RBLX Stock Trading At A Premium: When To Buy, Sell, Or Hold

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBLX Stock Trading at a Premium: When to Buy, Sell, or Hold

Roblox (RBLX) has captured the imagination of investors and gamers alike, but its stock price has seen significant swings. Is now the time to buy, sell, or hold onto your RBLX shares? This comprehensive guide dives into the current market conditions, future projections, and risk factors to help you make informed decisions about your investment.

Understanding the RBLX Premium:

Roblox's stock price often trades at a premium, reflecting investor optimism about its long-term growth potential. The company's massive user base, particularly among younger demographics, and its robust platform for user-generated content contribute to this positive sentiment. However, this premium also means the stock is more susceptible to market corrections and negative news.

Factors Influencing RBLX Stock Price:

Several key factors influence RBLX's price volatility:

-

User Engagement and Growth: Consistent growth in daily active users (DAU) and average bookings per DAU (ABPU) are crucial indicators of Roblox's health. A decline in these metrics could trigger a sell-off. Keep an eye on quarterly earnings reports for these vital statistics.

-

Monetization Strategies: Roblox's ability to effectively monetize its massive user base through Robux sales, virtual item purchases, and developer payouts is paramount. Changes in monetization strategies or a decline in revenue could impact investor confidence.

-

Competition: The gaming industry is fiercely competitive. The emergence of new platforms or competitors with similar offerings could pose a significant threat to Roblox's market share.

-

Economic Conditions: Like many tech stocks, RBLX is sensitive to broader economic trends. Recessions or periods of economic uncertainty can lead to investors shifting their focus to safer investments.

-

Regulatory Scrutiny: The increasing regulatory scrutiny surrounding data privacy and children's online safety could impact Roblox's operations and investor sentiment.

When to Buy RBLX Stock:

Consider buying RBLX stock when:

-

The price dips significantly: Market corrections offer potential buying opportunities if you believe in Roblox's long-term prospects. Look for dips below the 200-day moving average, a common technical analysis indicator.

-

Growth metrics are strong: Positive earnings reports showcasing robust user growth, increased engagement, and rising average bookings per DAU are bullish signs.

-

New features or partnerships are announced: Innovative updates to the platform or strategic partnerships can boost investor confidence and drive up the stock price.

When to Sell RBLX Stock:

Consider selling RBLX stock when:

-

User growth stalls or declines: A consistent decline in DAU or ABPU indicates potential problems and warrants caution.

-

Negative earnings reports are released: Consistently disappointing earnings reports suggest underlying issues within the company's business model.

-

Significant competition emerges: The arrival of a major competitor offering similar functionality could significantly impact Roblox's market share and profitability.

-

You've achieved your investment goals: If you've reached your desired return on investment, it's prudent to consider selling and securing your profits.

When to Hold RBLX Stock:

Holding RBLX stock can be a viable strategy if:

-

You have a long-term investment horizon: Roblox is a growth stock, and growth stocks typically require a long-term perspective to see significant returns.

-

The company consistently exceeds expectations: If Roblox continues to deliver strong financial performance and user growth, holding onto your shares might be a sound decision.

-

You believe in the company's future: Having faith in Roblox's long-term vision and its ability to adapt to the changing gaming landscape is essential for a hold strategy.

Disclaimer: This article provides general information and should not be considered financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Investing in stocks always carries inherent risk, and past performance is not indicative of future results.

Further Research: To stay updated on RBLX's performance, regularly check the company's investor relations website and follow reputable financial news sources. Understanding financial statements and key metrics like DAU and ABPU is crucial for informed decision-making. Consider exploring resources like [link to a reputable financial news website] and [link to SEC Edgar database] for more in-depth analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBLX Stock Trading At A Premium: When To Buy, Sell, Or Hold. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Memphis Community Pushes Back Against Elon Musks X Ai Expansion

