Rigetti Computing (RGTI) Stock Plunge: Analyzing Tuesday's Market Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rigetti Computing (RGTI) Stock Plunge: Analyzing Tuesday's Market Meltdown

Rigetti Computing (RGTI) stock experienced a dramatic plunge on Tuesday, leaving investors reeling and prompting urgent questions about the future of the quantum computing company. The sharp decline underscores the inherent volatility in the burgeoning quantum computing sector and highlights the challenges faced by companies striving for leadership in this nascent technology field. Understanding the reasons behind this significant drop requires a closer look at market forces, company performance, and the broader landscape of the quantum computing industry.

The Tuesday Tumble: A Closer Look at the Numbers

RGTI stock saw a significant percentage drop on Tuesday, [Insert exact percentage and closing price here]. This followed [mention any preceding events, such as earnings reports, announcements, or market trends]. The immediate impact was a considerable loss in market capitalization for Rigetti, underscoring the sensitivity of investor sentiment towards the company's prospects.

Factors Contributing to the Stock Plunge

Several factors likely contributed to RGTI's steep decline. These include:

-

General Market Sentiment: The broader market conditions played a role. [Mention any relevant overall market downturns or sector-specific negative trends affecting technology stocks]. A risk-off sentiment often disproportionately affects smaller-cap stocks like RGTI.

-

Company-Specific Concerns: [Analyze any specific news or announcements from Rigetti that might have spooked investors. This could include concerns about funding, research and development setbacks, competitive pressures, or disappointing financial results. Be specific with details and cite sources if available]. These concerns fueled selling pressure, exacerbating the already negative market sentiment.

-

Competition in the Quantum Computing Space: The quantum computing field is intensely competitive. Established players like IBM, Google, and Microsoft, along with numerous startups, are vying for market share. [Mention specific competitors and their recent advancements that could be impacting investor confidence in Rigetti]. Any perceived lagging behind competitors can negatively affect investor confidence.

-

Investor Expectations: The high expectations surrounding quantum computing can create a double-edged sword. While the potential is immense, the reality of delivering on those expectations is challenging. [Discuss if unmet expectations for RGTI's technology or progress contributed to the sell-off]. Any perceived shortfall from projected milestones can lead to rapid sell-offs.

What's Next for Rigetti Computing?

The future of RGTI remains uncertain. The company's response to this market downturn will be crucial. [Mention any official statements or actions taken by the company in response to the stock drop]. Investors will be keenly watching for signs of strategic pivots, new partnerships, or breakthroughs in their technology.

The Broader Implications for Quantum Computing

The RGTI stock plunge serves as a reminder of the risks inherent in investing in early-stage technology companies. While the quantum computing industry holds immense long-term potential, navigating the short-term volatility requires careful consideration and a long-term perspective. The sector is still in its early stages, and setbacks are inevitable.

Conclusion: Navigating the Quantum Uncertainty

The dramatic fall in Rigetti Computing's stock price highlights the challenges and uncertainties inherent in the quantum computing sector. While the long-term prospects remain promising, investors need to carefully assess the risks involved. Further analysis of the company's strategic direction, technological advancements, and competitive landscape will be essential to gauge its future performance and potential recovery. This event underscores the need for a nuanced understanding of the market and the specific factors impacting individual companies in this rapidly evolving field.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and you should always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rigetti Computing (RGTI) Stock Plunge: Analyzing Tuesday's Market Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wirtz Vor Man City Wechsel Neues Angebot Sorgt Fuer Spekulationen

May 15, 2025

Wirtz Vor Man City Wechsel Neues Angebot Sorgt Fuer Spekulationen

May 15, 2025 -

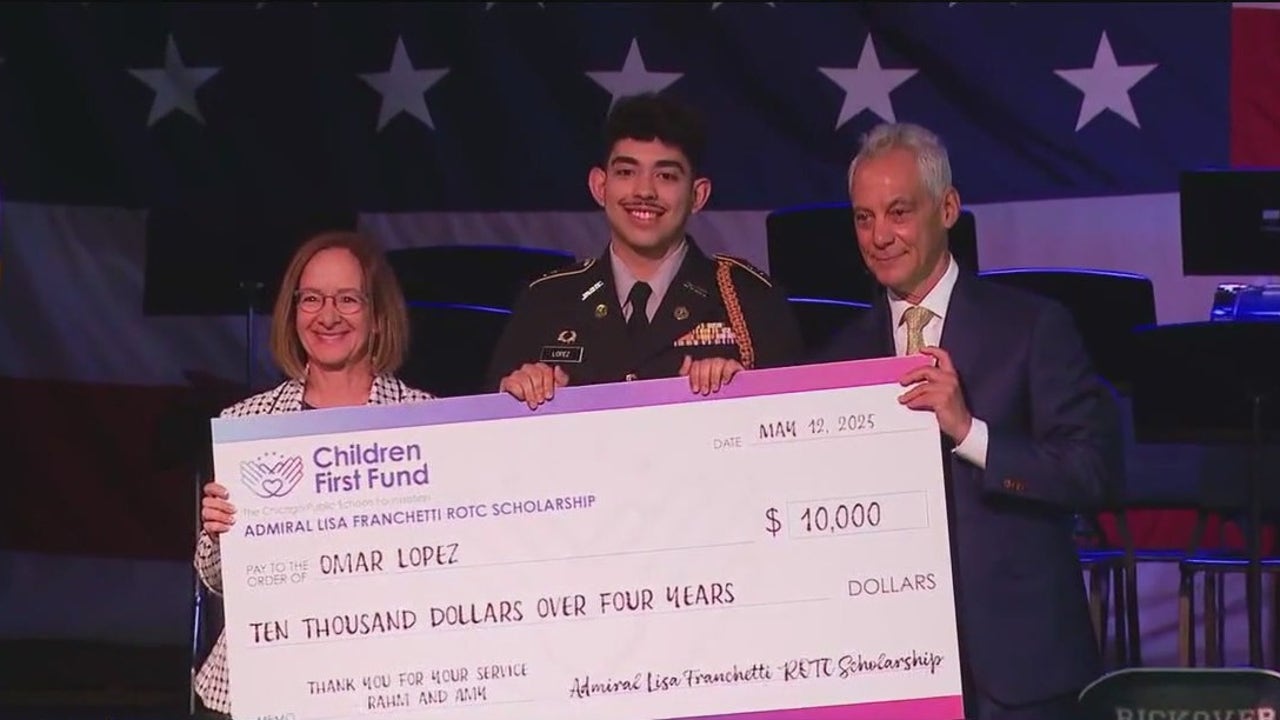

Mayor Emanuels Commitment To Cps Launch Of Rotc Scholarship Program

May 15, 2025

Mayor Emanuels Commitment To Cps Launch Of Rotc Scholarship Program

May 15, 2025 -

6 1 Magnitude Earthquake Shakes Greece Usgs Details And Impact Assessment

May 15, 2025

6 1 Magnitude Earthquake Shakes Greece Usgs Details And Impact Assessment

May 15, 2025 -

Trumps Tariff Retreat A Strategic Shift Or A Concede To China

May 15, 2025

Trumps Tariff Retreat A Strategic Shift Or A Concede To China

May 15, 2025 -

Cybersecurity Alert Act Now To Secure Your Steam Account After Data Breach

May 15, 2025

Cybersecurity Alert Act Now To Secure Your Steam Account After Data Breach

May 15, 2025