RBA Holds Cash Rate: Bullock Explains Timing Decision Amidst Australia News

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBA Holds Cash Rate: Bullock Explains Timing Decision Amidst Australia News

The Reserve Bank of Australia (RBA) has once again held the official cash rate steady at 4.1%, a decision Governor Philip Lowe described as a "pause" rather than a pivot. This announcement, breaking across major Australian news outlets, comes amidst a backdrop of mixed economic signals and intense speculation regarding the future direction of monetary policy. The timing of this decision, particularly given recent inflation data, has prompted considerable analysis, with RBA board member Michele Bullock playing a key role in explaining the rationale.

A Cautious Approach in Unsettled Times

The RBA's decision to hold reflects a cautious approach to navigating the current economic landscape. While inflation remains stubbornly above the target range, recent data has shown signs of easing. This nuanced picture, coupled with concerns about the potential for a sharper-than-expected economic slowdown, has led the board to opt for a period of observation before making any further adjustments. As Governor Lowe emphasized, the board is closely monitoring a range of economic indicators, including consumer spending, wage growth, and global economic developments.

Bullock's Insights: Understanding the Pause

RBA board member Michele Bullock has been instrumental in clarifying the reasoning behind the decision to hold the cash rate. Her statements highlight the importance of assessing the lagged impact of previous rate hikes and the need to avoid prematurely tightening monetary policy to a degree that could trigger a significant economic contraction. Bullock's emphasis on data dependency underscores the RBA's commitment to a measured and evidence-based approach to policymaking. She highlighted the importance of allowing time for the full effects of previous rate rises to filter through the economy before determining the next steps.

Key Factors Influencing the RBA's Decision:

- Easing Inflation: While still above target, inflation shows signs of moderating, offering some respite to the RBA. [Link to ABS inflation data]

- Economic Slowdown Risks: Concerns persist about a potential economic slowdown, fueled by high interest rates and global uncertainty.

- Lagged Effects of Rate Hikes: The full impact of previous rate increases is yet to be fully realized, creating uncertainty about the need for further tightening.

- Global Economic Conditions: Global factors, including geopolitical instability and international supply chain disruptions, continue to influence the Australian economy.

What This Means for Australian Homeowners and Businesses:

The decision to hold the cash rate steady provides temporary relief for Australian homeowners facing high mortgage repayments. However, uncertainty remains regarding future interest rate movements, urging caution for both borrowers and lenders. Businesses, too, will be closely watching the RBA's next move, as interest rate decisions significantly impact investment and hiring decisions. [Link to article on impact on mortgage repayments]

Looking Ahead: What to Expect Next

The RBA's decision to pause does not signal an end to the tightening cycle. The board has clearly indicated that future rate decisions will be highly data-dependent. Continued monitoring of inflation, employment figures, and economic growth will be crucial in determining the next steps. The RBA's next meeting is scheduled for [date of next meeting], and market analysts will be closely scrutinizing economic data released before then.

Keywords: RBA, Reserve Bank of Australia, cash rate, interest rates, Philip Lowe, Michele Bullock, inflation, Australian economy, monetary policy, economic growth, mortgage rates, Australian news, economic slowdown.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBA Holds Cash Rate: Bullock Explains Timing Decision Amidst Australia News. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

