Private Equity Firm Behind Subway Purchases Major Chicken Restaurant Brand For $1B

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Private Equity Giant Roark Capital Acquires Arby's for $1 Billion, Expanding Fast-Food Empire

Roark Capital, the private equity firm already owning Subway, has made a significant splash in the fast-food industry, acquiring the popular roast beef and sandwich chain Arby's for a staggering $1 billion. This blockbuster deal marks another major step in Roark's aggressive expansion strategy within the restaurant sector, solidifying its position as a dominant player.

The acquisition, announced [Insert Date of Announcement], sends ripples throughout the fast-food landscape. Analysts predict significant changes in Arby's operations and menu offerings, potentially mirroring the strategic moves Roark has implemented at Subway since its acquisition. This could include a renewed focus on menu innovation, aggressive franchise expansion, and a potential streamlining of operations to boost profitability.

Roark Capital's Restaurant Portfolio: A Growing Powerhouse

Roark Capital has built an impressive portfolio of restaurant brands over the years. Beyond Subway and now Arby's, the firm also owns several other notable chains, showcasing its keen eye for identifying and developing successful food businesses. This diversified portfolio allows for synergies and cross-promotional opportunities, potentially leading to increased market share and profitability for each brand.

- Subway: The iconic submarine sandwich chain, acquired by Roark in 2021, is undergoing a significant transformation under the private equity firm's ownership. This includes menu updates, store renovations, and a greater emphasis on digital ordering and delivery.

- Arby's: Now the latest addition to the Roark portfolio, Arby's brings a strong brand recognition and a loyal customer base. The integration of Arby's into Roark’s existing ecosystem is expected to generate significant returns.

- Other Roark Brands: Roark Capital's portfolio also includes other well-known restaurant chains, demonstrating the firm's extensive experience and expertise in the industry. (Include a list of prominent Roark-owned brands if available, linking to relevant information where possible).

Implications of the Arby's Acquisition

The $1 billion acquisition of Arby's raises several key questions about the future of both brands and the wider fast-food industry. Experts believe this deal could:

- Increase Competition: The combined power of Subway and Arby's under Roark's umbrella will intensify competition within the fast-food sector, potentially leading to price wars and innovative new menu offerings.

- Drive Innovation: Roark's track record suggests a focus on modernization and innovation. Expect to see updates to Arby's technology, marketing, and menu items in the coming years.

- Reshape the Fast-Food Landscape: This acquisition is a significant event that will likely influence the strategic decisions of other players in the fast-food industry. Expect to see other private equity firms and large corporations closely watching Roark's moves.

What's Next for Arby's and Roark Capital?

The coming months and years will be crucial in observing how Roark Capital integrates Arby's into its portfolio and implements its strategic vision. Investors and industry analysts will be closely monitoring the company's performance and any resulting changes to Arby's operations. This acquisition signals a bold move in the fast-food industry, suggesting further consolidation and significant changes within the sector are likely. The long-term impact of this deal remains to be seen, but it undoubtedly marks a significant turning point in the fast-food landscape.

Keywords: Roark Capital, Arby's, Subway, Private Equity, Fast Food Acquisition, Restaurant Industry, Billion Dollar Deal, Franchise, Menu Innovation, Industry Consolidation, Fast Food Trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Private Equity Firm Behind Subway Purchases Major Chicken Restaurant Brand For $1B. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Call To Action Corporate Strategies For A 2 C World

Jun 04, 2025

Urgent Call To Action Corporate Strategies For A 2 C World

Jun 04, 2025 -

Asante Blackk Peyton Alex Smith And Simmie Sims Iii Lead Cast In Snowfall Spinoff

Jun 04, 2025

Asante Blackk Peyton Alex Smith And Simmie Sims Iii Lead Cast In Snowfall Spinoff

Jun 04, 2025 -

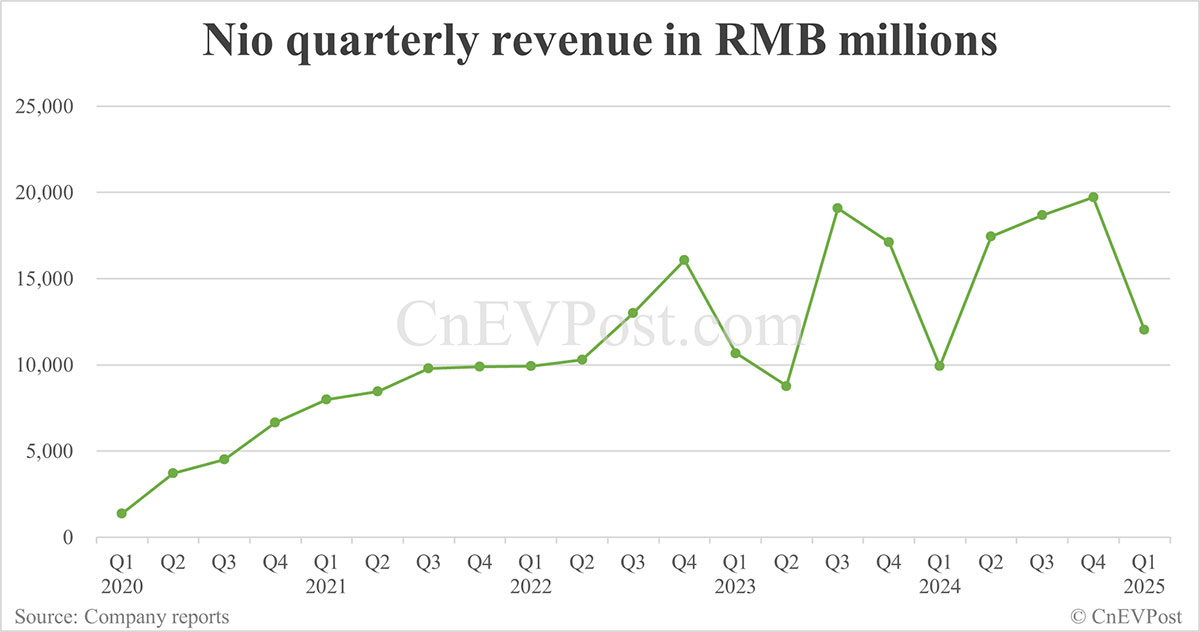

Nio Reports 21 Year On Year Revenue Growth In Q1

Jun 04, 2025

Nio Reports 21 Year On Year Revenue Growth In Q1

Jun 04, 2025 -

Underwater Explosions Damage Key Russia Crimea Bridge Ukraine Confirms

Jun 04, 2025

Underwater Explosions Damage Key Russia Crimea Bridge Ukraine Confirms

Jun 04, 2025 -

Significant Team Changes For India And Thailands Upcoming Friendly

Jun 04, 2025

Significant Team Changes For India And Thailands Upcoming Friendly

Jun 04, 2025