Restaurant Industry Shakeup: Subway's Owner Makes $1 Billion Chicken Chain Acquisition

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Restaurant Industry Shakeup: Subway's Owner Makes $1 Billion Chicken Chain Acquisition

The restaurant industry is buzzing with news of a major acquisition that signals a significant shift in the fast-food landscape. Roark Capital, the private equity firm that owns Subway, has just finalized a stunning $1 billion deal to acquire Inspire Brands, the parent company of Arby's, Buffalo Wild Wings, and now, another major player: Baskin-Robbins. This move consolidates Roark's position as a fast-food behemoth and raises intriguing questions about the future of these iconic brands.

A Billion-Dollar Bet on Chicken (and Ice Cream): Analyzing the Impact

This acquisition isn't just about adding another brand to Roark's portfolio; it's a strategic play to capitalize on the booming chicken market and diversify its holdings. Inspire Brands' diverse portfolio, including the popular ice cream chain Baskin-Robbins, provides Roark with a broader customer base and operational synergy.

The deal, valued at approximately $1 billion, represents a significant investment in the future of fast food. Analysts predict several key impacts:

- Increased Market Share: Roark Capital now controls a vast network of restaurants, significantly increasing its market share and competitive edge. This move places them in direct competition with other fast-food giants like McDonald's and Yum! Brands.

- Operational Synergies: Combining the operations of Subway, Arby's, Buffalo Wild Wings, and Baskin-Robbins offers significant opportunities for cost savings and efficiency improvements. This could lead to streamlined supply chains, reduced operational costs, and potentially lower prices for consumers.

- Enhanced Brand Portfolio: Roark now boasts a diverse portfolio of brands catering to various tastes and preferences. This diversification reduces reliance on a single brand and mitigates the risk associated with fluctuating consumer demand.

- Potential Menu Innovations: The acquisition could lead to exciting menu innovations and cross-promotional opportunities. Imagine Subway collaborating with Arby's for a limited-time sandwich offering! This could generate significant buzz and attract new customers.

Roark Capital's Strategic Vision: A Focus on Franchising and Growth

Roark Capital has a proven track record of successfully acquiring and managing restaurant chains. Their focus on franchising models allows for rapid expansion and minimizes financial risk. This strategy has been key to the success of Subway and is expected to be replicated with Inspire Brands' portfolio.

This acquisition signifies Roark's ambition to become a dominant force in the global fast-food industry. Their strategic acquisitions demonstrate a clear vision of consolidating market share and maximizing profitability within a highly competitive sector.

The Future of Fast Food: What's Next?

This landmark acquisition is likely to trigger a wave of consolidation within the restaurant industry. Other private equity firms and large corporations might follow suit, leading to further mergers and acquisitions in the coming years. The fast-food landscape is constantly evolving, and this deal is a clear indication of the ongoing competition and the importance of strategic growth in the sector. Consumers can expect to see changes in menu offerings, promotional strategies, and potentially even pricing as these brands adjust to their new ownership structure.

Call to Action: What are your thoughts on this major acquisition? Share your predictions for the future of these brands in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Restaurant Industry Shakeup: Subway's Owner Makes $1 Billion Chicken Chain Acquisition. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

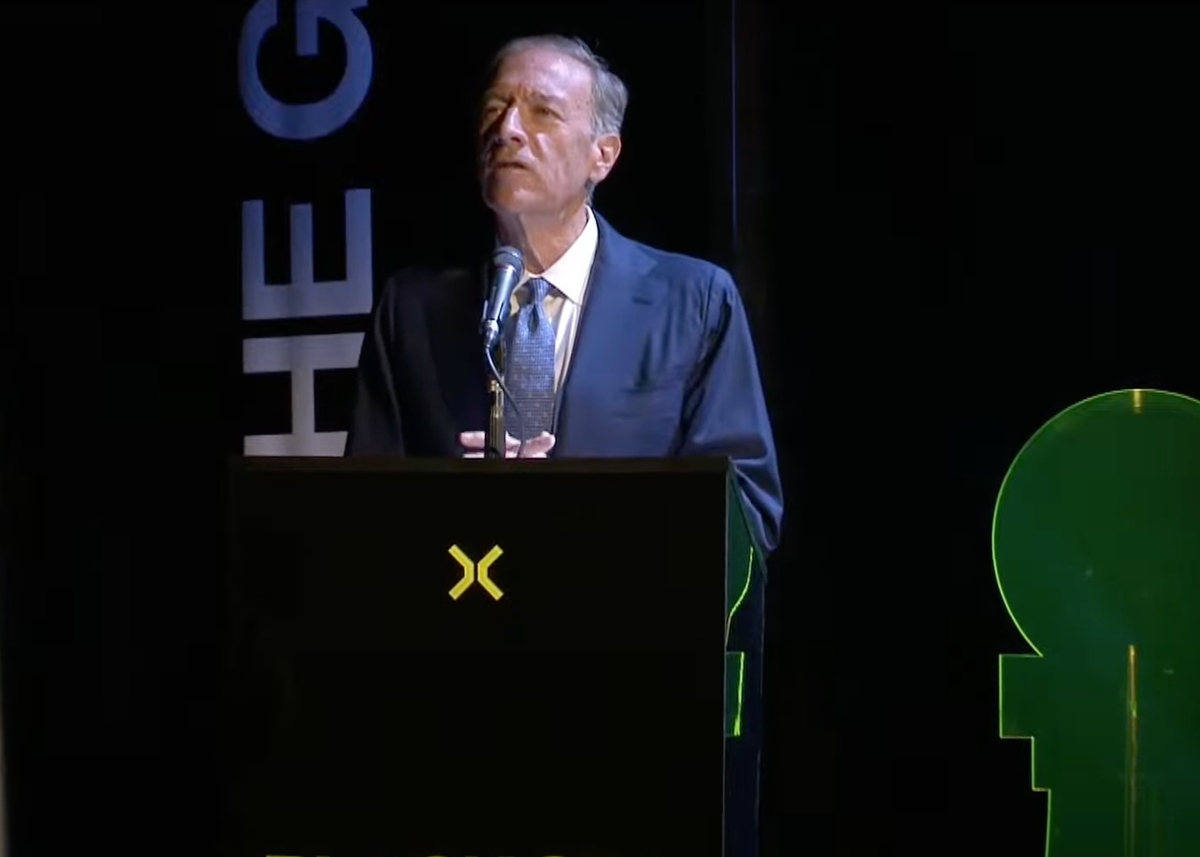

Us Perspective On Black Sea Security Pompeo Speaks At Odesa Forum

Jun 05, 2025

Us Perspective On Black Sea Security Pompeo Speaks At Odesa Forum

Jun 05, 2025 -

England Vs West Indies Womens Cricket Odi Live Scores And Commentary

Jun 05, 2025

England Vs West Indies Womens Cricket Odi Live Scores And Commentary

Jun 05, 2025 -

Boxing News Haney Lopez Bout In Jeopardy After Accusation Of Dodging

Jun 05, 2025

Boxing News Haney Lopez Bout In Jeopardy After Accusation Of Dodging

Jun 05, 2025 -

England Triumphs Over West Indies Century Partnerships Power 108 Run Win

Jun 05, 2025

England Triumphs Over West Indies Century Partnerships Power 108 Run Win

Jun 05, 2025 -

The Effects Of A Year Without Sexual Intimacy A Comprehensive Look

Jun 05, 2025

The Effects Of A Year Without Sexual Intimacy A Comprehensive Look

Jun 05, 2025