Record-Breaking Robinhood: $255 Billion In Assets, Trading Volume Up 108%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record-Breaking Robinhood: $255 Billion in Assets, Trading Volume Soars 108%

Robinhood, the popular commission-free trading app, has announced record-breaking figures, showcasing its continued dominance in the retail investing landscape. The company revealed a staggering $255 billion in assets under custody, a significant jump compared to previous quarters, coupled with a phenomenal 108% increase in trading volume. This explosive growth underscores Robinhood's enduring appeal and the surging interest in retail investment.

This unprecedented success comes amidst a period of both market volatility and regulatory scrutiny for the fintech giant. Let's delve deeper into the details and analyze what this signifies for Robinhood's future.

<h3>A Closer Look at the Numbers: Growth and Challenges</h3>

The $255 billion in assets under custody represents a monumental achievement for Robinhood. This figure highlights the massive influx of new users and the increased trading activity on the platform. The 108% surge in trading volume is equally impressive, suggesting a robust and engaged user base actively participating in the market. This growth can be attributed to several factors, including:

- Increased retail investor participation: The pandemic spurred a significant increase in retail investing, with many turning to user-friendly platforms like Robinhood.

- Expansion of offerings: Robinhood has expanded beyond its core brokerage services to include options trading, cryptocurrency trading, and other financial products, attracting a broader range of users.

- Ease of use and accessibility: Robinhood's intuitive interface and commission-free trading model have made investing accessible to a wider demographic.

However, Robinhood's journey hasn't been without its challenges. The company has faced regulatory scrutiny, including investigations into its practices and allegations of manipulative trading. These challenges, along with overall market fluctuations, will continue to impact its trajectory.

<h3>What Does This Mean for the Future of Robinhood?</h3>

The record-breaking numbers paint a promising picture for Robinhood's future. However, maintaining this momentum will require strategic planning and adaptation to a constantly evolving market. Key areas for Robinhood to focus on include:

- Regulatory compliance: Addressing regulatory concerns and ensuring compliance will be crucial for long-term sustainability.

- Product innovation: Continuously innovating and expanding its product offerings will be essential to retaining and attracting new users.

- Diversification of revenue streams: Reducing reliance on transaction-based revenue and exploring alternative revenue streams will improve resilience.

- Enhanced customer service: Providing exceptional customer service and addressing user concerns will be vital to maintaining user loyalty.

The recent performance showcases Robinhood's significant influence on the retail investing landscape. Its future success hinges on effectively navigating regulatory hurdles, adapting to market changes, and continuing to deliver a compelling user experience.

<h3>The Broader Implications for Retail Investing</h3>

Robinhood's success reflects a broader trend of increased retail investor participation in the financial markets. This democratization of investing has both advantages and disadvantages. While it offers greater access to financial markets, it also necessitates a greater understanding of investment risks and responsible trading practices. Platforms like Robinhood bear a responsibility in educating users and promoting financial literacy.

In conclusion, Robinhood's record-breaking performance underscores the significant shift in the retail investment landscape. While the company faces ongoing challenges, its ability to adapt and innovate will determine its long-term success and influence on the future of finance. The coming years will be crucial in observing how Robinhood navigates its growth and solidifies its position as a leader in the fintech industry. Stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record-Breaking Robinhood: $255 Billion In Assets, Trading Volume Up 108%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kittle Addresses Backlash Against Deebo Samuel A Show Of Loyalty

Jun 14, 2025

Kittle Addresses Backlash Against Deebo Samuel A Show Of Loyalty

Jun 14, 2025 -

Ongoing L A Protests Curfew Remains In Effect For Second Consecutive Night

Jun 14, 2025

Ongoing L A Protests Curfew Remains In Effect For Second Consecutive Night

Jun 14, 2025 -

Major Investment Wellington Management Buys 15 775 Robinhood Hood Shares

Jun 14, 2025

Major Investment Wellington Management Buys 15 775 Robinhood Hood Shares

Jun 14, 2025 -

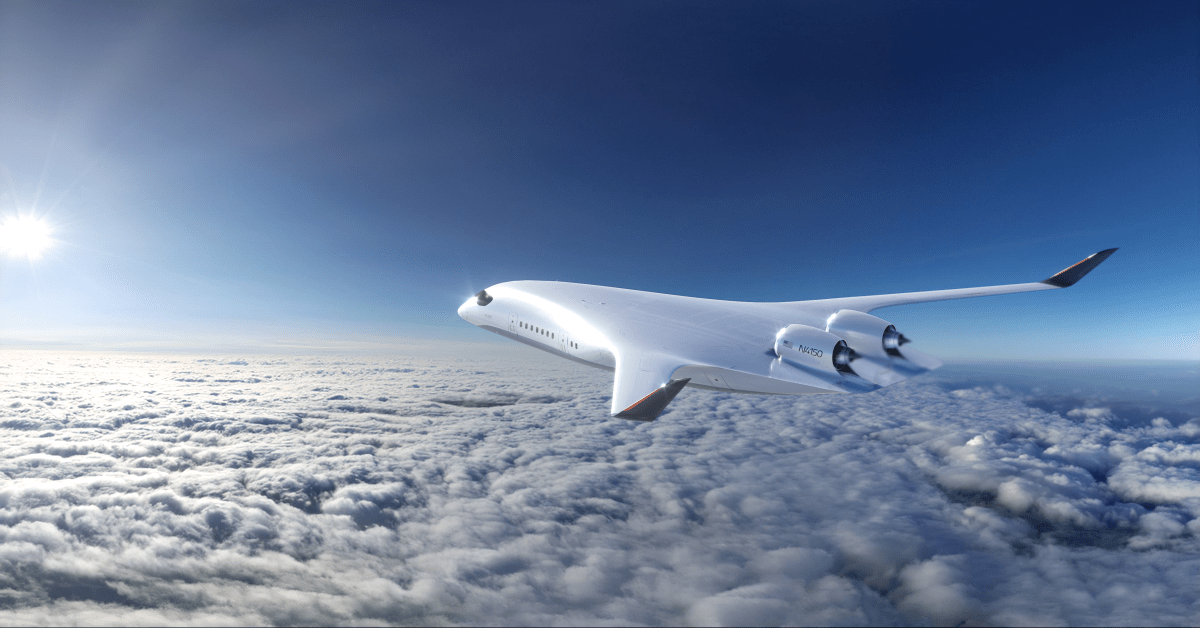

Sustainable Skies A Look At This Companys Green Aviation Technology

Jun 14, 2025

Sustainable Skies A Look At This Companys Green Aviation Technology

Jun 14, 2025 -

From The Gridiron To Recovery Barry Sanders Heart Health Journey

Jun 14, 2025

From The Gridiron To Recovery Barry Sanders Heart Health Journey

Jun 14, 2025