Record Bitcoin ETF Investments: Over $5 Billion Shows Confidence In Market Direction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: Over $5 Billion Shows Confidence in Market Direction

Bitcoin ETF investments have surged past the $5 billion mark, signaling a significant vote of confidence in the cryptocurrency's future. This unprecedented influx of capital into Bitcoin exchange-traded funds (ETFs) marks a pivotal moment for the digital asset market, suggesting a potential shift in institutional investor sentiment. The rapid growth signifies a growing acceptance of Bitcoin as a viable asset class for long-term investment strategies.

This monumental leap in investment underscores a broader trend: the increasing mainstream adoption of Bitcoin. The availability of regulated Bitcoin ETFs has played a crucial role, making it easier for institutional and retail investors to gain exposure to the cryptocurrency market without the complexities of direct ownership. This accessibility has undeniably fueled the surge in investment.

A Deeper Dive into the Numbers: What's Driving the Surge?

Several factors contribute to this record-breaking investment surge. Firstly, the regulatory clarity surrounding Bitcoin ETFs in certain jurisdictions has instilled confidence in investors. The approval of the first spot Bitcoin ETF in the United States, for example, would likely trigger an even larger wave of investment.

Secondly, the growing institutional interest in Bitcoin is a key driver. Large financial institutions are increasingly recognizing the potential of Bitcoin as a hedge against inflation and a diversification tool within their portfolios. This institutional adoption lends significant credibility to the market.

Thirdly, the maturing Bitcoin ecosystem itself plays a vital role. Improvements in infrastructure, security, and scalability have made Bitcoin a more attractive investment option. The increasing use of Bitcoin for payments and transactions also contributes to its long-term value proposition.

- Regulatory Clarity: Clearer regulatory frameworks reduce uncertainty and encourage investment.

- Institutional Adoption: Major financial institutions are increasingly integrating Bitcoin into their portfolios.

- Ecosystem Maturity: Improvements in infrastructure and technology boost investor confidence.

The Implications of this Record Investment

This massive influx of capital into Bitcoin ETFs has several significant implications for the cryptocurrency market and the broader financial landscape. It could potentially:

- Increase Bitcoin's price: Higher demand often translates to higher prices, potentially leading to further price appreciation.

- Boost market liquidity: Increased trading volume in Bitcoin ETFs could enhance liquidity within the market.

- Attract further investment: The success of Bitcoin ETFs could attract more investors to the cryptocurrency space.

- Drive innovation: The growing interest in Bitcoin could stimulate innovation within the cryptocurrency and blockchain technology sectors.

What the Future Holds for Bitcoin ETF Investments

Predicting the future is always challenging, but the current trend suggests sustained growth in Bitcoin ETF investments. However, market volatility remains a factor. Geopolitical events, regulatory changes, and technological advancements can all influence investment decisions. It’s crucial to remember that investing in cryptocurrencies carries inherent risks. Thorough research and a well-defined investment strategy are essential before committing capital.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment.

Further Reading:

Call to Action: Stay informed about the evolving cryptocurrency market by following reputable news sources and conducting thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: Over $5 Billion Shows Confidence In Market Direction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brett Favres Untold Controversy A J Perez Reveals Intimidation Tactics

May 20, 2025

Brett Favres Untold Controversy A J Perez Reveals Intimidation Tactics

May 20, 2025 -

Strip The Duck Jon Jones Aspinall Diss Sparks Fury Among Mma Fans

May 20, 2025

Strip The Duck Jon Jones Aspinall Diss Sparks Fury Among Mma Fans

May 20, 2025 -

Halting The Ukraine Bloodshed Trumps Planned Monday Discussion With Putin

May 20, 2025

Halting The Ukraine Bloodshed Trumps Planned Monday Discussion With Putin

May 20, 2025 -

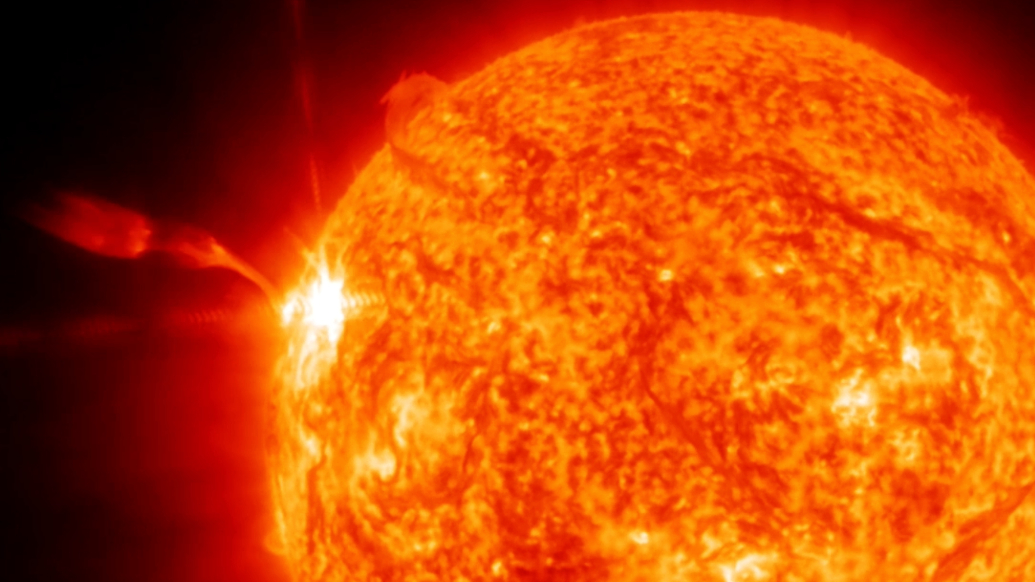

2025s Strongest Solar Flare Widespread Radio Disruptions In Europe Asia And The Middle East

May 20, 2025

2025s Strongest Solar Flare Widespread Radio Disruptions In Europe Asia And The Middle East

May 20, 2025 -

65 000 Airbnb Rentals In Spain Blocked For Regulatory Non Compliance

May 20, 2025

65 000 Airbnb Rentals In Spain Blocked For Regulatory Non Compliance

May 20, 2025