Record-Breaking Robinhood: $255 Billion In Assets, 108% Trading Volume Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record-Breaking Robinhood: $255 Billion in Assets, 108% Trading Volume Increase Signals a Bullish Market?

Robinhood, the popular commission-free trading app, has announced staggering figures that are sending ripples through the financial world. With a reported $255 billion in assets under custody and a 108% year-over-year increase in trading volume, the company is solidifying its position as a major player in the retail investment landscape. This unprecedented growth begs the question: is this a bullish indicator for the overall market?

This surge in activity isn't just a fleeting trend. Robinhood's success reflects a larger shift in how people interact with the stock market. The democratization of investing, fueled by accessible platforms and zero-commission trading, has empowered a new generation of retail investors. But what's driving this record-breaking performance?

Factors Contributing to Robinhood's Explosive Growth

Several factors contribute to Robinhood's impressive numbers:

-

Increased Retail Investor Participation: The pandemic played a significant role, pushing many to explore investing for the first time. Robinhood's user-friendly interface and commission-free trading made it the platform of choice for many new investors.

-

Meme Stock Mania: The rise of meme stocks like GameStop and AMC fueled a frenzy of trading activity, directly benefiting platforms like Robinhood that facilitate such transactions. While controversial, this phenomenon undoubtedly boosted trading volume. .

-

Cryptocurrency Adoption: Robinhood's expansion into cryptocurrency trading has also significantly contributed to its growth. The increasing popularity of cryptocurrencies, despite market volatility, has attracted a large user base to the platform.

-

Improved User Experience: Robinhood continuously refines its app, making it more intuitive and user-friendly, attracting and retaining a wider range of investors.

What Does This Mean for the Market?

While Robinhood's success is undeniably impressive, it's crucial to interpret its implications cautiously. While the increased trading volume and assets under custody suggest a buoyant market, it's not a foolproof indicator. The surge in retail investor activity is partly fueled by speculation and volatility, which can be a double-edged sword.

Experts caution against reading too much into Robinhood's performance alone. The overall market health depends on various macroeconomic factors, including inflation, interest rates, and geopolitical events. However, Robinhood's growth does highlight the increasing engagement of retail investors, a trend likely to continue shaping the future of the financial markets.

The Future of Robinhood and Retail Investing

Robinhood's continued success will depend on its ability to adapt to evolving market conditions and maintain investor trust. Competition is fierce, with other brokerage platforms also vying for market share. The company's long-term strategy will be crucial in determining its continued dominance in the retail investing space. .

In conclusion, Robinhood's record-breaking numbers are undeniably impressive and reflect a significant shift in the retail investing landscape. While not a definitive indicator of overall market health, it showcases the growing power and participation of individual investors. The future remains to be seen, but Robinhood’s journey is certainly one to watch closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record-Breaking Robinhood: $255 Billion In Assets, 108% Trading Volume Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

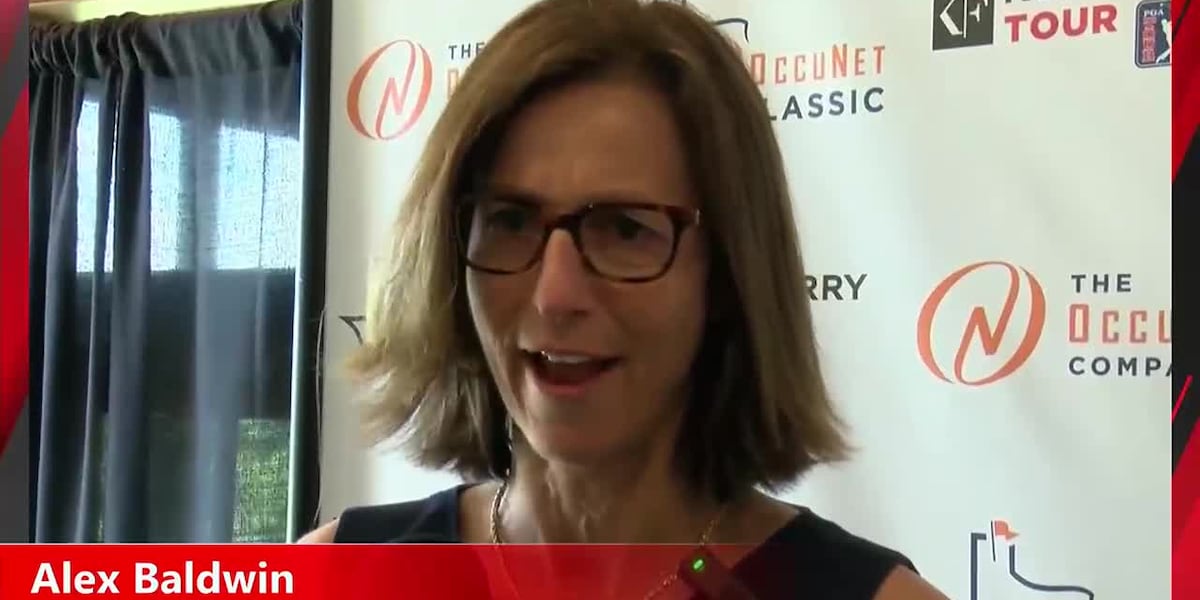

In Depth Report Korn Ferry Tour Press Conference

Jun 14, 2025

In Depth Report Korn Ferry Tour Press Conference

Jun 14, 2025 -

Excited To Play Morgan Wallen Previews 2025 Tour Setlist

Jun 14, 2025

Excited To Play Morgan Wallen Previews 2025 Tour Setlist

Jun 14, 2025 -

Crypto Trading Fuels Robinhoods Growth 65 Jump In Crypto Volume

Jun 14, 2025

Crypto Trading Fuels Robinhoods Growth 65 Jump In Crypto Volume

Jun 14, 2025 -

From Screen To Stage Paula Patton Talks New Movie And Future Endeavors

Jun 14, 2025

From Screen To Stage Paula Patton Talks New Movie And Future Endeavors

Jun 14, 2025 -

Barry Sanders Health Scare A Wake Up Call For Heart Health Awareness

Jun 14, 2025

Barry Sanders Health Scare A Wake Up Call For Heart Health Awareness

Jun 14, 2025