Reframing Climate Change: A Business And Finance Dialogue

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Reframing Climate Change: A Business and Finance Dialogue for a Sustainable Future

Climate change is no longer a distant threat; it's a present reality impacting businesses and financial markets globally. This isn't just an environmental issue; it's an economic one, demanding a fundamental reframing of how we approach business and finance. The dialogue has shifted from "if" we need to act to "how" we can effectively integrate climate considerations into core strategies.

This article explores the evolving conversation between business leaders and financial institutions, highlighting the opportunities and challenges of navigating the climate crisis while fostering sustainable growth.

The Shifting Sands of Investment: ESG and Beyond

Environmental, Social, and Governance (ESG) investing is no longer a niche strategy; it's rapidly becoming the mainstream. Investors are increasingly demanding transparency and accountability from companies regarding their environmental impact. This shift is driven by several factors:

- Growing awareness of climate risks: From physical risks like extreme weather events to transitional risks associated with policy changes and technological shifts, businesses are facing mounting pressure to mitigate their impact.

- Increased regulatory scrutiny: Governments worldwide are implementing stricter regulations on carbon emissions and environmental disclosures, forcing companies to adapt. The EU's Taxonomy for Sustainable Activities, for instance, is a significant step in this direction. [Link to EU Taxonomy website]

- Consumer demand for sustainable products and services: Consumers are increasingly conscious of their environmental footprint and are actively seeking out businesses committed to sustainability.

This heightened awareness translates to significant financial implications. Companies with strong ESG profiles are often rewarded with higher valuations and lower cost of capital. Conversely, companies lagging behind risk facing penalties, reputational damage, and reduced investor interest.

Beyond ESG: Integrating Climate into Core Business Strategy

While ESG provides a valuable framework, integrating climate considerations into the core business strategy is crucial for long-term success. This involves:

- Developing robust climate risk assessments: Understanding the specific climate-related risks and opportunities facing the business is paramount for effective mitigation and adaptation strategies.

- Setting ambitious emission reduction targets: Companies need to commit to measurable and verifiable emission reductions aligned with the Paris Agreement's goals.

- Investing in climate-friendly technologies and innovations: Embracing renewable energy, energy efficiency improvements, and circular economy principles are key to achieving long-term sustainability.

- Building resilience and adaptability: Companies must develop strategies to adapt to the unavoidable impacts of climate change, ensuring business continuity in the face of extreme weather events.

The Role of Financial Institutions in Driving Change

Financial institutions have a critical role to play in driving this transition. They can:

- Increase financing for sustainable projects: Channeling capital towards renewable energy, energy efficiency, and climate adaptation projects is crucial for accelerating the green transition.

- Develop innovative financial instruments: Green bonds, sustainability-linked loans, and other innovative financial instruments can provide attractive financing options for businesses committed to sustainability.

- Implement robust climate risk management frameworks: Financial institutions need to assess and manage their own climate-related financial risks, including those related to stranded assets and physical damage.

- Promote transparency and disclosure: Encouraging companies to disclose their climate-related information is crucial for informed investment decisions and accountability.

Conclusion: A Collaborative Imperative

Reframing climate change as a business and finance dialogue is not just a responsible approach; it's a strategic imperative for long-term success. Collaboration between businesses, investors, and policymakers is crucial to drive the transition to a sustainable future. By embracing innovative solutions, fostering transparency, and committing to ambitious targets, we can build a resilient and prosperous economy while mitigating the devastating impacts of climate change. This requires a collective effort – a shared responsibility – and the time to act is now.

Call to Action: Learn more about integrating climate considerations into your business strategy by visiting [Link to relevant resource, e.g., a government website or sustainability organization].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Reframing Climate Change: A Business And Finance Dialogue. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

