Quantum Computing Setback: Rigetti (RGTI) Stock Drops On Revenue Miss

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Quantum Computing Setback: Rigetti (RGTI) Stock Plummets on Revenue Miss

Rigetti Computing, a leading player in the burgeoning field of quantum computing, experienced a significant stock drop following its recent earnings report, which revealed a substantial revenue miss. The news sent shockwaves through the already volatile tech sector, raising questions about the timeline for widespread quantum computing adoption and the financial viability of companies operating in this cutting-edge space. Investors reacted swiftly, driving RGTI stock prices down considerably. This setback underscores the inherent risks associated with investing in early-stage technological advancements.

Revenue Miss Highlights Challenges in Quantum Computing Commercialization

Rigetti's disappointing financial results highlight the considerable hurdles faced by companies attempting to commercialize quantum computing technology. While the potential applications of quantum computers are vast – from drug discovery and materials science to financial modeling and artificial intelligence – translating this potential into tangible revenue streams proves challenging. The company missed its revenue projections, indicating that the market for quantum computing solutions is still developing more slowly than many had anticipated.

This revenue miss wasn't the only factor contributing to the RGTI stock decline. The company also provided a less-than-optimistic outlook for the coming quarters, further dampening investor enthusiasm. This cautious forecast reflects the broader challenges facing the quantum computing industry, including the significant research and development costs required to build and improve these complex machines.

What Went Wrong for Rigetti?

Several factors likely contributed to Rigetti's revenue miss:

- Slow adoption: The market for quantum computing is still nascent. Businesses are hesitant to invest in a technology that is still under development and lacks widespread standardization.

- High development costs: Building and maintaining quantum computers is extremely expensive. This high capital expenditure limits the company's ability to scale its operations and generate substantial revenue quickly.

- Competition: The quantum computing industry is highly competitive, with several major players vying for market share. This competition intensifies the pressure on companies like Rigetti to deliver results quickly.

- Technological hurdles: Quantum computing technology is inherently complex, and significant challenges remain in terms of scalability, error correction, and algorithm development.

The Future of Quantum Computing and Rigetti's Prospects

Despite this recent setback, the long-term prospects for quantum computing remain promising. Many experts believe that quantum computers will eventually revolutionize various industries. However, the path to widespread adoption is likely to be longer and more challenging than initially predicted.

Rigetti, along with other companies in the field, must continue to focus on:

- Improving qubit performance: Increasing the number and quality of qubits is crucial for building more powerful quantum computers.

- Developing practical applications: Identifying and developing commercially viable applications for quantum computing is essential for attracting customers and generating revenue.

- Securing strategic partnerships: Collaborating with industry leaders and research institutions can help accelerate the development and adoption of quantum computing technology.

The Rigetti setback serves as a cautionary tale for investors. While the potential rewards in the quantum computing sector are enormous, the risks are equally significant. Careful due diligence and a long-term investment horizon are crucial for navigating this volatile and rapidly evolving field. The future of quantum computing remains bright, but the road ahead is likely to be bumpy. For those interested in learning more about the complexities of quantum computing, resources like the website offer valuable insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Quantum Computing Setback: Rigetti (RGTI) Stock Drops On Revenue Miss. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Habeas Corpus Erosion Of Rights Under The Trump Administration

May 14, 2025

Habeas Corpus Erosion Of Rights Under The Trump Administration

May 14, 2025 -

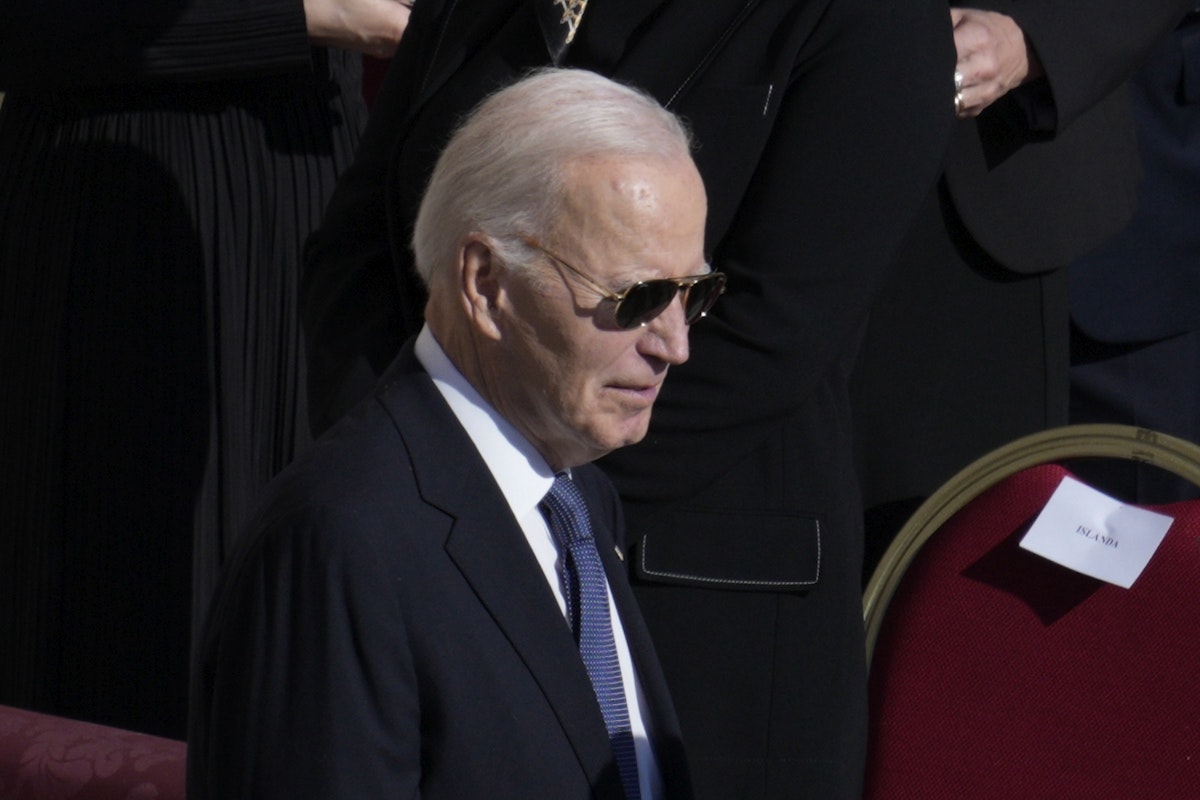

Bidens Health The Untold Story Of Internal Staff Concerns

May 14, 2025

Bidens Health The Untold Story Of Internal Staff Concerns

May 14, 2025 -

Predicting Alaves Vs Valencia Lineups Team News And Key Matchups

May 14, 2025

Predicting Alaves Vs Valencia Lineups Team News And Key Matchups

May 14, 2025 -

Villarreal Leganes Hoy En Vivo Minuto A Minuto De La Liga Ea Sports

May 14, 2025

Villarreal Leganes Hoy En Vivo Minuto A Minuto De La Liga Ea Sports

May 14, 2025 -

Microsoft Layoffs 2024 A Deeper Look At The Companys Restructuring

May 14, 2025

Microsoft Layoffs 2024 A Deeper Look At The Companys Restructuring

May 14, 2025