Record $255 Billion In Assets: Robinhood's Trading Volumes Soar On Crypto Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record $255 Billion in Assets: Robinhood's Trading Volumes Soar on Crypto Growth

Robinhood, the popular commission-free trading app, has announced record-breaking assets under custody, reaching a staggering $255 billion. This significant surge is largely attributed to the explosive growth in cryptocurrency trading on the platform. The news has sent ripples through the financial tech industry, highlighting the increasing mainstream adoption of digital assets.

The dramatic increase in Robinhood's assets under custody represents a monumental leap for the company, showcasing its burgeoning position within the rapidly expanding fintech landscape. This growth is not merely a reflection of increased user base, but also a powerful indicator of the shifting tides in the investment world, with cryptocurrencies playing an increasingly central role.

The Crypto Catalyst:

The primary driver behind this remarkable growth is undoubtedly the renewed interest in cryptocurrencies. Bitcoin's price fluctuations, along with the burgeoning popularity of altcoins like Ethereum and Solana, have drawn a significant influx of new and seasoned investors to platforms like Robinhood. The platform's user-friendly interface and commission-free trading model have made it particularly attractive to both novice and experienced crypto traders.

This surge in crypto trading volume isn't just a temporary blip; it reflects a broader trend of institutional and retail investors embracing digital assets as a viable investment class. This is further fueled by increasing regulatory clarity (in some jurisdictions) and the development of sophisticated DeFi (Decentralized Finance) applications.

Robinhood's Strategic Response:

Robinhood has strategically positioned itself to capitalize on this crypto boom. The company has consistently expanded its cryptocurrency offerings, adding support for a wider range of digital assets and introducing new features to enhance the trading experience. This proactive approach has allowed them to attract and retain users in a highly competitive market. Their commitment to user education and transparency has also contributed to their success.

Challenges and Future Outlook:

While Robinhood's success is undeniable, the company also faces significant challenges. The volatile nature of the cryptocurrency market presents inherent risks, and regulatory scrutiny continues to intensify globally. Maintaining user trust and ensuring platform security remain paramount concerns.

Despite these challenges, the future looks bright for Robinhood. The continued growth of the cryptocurrency market, coupled with the platform's strategic adaptations, suggests that the $255 billion milestone is merely a stepping stone towards even greater expansion. The company's commitment to innovation and its focus on the burgeoning retail crypto investment market positions it for continued success in the years to come.

Key Takeaways:

- Record-breaking assets: Robinhood now holds $255 billion in assets under custody.

- Cryptocurrency's role: The surge is primarily driven by increased cryptocurrency trading volumes.

- Strategic positioning: Robinhood's user-friendly interface and expansion of crypto offerings are key factors in its success.

- Future outlook: While challenges remain, Robinhood's future appears strong given the continued growth of the crypto market.

Want to learn more about investing in cryptocurrencies? [Link to a reputable financial news source or educational resource on cryptocurrency investing (replace bracketed information with actual link)]. Disclaimer: Investing in cryptocurrencies involves significant risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record $255 Billion In Assets: Robinhood's Trading Volumes Soar On Crypto Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get Ready Morgan Wallens Tour Merch And Song Details Revealed

Jun 14, 2025

Get Ready Morgan Wallens Tour Merch And Song Details Revealed

Jun 14, 2025 -

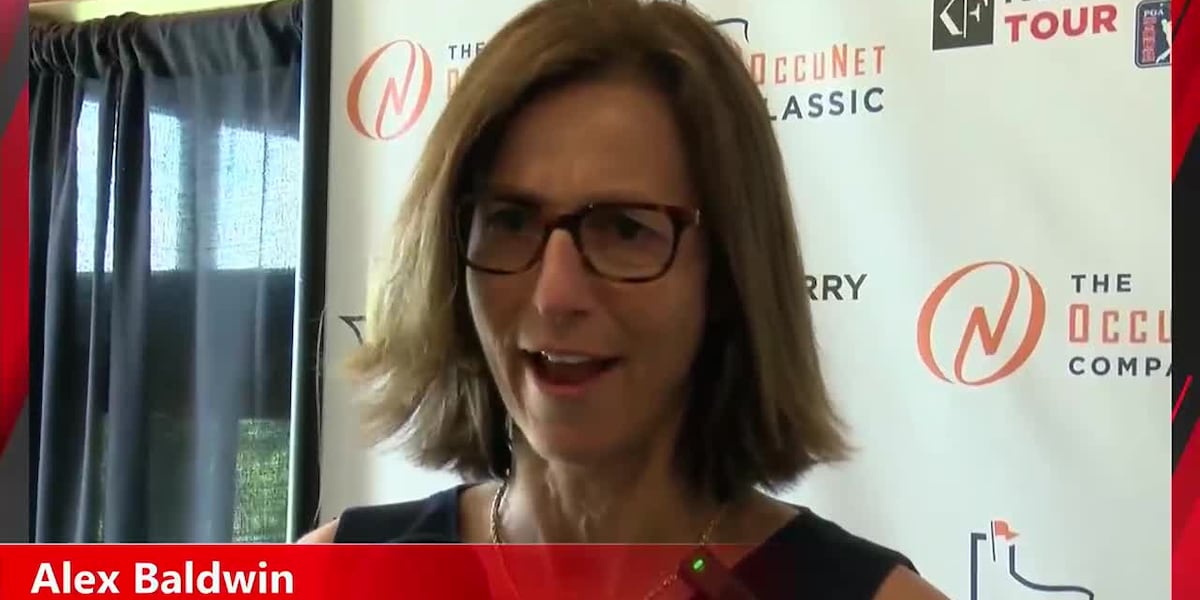

Analysis Key Issues Discussed At The Korn Ferry Tour News Conference

Jun 14, 2025

Analysis Key Issues Discussed At The Korn Ferry Tour News Conference

Jun 14, 2025 -

255 Billion In Assets Robinhood Reports Massive Growth In Trading Volume And Crypto Activity

Jun 14, 2025

255 Billion In Assets Robinhood Reports Massive Growth In Trading Volume And Crypto Activity

Jun 14, 2025 -

Second Night Of Curfew L A Protests Intensify

Jun 14, 2025

Second Night Of Curfew L A Protests Intensify

Jun 14, 2025 -

Lions Great Barry Sanders Shares His Heart Attack Story In Upcoming Documentary

Jun 14, 2025

Lions Great Barry Sanders Shares His Heart Attack Story In Upcoming Documentary

Jun 14, 2025