Rethinking Climate Change: A Business And Finance Dialogue

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rethinking Climate Change: A Business and Finance Dialogue for a Sustainable Future

Climate change is no longer a distant threat; it's a present reality impacting businesses and financial markets globally. This isn't just an environmental concern; it's a profound economic and social one, demanding a fundamental rethink of how businesses operate and investors allocate capital. This article explores the evolving dialogue between the business and finance worlds as they grapple with the urgent need for climate action and sustainable growth.

The Shifting Landscape: From Risk to Opportunity

For years, climate change was largely viewed as a source of risk – potential disruptions to supply chains, increased insurance costs, and the threat of stranded assets. However, this perspective is rapidly shifting. Forward-thinking businesses and investors are increasingly recognizing the enormous opportunities presented by the transition to a low-carbon economy. This includes:

- Green technologies and innovation: The demand for renewable energy, energy-efficient technologies, and sustainable materials is exploding, creating new markets and driving innovation.

- Sustainable investments: The growth of Environmental, Social, and Governance (ESG) investing demonstrates a growing appetite for companies committed to sustainability. ESG funds are attracting significant capital, pushing businesses to prioritize climate-friendly practices.

- Enhanced brand reputation: Consumers are increasingly conscious of environmental issues and are more likely to support businesses actively addressing climate change. A strong sustainability profile can enhance brand reputation and customer loyalty.

The Role of Finance in Driving Climate Action

The financial sector plays a crucial role in accelerating the transition to a sustainable future. Banks, insurance companies, and investment firms are under increasing pressure to align their portfolios with the goals of the Paris Agreement. This includes:

- Green financing: Providing capital for renewable energy projects, sustainable infrastructure, and climate-resilient technologies. This involves developing innovative financial instruments and scaling up green bond issuance.

- Carbon pricing and disclosure: Implementing effective carbon pricing mechanisms and requiring companies to transparently disclose their carbon emissions are essential for driving corporate action.

- Divestment from fossil fuels: Many investors are divesting from fossil fuel companies, shifting their capital towards cleaner energy sources and businesses committed to decarbonization. .

Challenges and Collaboration:

Despite the growing momentum, significant challenges remain. These include:

- Measuring and managing climate-related risks: Accurately assessing and managing the financial risks associated with climate change remains a complex challenge.

- Data transparency and standardization: The lack of standardized data on ESG factors makes it difficult to compare and evaluate companies' sustainability performance.

- Policy uncertainty: Inconsistent climate policies across different jurisdictions can create uncertainty for businesses and investors.

Addressing these challenges requires collaboration between businesses, investors, governments, and other stakeholders. Open dialogue, data sharing, and the development of common standards are crucial for fostering a sustainable and resilient economy.

Looking Ahead: A Sustainable Future through Collaboration

The conversation around climate change is evolving beyond awareness to action. The business and finance communities are increasingly recognizing their vital role in shaping a sustainable future. By embracing the opportunities presented by the transition to a low-carbon economy and collaborating to overcome the challenges, we can pave the way for a more prosperous and sustainable world. The future demands not just a rethinking of climate change, but a fundamental reshaping of our economic systems. This requires proactive engagement, sustainable practices, and a collective commitment to a greener future. Are you ready to join the conversation?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rethinking Climate Change: A Business And Finance Dialogue. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

