Record Assets At Robinhood: $255 Billion, Crypto Trading Up 65%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Hits Record $255 Billion in Assets, Crypto Trading Soars 65%

Robinhood Markets, the popular commission-free trading platform, announced record-breaking assets under custody, reaching a staggering $255 billion. This significant surge is largely attributed to a 65% increase in cryptocurrency trading volume, showcasing the growing appeal of digital assets among retail investors. The news sent ripples through the financial markets, highlighting Robinhood's continued growth and the enduring popularity of cryptocurrencies despite recent market volatility.

This impressive milestone comes at a crucial time for Robinhood, which has faced its share of challenges in recent years. The company's stock price has seen its ups and downs, but this latest announcement paints a picture of robust growth and a strong user base. The increase in assets under custody represents a significant vote of confidence in the platform and its services.

Cryptocurrency's Continued Rise:

The 65% jump in cryptocurrency trading volume is particularly noteworthy. This reflects a broader trend of increasing retail investor interest in digital assets, despite the well-documented price swings inherent in the crypto market. Experts attribute this surge to several factors:

- Increased Accessibility: Platforms like Robinhood have made cryptocurrency trading more accessible to the average investor, removing many of the technical barriers that previously existed.

- Growing Institutional Adoption: The growing acceptance of cryptocurrencies by institutional investors lends credibility to the asset class and encourages retail participation.

- Technological Advancements: Continuous improvements in blockchain technology and the emergence of new, innovative crypto projects fuel ongoing interest.

However, it's important to remember that cryptocurrency investing remains inherently risky. Price volatility can lead to significant gains or losses, and investors should always conduct thorough research and understand the risks before investing. Consider consulting a financial advisor before making any investment decisions.

Robinhood's Strategic Moves:

Robinhood's success isn't solely dependent on the cryptocurrency market's performance. The company has implemented several strategic moves to enhance its platform and attract new users, including:

- Expansion of Offerings: Robinhood continues to expand its range of investment options, offering access to stocks, ETFs, options, and cryptocurrencies.

- Improved User Experience: The platform has focused on enhancing its user interface and overall user experience, making it more intuitive and user-friendly.

- Focus on Education: Robinhood has invested in educational resources to help users better understand investing and manage their portfolios.

Looking Ahead:

The record $255 billion in assets under custody and the significant increase in cryptocurrency trading represent a strong performance for Robinhood. This signifies the platform's ability to adapt to the evolving financial landscape and cater to the growing demand for accessible and user-friendly investment tools. However, the company's future success will depend on its continued ability to innovate, adapt to market changes, and maintain user trust. The ongoing regulatory scrutiny of the cryptocurrency market will also play a significant role in shaping Robinhood's trajectory. Whether this growth is sustainable remains to be seen, but the current figures certainly paint a positive picture for the company’s immediate future.

Keywords: Robinhood, assets under custody, cryptocurrency trading, crypto, Bitcoin, Ethereum, investing, stock market, retail investors, financial markets, fintech, blockchain, digital assets, investment platform, commission-free trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Assets At Robinhood: $255 Billion, Crypto Trading Up 65%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Barry Sanders Health Crisis Heart Attack And Recovery Journey