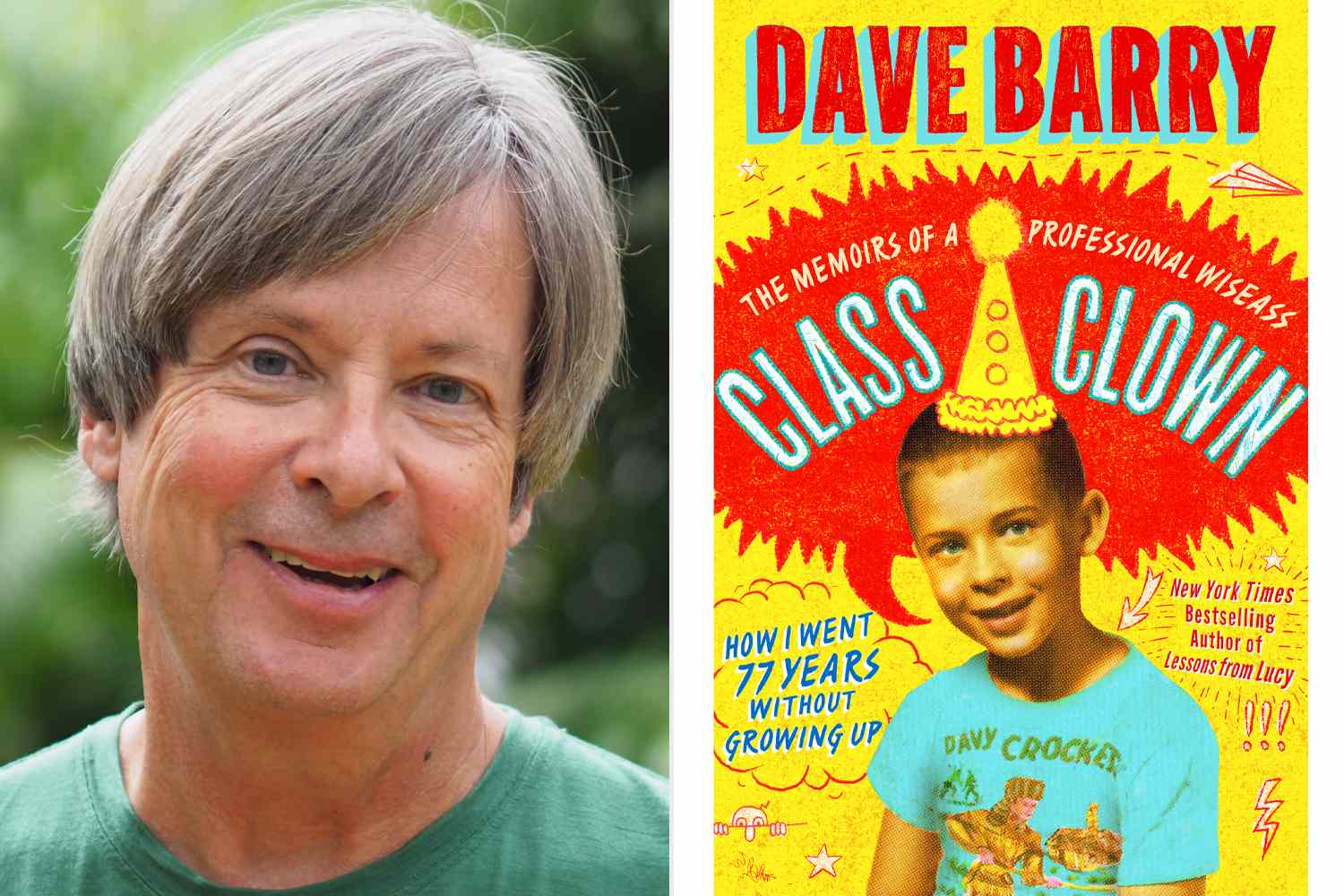

Legendary Humorist Dave Barry Reveals Key Writing Advice Exclusive

May 11, 2025

Legendary Humorist Dave Barry Reveals Key Writing Advice Exclusive

May 11, 2025 -

The Deep Oceans Mysteries What Lies Beneath

May 11, 2025

The Deep Oceans Mysteries What Lies Beneath

May 11, 2025 -

Hilaria Baldwin On Public Feud I Hope I Never Meet Her

May 11, 2025

Hilaria Baldwin On Public Feud I Hope I Never Meet Her

May 11, 2025 -

Rome Masters Where To Watch Jabeur Vs Kvitova Odds And Match Analysis

May 11, 2025

Rome Masters Where To Watch Jabeur Vs Kvitova Odds And Match Analysis

May 11, 2025 -

Real Madrid Vs Barcelona Live Score Intense First Half In El Clasico

May 11, 2025

Real Madrid Vs Barcelona Live Score Intense First Half In El Clasico

May 11, 2025