Rethinking Risk: How Climate Change Is Reshaping Business And Finance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rethinking Risk: How Climate Change is Reshaping Business and Finance

Climate change is no longer a distant threat; it's a present-day reality reshaping the global landscape, impacting businesses and financial markets in profound ways. From extreme weather events disrupting supply chains to stricter environmental regulations impacting profitability, companies are increasingly recognizing the urgent need to integrate climate risk into their core strategies. This shift necessitates a fundamental rethinking of risk management, demanding proactive adaptation and a long-term perspective.

The Evolving Landscape of Climate Risk

The financial implications of climate change are multifaceted and far-reaching. Traditionally, risk assessments focused on short-term fluctuations and operational challenges. However, climate change introduces long-term systemic risks that threaten the stability of entire industries. These risks can be broadly categorized as:

-

Physical Risks: These include direct damage from extreme weather events like hurricanes, floods, and wildfires, as well as gradual changes like sea-level rise and changes in precipitation patterns. Businesses with significant physical assets, such as real estate developers or energy companies, are particularly vulnerable. The increasing frequency and intensity of these events translate to higher insurance premiums, operational disruptions, and potential asset devaluation.

-

Transition Risks: These stem from the global shift towards a low-carbon economy. Regulations aimed at reducing greenhouse gas emissions, such as carbon pricing mechanisms and stricter environmental standards, can significantly impact businesses reliant on fossil fuels or high-carbon processes. Companies failing to adapt to these changing regulations face substantial financial penalties and competitive disadvantages.

-

Liability Risks: Companies may face increasing legal challenges related to their contribution to climate change and the resulting damages. This includes lawsuits from communities affected by pollution or extreme weather events, as well as shareholder activism demanding greater transparency and accountability on climate-related issues.

How Businesses are Adapting

Forward-thinking businesses are already taking steps to mitigate climate-related risks and capitalize on emerging opportunities:

-

Investing in Renewable Energy: Many companies are transitioning to renewable energy sources to reduce their carbon footprint and hedge against rising energy costs. This move not only improves their environmental performance but also enhances their brand reputation and attracts environmentally conscious investors.

-

Developing Climate-Resilient Supply Chains: Businesses are diversifying their supply chains to reduce their vulnerability to extreme weather events and geopolitical instability. This involves identifying suppliers with robust climate risk management strategies and investing in technologies that enhance resilience.

-

Implementing Carbon Accounting and Reporting: Transparent reporting on greenhouse gas emissions is becoming increasingly crucial. Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) provide guidance on disclosing climate-related risks and opportunities, enhancing investor confidence and improving access to capital. [Link to TCFD website]

-

Integrating ESG (Environmental, Social, and Governance) Factors into Investment Decisions: Investors are increasingly incorporating ESG factors into their investment strategies, recognizing that climate change poses both financial risks and opportunities. This growing trend is driving demand for sustainable and responsible investments.

The Role of Finance in Addressing Climate Change

The financial sector has a critical role to play in addressing climate change. This includes:

-

Developing Climate-related Financial Products: Innovative financial instruments, such as green bonds and sustainability-linked loans, are emerging to channel capital towards climate-friendly projects and businesses.

-

Improving Climate Risk Disclosure and Transparency: Regulators are increasingly demanding greater transparency on climate-related risks, requiring financial institutions to assess and disclose their exposure to climate-related risks.

-

Promoting Sustainable Investing: Financial institutions are actively promoting sustainable and responsible investing strategies, encouraging capital allocation towards businesses committed to reducing their environmental impact.

Conclusion:

Climate change is fundamentally altering the business and financial landscape. Ignoring these risks is no longer an option. By proactively addressing climate-related challenges, businesses and financial institutions can not only mitigate potential losses but also unlock new opportunities and contribute to a more sustainable and resilient future. The time for adaptation is now; a proactive approach will prove crucial for long-term success and stability in an increasingly climate-conscious world.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rethinking Risk: How Climate Change Is Reshaping Business And Finance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Time 100 Analyzing The Influence Of 2025s Most Impactful Individuals

May 16, 2025

Time 100 Analyzing The Influence Of 2025s Most Impactful Individuals

May 16, 2025 -

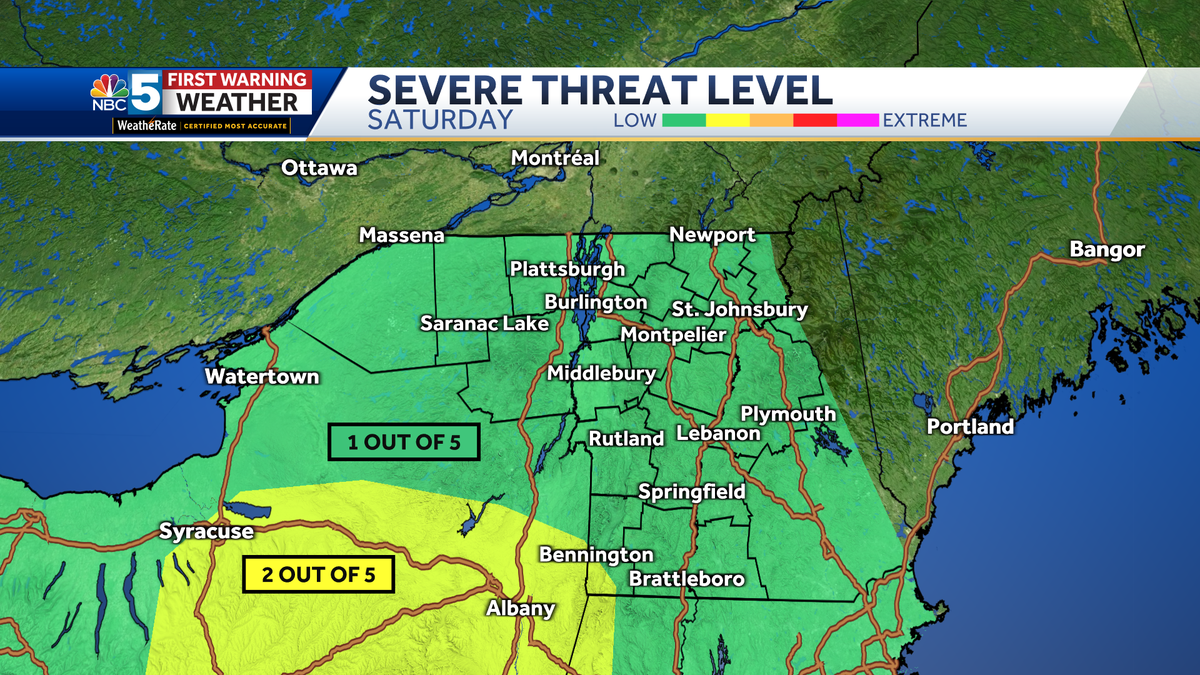

New York And Vermont Flood Risk Thursdays Pop Up Storms Could Bring Intense Rainfall

May 16, 2025

New York And Vermont Flood Risk Thursdays Pop Up Storms Could Bring Intense Rainfall

May 16, 2025 -

Syria Sanctions Relief Analyzing Trumps Decision And Meeting With Assad

May 16, 2025

Syria Sanctions Relief Analyzing Trumps Decision And Meeting With Assad

May 16, 2025 -

Chelsea Vs Man United A 2025 Pre Match Preview

May 16, 2025

Chelsea Vs Man United A 2025 Pre Match Preview

May 16, 2025 -

The Last Rodeo Film Review Honest Assessment Of Straits Cinematic Journey

May 16, 2025

The Last Rodeo Film Review Honest Assessment Of Straits Cinematic Journey

May 16, 2025