Jun 14, 2025

Barry Sanders Health Crisis Heart Attack And Recovery Journey

Jun 14, 2025 -

Understanding The Northern Ireland Unrest Whats Fueling The Violence

Jun 14, 2025

Understanding The Northern Ireland Unrest Whats Fueling The Violence

Jun 14, 2025 -

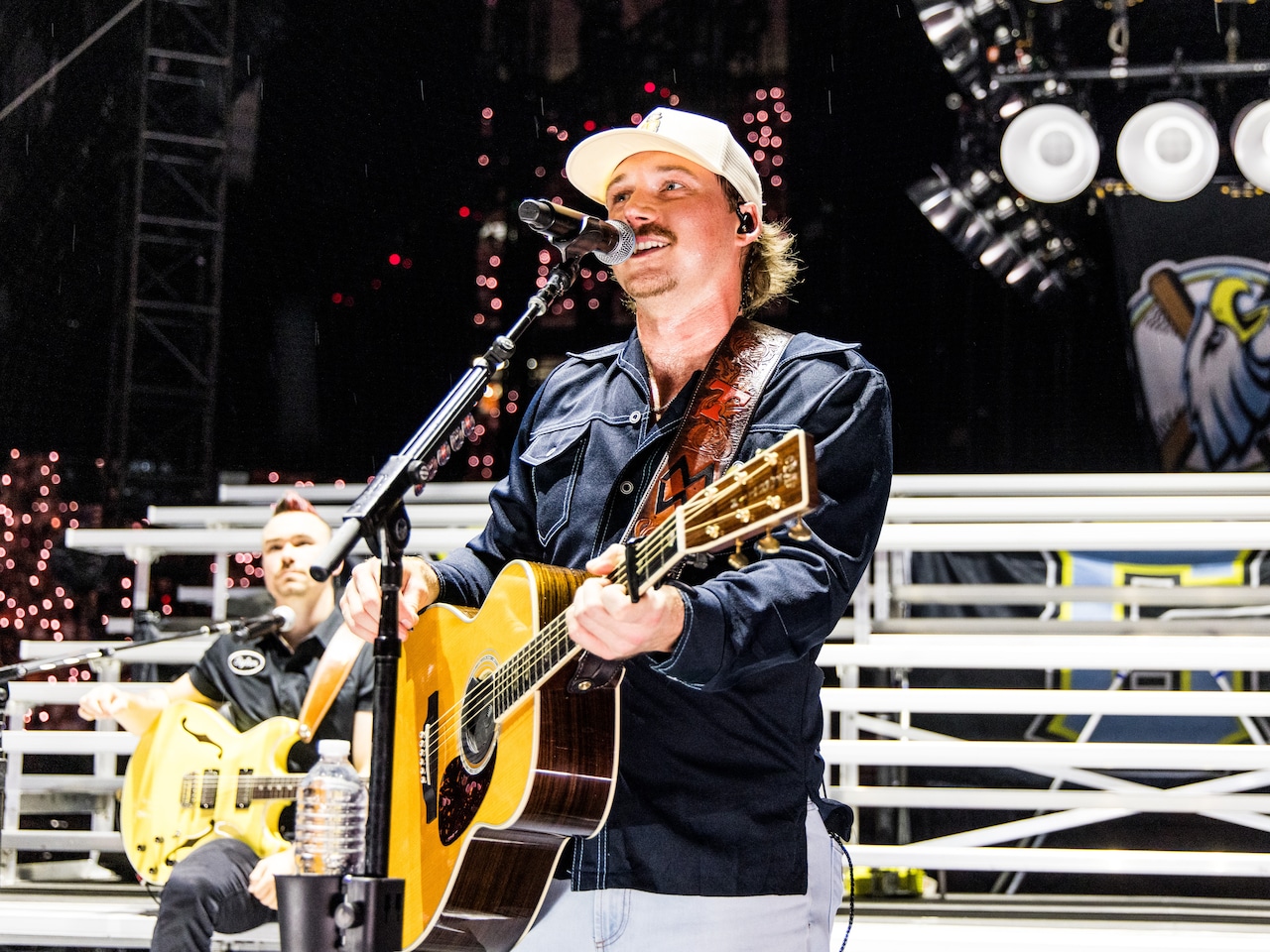

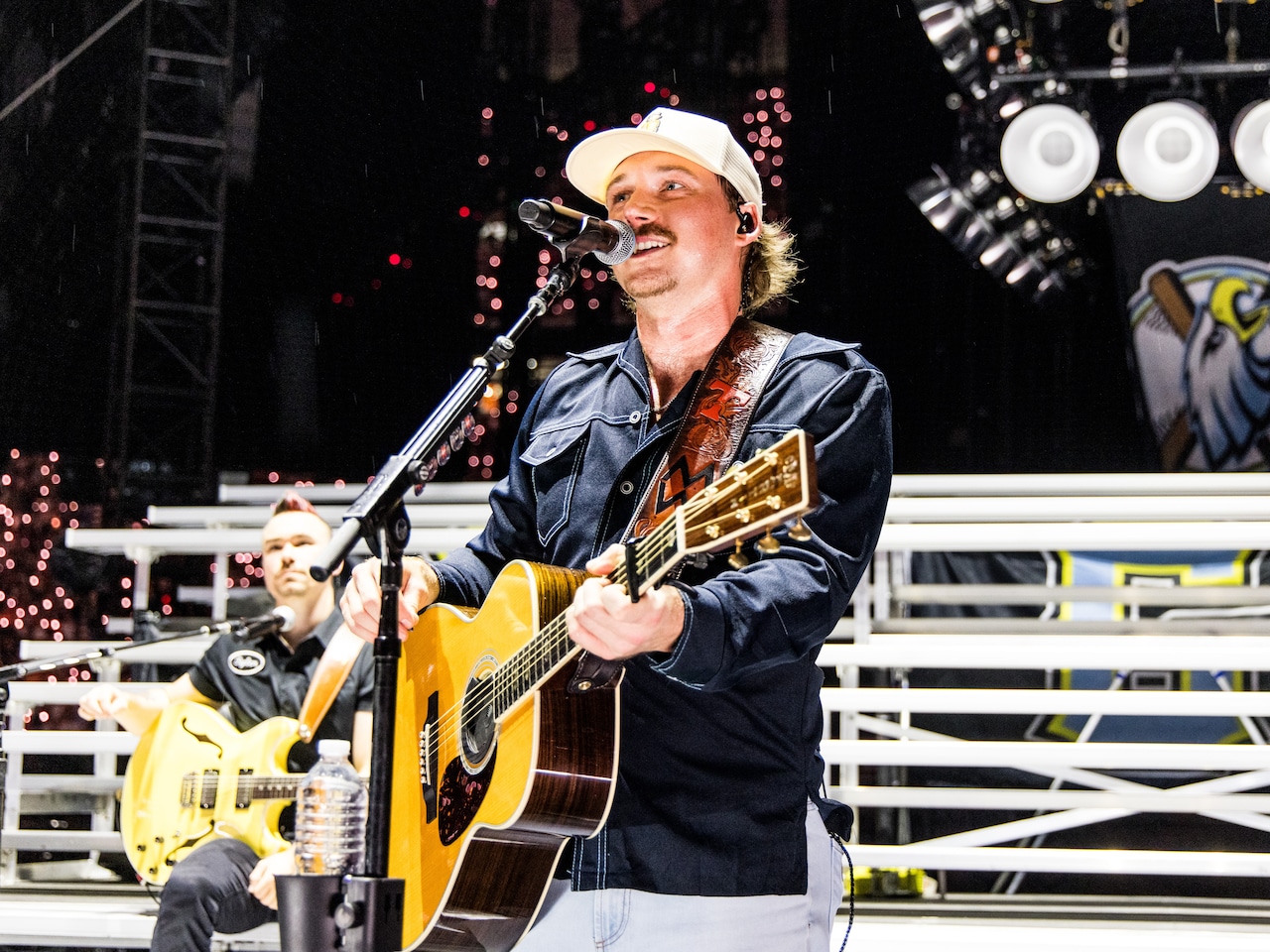

Cheap Morgan Wallen Houston Tickets I M The Problem Tour June 20 And 21 Dates

Jun 14, 2025

Cheap Morgan Wallen Houston Tickets I M The Problem Tour June 20 And 21 Dates

Jun 14, 2025 -

Excited To Play Morgan Wallen Previews Setlist For Upcoming I M The Problem Tour

Jun 14, 2025

Excited To Play Morgan Wallen Previews Setlist For Upcoming I M The Problem Tour

Jun 14, 2025 -

Houstons Morgan Wallen Concert Find Discounted Tickets June 20 And 21

Jun 14, 2025

Houstons Morgan Wallen Concert Find Discounted Tickets June 20 And 21

Jun 14, 2025