Record Bitcoin ETF Investments: Understanding The Current Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: Understanding the Current Market Trend

The world of finance is buzzing. Record-breaking investments are pouring into Bitcoin exchange-traded funds (ETFs), signaling a significant shift in investor sentiment and potentially marking a new era for cryptocurrency adoption. This surge isn't just a fleeting trend; it reflects a growing confidence in Bitcoin's long-term viability as a valuable asset. But what's driving this unprecedented influx of capital, and what does it mean for the future of Bitcoin and the broader crypto market?

The Rise of Bitcoin ETFs: A Gateway to Crypto Investing

Bitcoin ETFs are investment funds that track the price of Bitcoin, allowing investors to gain exposure to the cryptocurrency without directly owning and managing it. This accessibility is a key factor in their rising popularity. Previously, investing in Bitcoin involved navigating the complexities of cryptocurrency exchanges, managing private keys, and understanding the intricacies of blockchain technology. ETFs simplify this process, making Bitcoin more accessible to a wider range of investors, from seasoned professionals to retail traders. The approval of the first spot Bitcoin ETF in the US, for example, is expected to further fuel this growth.

Factors Fueling Record Investments

Several factors contribute to the current surge in Bitcoin ETF investments:

- Increased Regulatory Clarity: Gradual regulatory clarity around cryptocurrencies in key markets is boosting investor confidence. While regulations are still evolving, the increased dialogue and frameworks provide a sense of stability that was previously lacking.

- Institutional Adoption: Large institutional investors, including hedge funds and pension funds, are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversification tool.

- Mainstream Media Attention: Increased media coverage of Bitcoin and its potential has helped raise awareness and attract new investors. Positive news stories and discussions about Bitcoin's role in the future of finance contribute to the growing interest.

- Technological Advancements: Ongoing developments in blockchain technology and the expanding utility of Bitcoin are also driving investment. The potential for Bitcoin to be integrated into various financial systems and applications enhances its long-term appeal.

Understanding the Risks

While the current trend is positive, it's crucial to acknowledge the inherent risks associated with Bitcoin investments. Bitcoin's price is highly volatile, subject to significant fluctuations based on market sentiment, regulatory changes, and technological developments. Investors should proceed with caution and conduct thorough research before investing in any Bitcoin ETF. Diversification is key to mitigating risk.

It's important to consult with a financial advisor before making any investment decisions.

What the Future Holds

The record Bitcoin ETF investments suggest a growing acceptance of Bitcoin as a legitimate asset class. While predicting the future of any market is impossible, the current trend points toward increased institutional adoption and potentially further price appreciation. However, the market remains volatile, and investors should prepare for potential fluctuations.

The continued development of robust regulatory frameworks and the expansion of Bitcoin's utility will be crucial in shaping the future of Bitcoin ETFs and the overall cryptocurrency market. Stay informed about industry news and regulatory updates to navigate the evolving landscape effectively.

Keywords: Bitcoin ETF, Bitcoin investment, Cryptocurrency investment, ETF investment, Bitcoin price, Bitcoin regulation, Cryptocurrency ETF, Institutional investment, Bitcoin future, Crypto market trend, Spot Bitcoin ETF

Related Articles: (Links to relevant articles on your website or other reputable sources) This section would include links to related articles discussing Bitcoin, investing, or ETFs. For example, you might link to articles about specific Bitcoin ETFs, regulatory updates, or market analysis reports.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: Understanding The Current Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

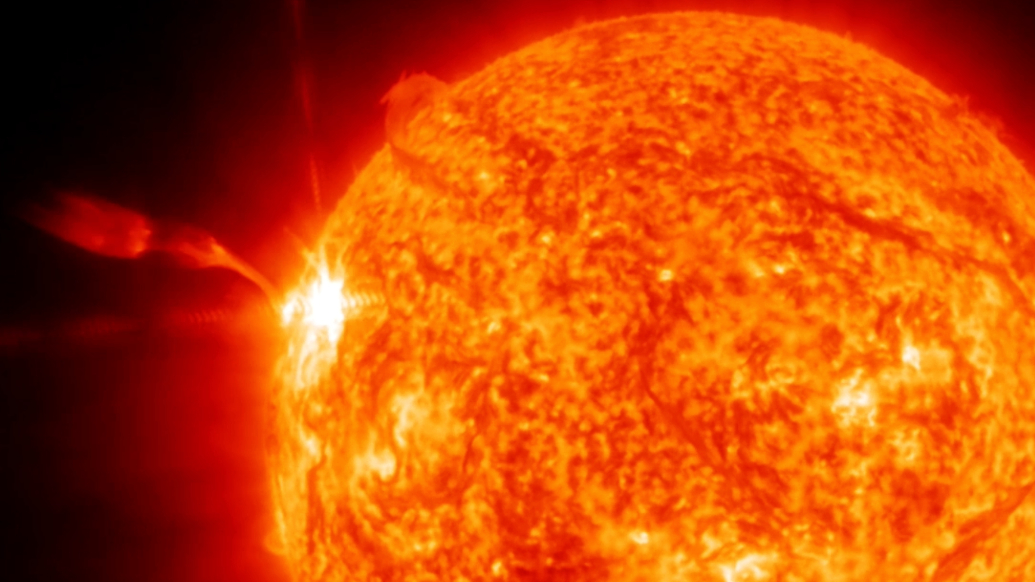

Powerful Solar Flare Causes Widespread Radio Blackouts Across Continents

May 20, 2025

Powerful Solar Flare Causes Widespread Radio Blackouts Across Continents

May 20, 2025 -

Ipl 2025 Lsg And Srh Players Clash In On Field Argument Check Live Score

May 20, 2025

Ipl 2025 Lsg And Srh Players Clash In On Field Argument Check Live Score

May 20, 2025 -

Creator Confirms New Peaky Blinders Series With Significant Shift

May 20, 2025

Creator Confirms New Peaky Blinders Series With Significant Shift

May 20, 2025 -

Ufc Fans Erupt Over Jon Jones Strip The Duck Jibe At Tom Aspinall

May 20, 2025

Ufc Fans Erupt Over Jon Jones Strip The Duck Jibe At Tom Aspinall

May 20, 2025 -

Enhancing Tourist Behavior In Bali A Call For International Assistance

May 20, 2025

Enhancing Tourist Behavior In Bali A Call For International Assistance

May 20, 2025