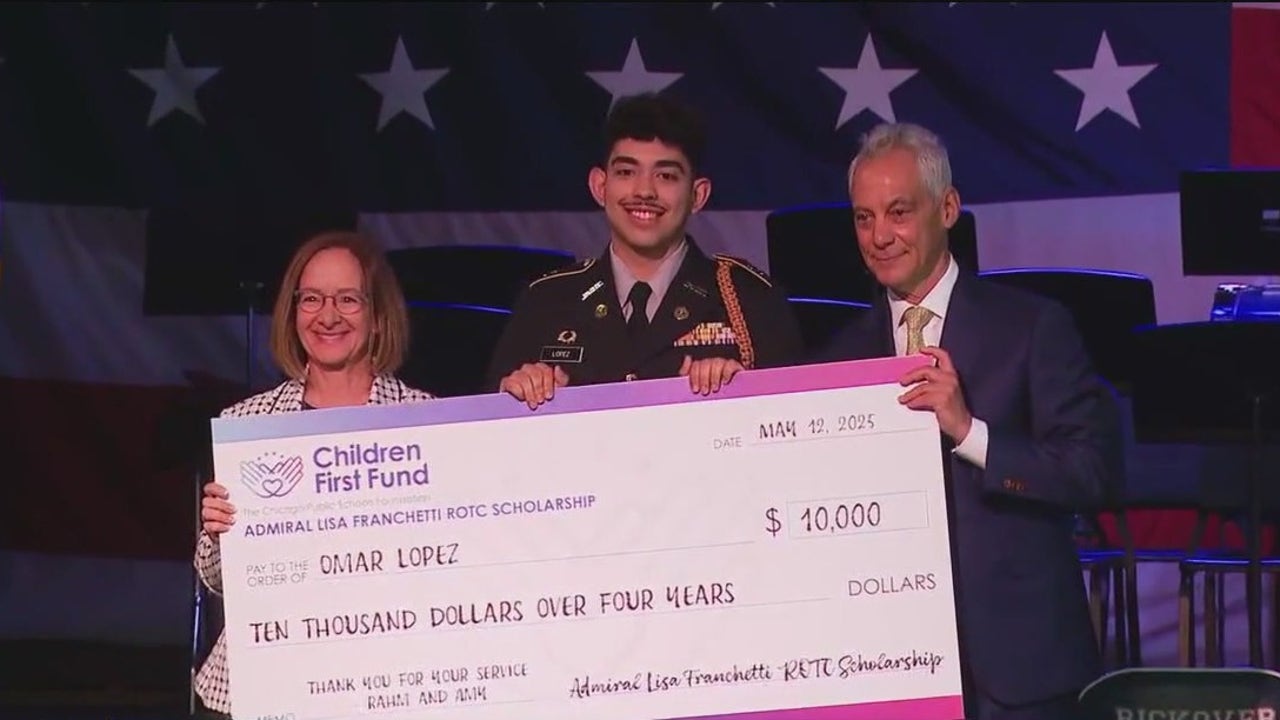

Chicago Rotc Students Benefit From Rahm Emanuels Scholarship Initiative

May 15, 2025

Chicago Rotc Students Benefit From Rahm Emanuels Scholarship Initiative

May 15, 2025