Aug 15, 2025

Memphis Community Pushes Back Against Elon Musks X Ai Expansion

Aug 15, 2025 -

Fortnite Servers Back Online After Outage Login Issues Resolved

Aug 15, 2025

Fortnite Servers Back Online After Outage Login Issues Resolved

Aug 15, 2025 -

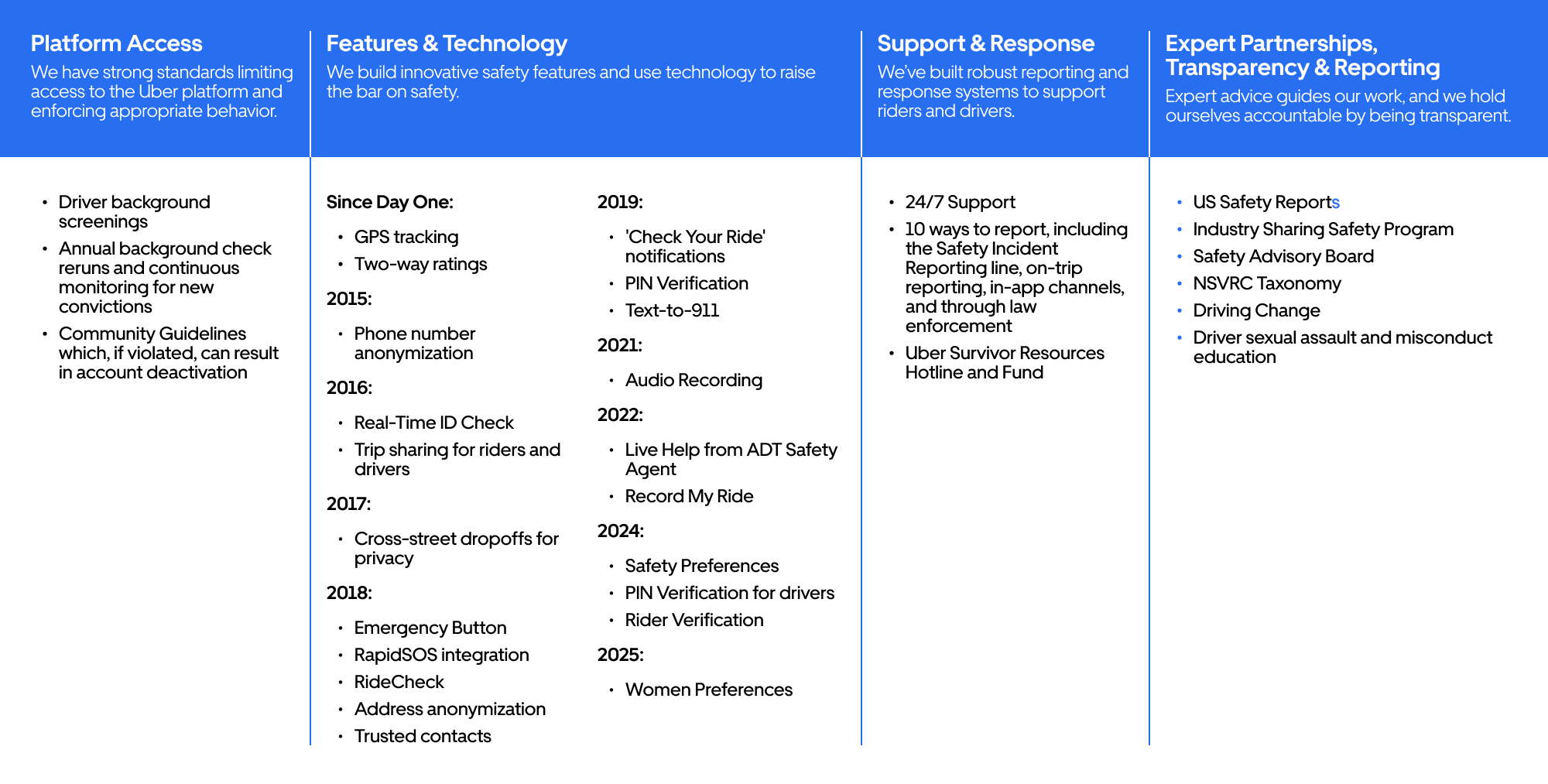

Examining Ubers Safety Performance Data And Analysis

Aug 15, 2025

Examining Ubers Safety Performance Data And Analysis

Aug 15, 2025 -

Data Privacy And Community Displacement Examining X Ais Footprint In Memphis

Aug 15, 2025

Data Privacy And Community Displacement Examining X Ais Footprint In Memphis

Aug 15, 2025 -

How Adhd Treatment Can Decrease The Likelihood Of Criminal Behavior Substance Abuse And Accidents

Aug 15, 2025

How Adhd Treatment Can Decrease The Likelihood Of Criminal Behavior Substance Abuse And Accidents

Aug 15, 2025

Latest Posts

-

2028 Democratic Nomination The Importance Of An Immediate Campaign Strategy

Aug 16, 2025

2028 Democratic Nomination The Importance Of An Immediate Campaign Strategy

Aug 16, 2025 -

Legal Experts Trumps Dc Police Control Unrepeatable In Other Cities

Aug 16, 2025

Legal Experts Trumps Dc Police Control Unrepeatable In Other Cities

Aug 16, 2025 -

Trumps Authority Challenged Can He Control Police Outside Washington D C

Aug 16, 2025

Trumps Authority Challenged Can He Control Police Outside Washington D C

Aug 16, 2025 -

Brooks Naders Italian Vacation A Showcase Of Topless And Rhinestone Styles

Aug 16, 2025

Brooks Naders Italian Vacation A Showcase Of Topless And Rhinestone Styles

Aug 16, 2025 -

Indi Go Safety Rating A Comprehensive Review Of Recent Changes

Aug 16, 2025

Indi Go Safety Rating A Comprehensive Review Of Recent Changes

Aug 16, 2025