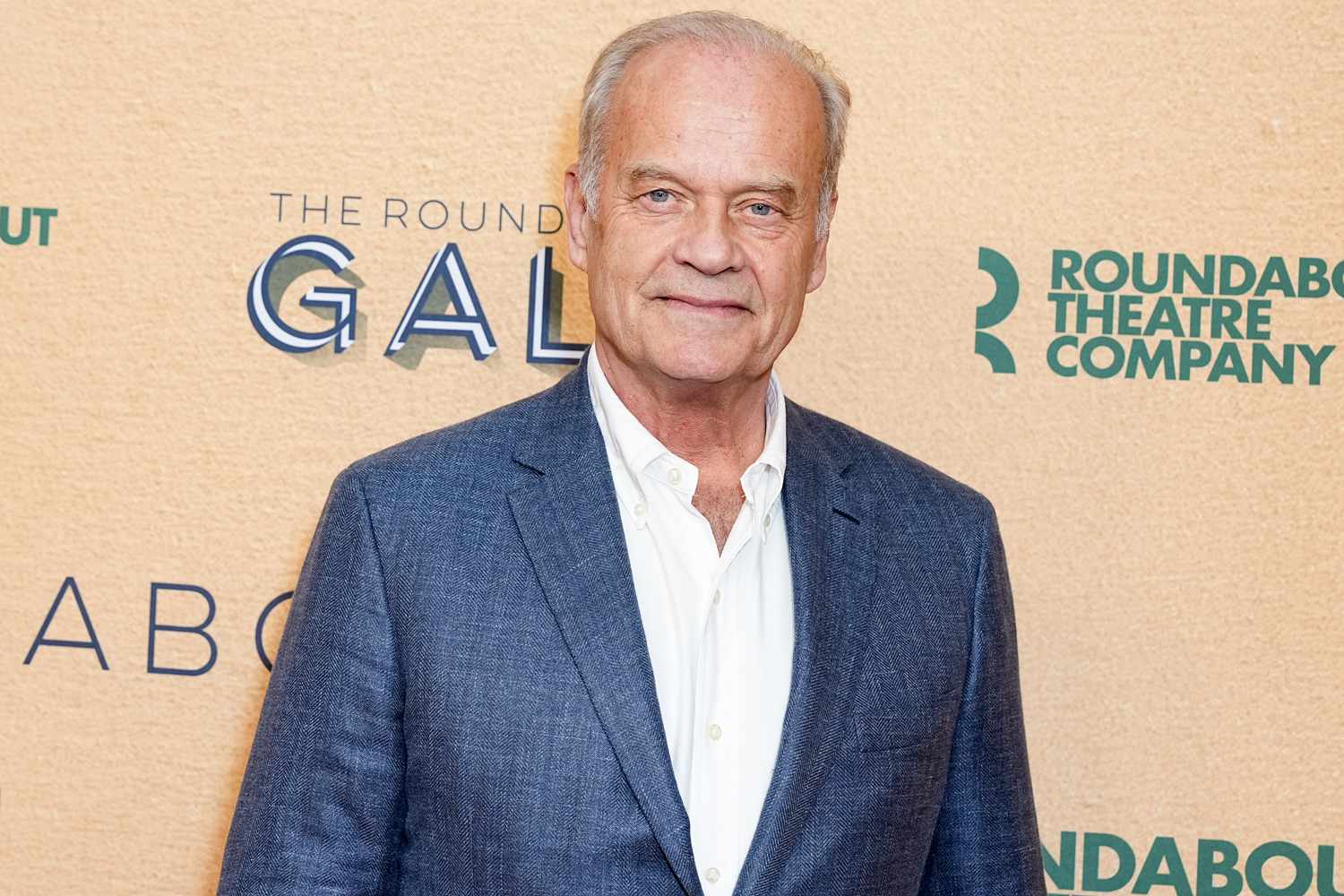

The Deepest Regret Kelsey Grammer Speaks Out About Past Abortion

May 15, 2025

The Deepest Regret Kelsey Grammer Speaks Out About Past Abortion

May 15, 2025 -

The Impact Of Climate Change On Business And Finance A Pragmatic Look

May 15, 2025

The Impact Of Climate Change On Business And Finance A Pragmatic Look

May 15, 2025 -

Wh 1000 Xm 6 Vs Competition Best Noise Canceling Headphones

May 15, 2025

Wh 1000 Xm 6 Vs Competition Best Noise Canceling Headphones

May 15, 2025 -

Sony Wh 1000 Xm 6 Noise Cancelling Headphones Performance And Value

May 15, 2025

Sony Wh 1000 Xm 6 Noise Cancelling Headphones Performance And Value

May 15, 2025 -

Actor Kelsey Grammer Opens Up About The Emotional Toll Of A Past Abortion

May 15, 2025

Actor Kelsey Grammer Opens Up About The Emotional Toll Of A Past Abortion

May 15, 2025