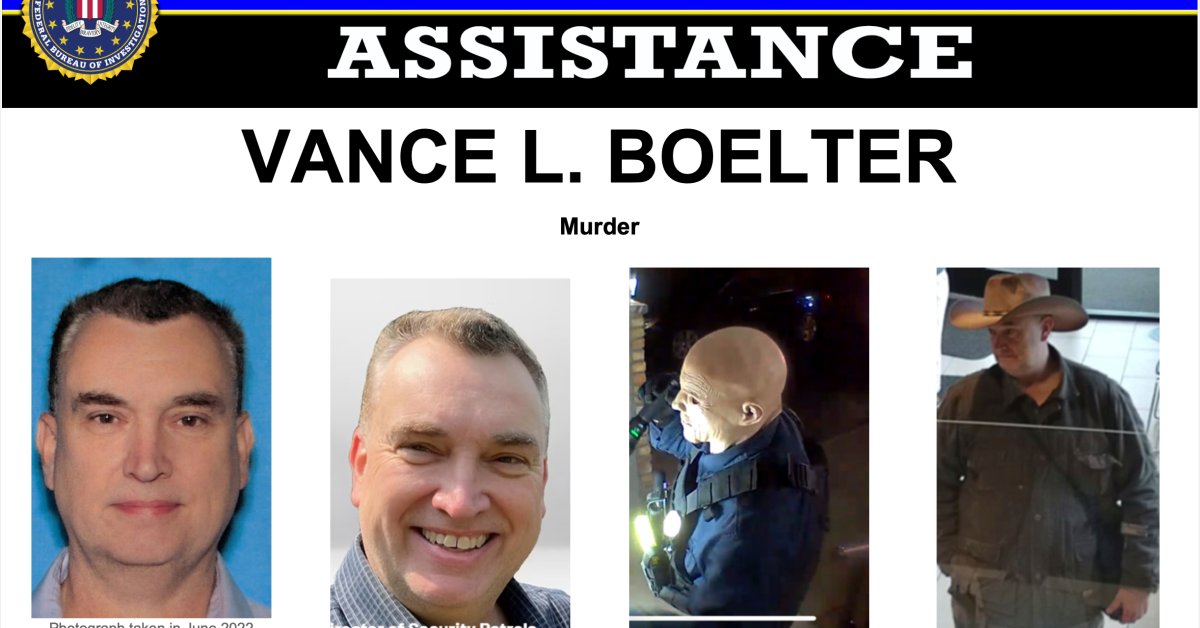

Minnesota Legislature Shooting Suspect Vance Boelters Arrest And Charges Explained

Jul 09, 2025

Minnesota Legislature Shooting Suspect Vance Boelters Arrest And Charges Explained

Jul 09, 2025 -

Update Neillsville Lottery Ticket Tampering Case Sees Plea From Defendant

Jul 09, 2025

Update Neillsville Lottery Ticket Tampering Case Sees Plea From Defendant

Jul 09, 2025 -

Falcon 9s 500th Orbital Launch A Quiet Weeks Big Event

Jul 09, 2025

Falcon 9s 500th Orbital Launch A Quiet Weeks Big Event

Jul 09, 2025 -

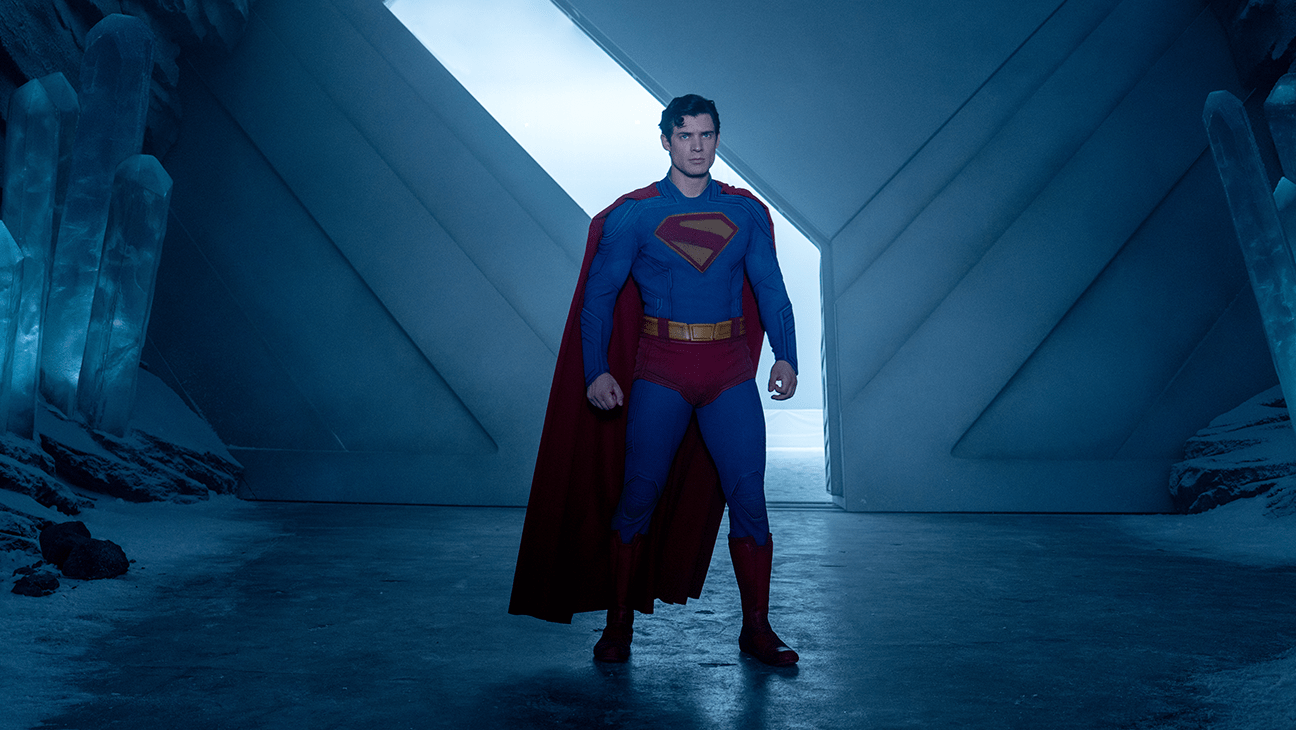

Superman First Reactions Promising Start For Dc Studios New Era

Jul 09, 2025

Superman First Reactions Promising Start For Dc Studios New Era

Jul 09, 2025 -

From Prostitution To Influencer Archita Phukans Harrowing Story

Jul 09, 2025

From Prostitution To Influencer Archita Phukans Harrowing Story

Jul 09, 2025

Latest Posts

-

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025 -

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025 -

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025 -

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025 -

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025