Private Equity Firm Acquires Major Fried Chicken Brand For $1 Billion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Private Equity Giant Gobbles Up Fried Chicken Brand in $1 Billion Deal

The fast-food world is sizzling with news of a major acquisition: A leading private equity firm, Zenith Capital Partners, has announced the acquisition of Golden Crisp Fried Chicken, a nationally recognized fried chicken brand, for a staggering $1 billion. This deal marks one of the largest private equity acquisitions in the fast-food sector this year and signals a significant shift in the competitive landscape.

The acquisition, finalized earlier this week, sees Zenith Capital Partners taking full ownership of Golden Crisp Fried Chicken, including its extensive network of franchise locations and its iconic brand recognition. While specific details of the transaction remain undisclosed, industry analysts predict this move will spark further consolidation within the already competitive fried chicken market.

<h3>Zenith Capital's Strategic Play</h3>

Zenith Capital Partners, known for its shrewd investments in established consumer brands, has clearly identified Golden Crisp Fried Chicken's potential for growth. The firm's CEO, Amelia Hernandez, stated in a press release that they were "excited about the opportunity to leverage Golden Crisp's strong brand equity and operational expertise to further expand its market share." This statement highlights Zenith's focus on not just acquiring a brand, but actively developing and scaling it for future success. The acquisition aligns with Zenith's broader strategy of investing in brands with strong potential for international expansion and digital transformation.

<h3>What This Means for Golden Crisp Fried Chicken</h3>

For Golden Crisp Fried Chicken, this acquisition promises significant changes. While the company has enjoyed considerable success, the injection of private equity capital will likely lead to:

- Accelerated Expansion: Expect to see new Golden Crisp locations popping up across the country, potentially even internationally.

- Menu Innovation: Zenith is likely to invest in research and development, leading to new menu items and potentially healthier options to appeal to a wider customer base.

- Technological Upgrades: The brand might see improvements to its online ordering systems, mobile app functionality, and overall digital customer experience.

- Enhanced Marketing Campaigns: Expect a significant boost in marketing and advertising efforts to further solidify Golden Crisp's position in the competitive fried chicken market.

<h3>The Broader Implications for the Fast-Food Industry</h3>

This billion-dollar deal underscores the ongoing consolidation within the fast-food industry. Larger private equity firms are increasingly seeking to acquire established brands with proven track records, leading to a more concentrated market. This trend may impact smaller, independent fast-food chains, forcing them to adapt or risk being acquired. The Golden Crisp acquisition sets a precedent, demonstrating the significant investment capital flowing into the sector and indicating a bullish outlook on the future of fried chicken.

<h3>Looking Ahead</h3>

The coming months will be crucial in observing how Zenith Capital Partners manages this significant acquisition. The success of this deal will depend on their ability to effectively integrate Golden Crisp into their portfolio, navigate the competitive landscape, and execute their growth strategy. Industry experts will be watching closely to see if this $1 billion gamble pays off. This acquisition is a significant event that will undoubtedly reshape the future of the fried chicken industry, making it a story worth following for investors and fried chicken lovers alike.

Keywords: Private Equity, Golden Crisp Fried Chicken, Acquisition, Billion Dollar Deal, Fast Food, Zenith Capital Partners, Franchise, Restaurant Industry, Market Consolidation, Investment, Brand Acquisition, Menu Innovation, Fried Chicken Industry, Industry Trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Private Equity Firm Acquires Major Fried Chicken Brand For $1 Billion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

20 Years 100 Pounds Lighter Al Rokers Lasting Weight Loss Strategies

Jun 04, 2025

20 Years 100 Pounds Lighter Al Rokers Lasting Weight Loss Strategies

Jun 04, 2025 -

Lu Pones Controversial Remarks A Public Apology Follows

Jun 04, 2025

Lu Pones Controversial Remarks A Public Apology Follows

Jun 04, 2025 -

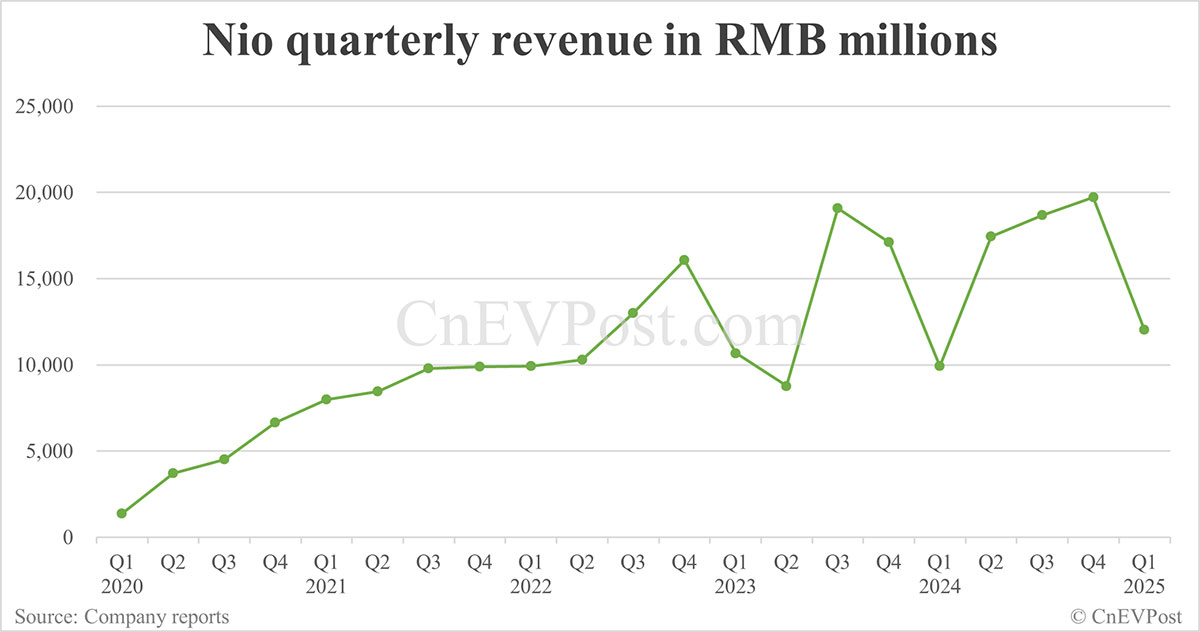

Strong Q1 2024 Results For Nio Revenue Up 21 Year On Year

Jun 04, 2025

Strong Q1 2024 Results For Nio Revenue Up 21 Year On Year

Jun 04, 2025 -

Analyzing Ukraines Drone Strikes Implications For Global Security

Jun 04, 2025

Analyzing Ukraines Drone Strikes Implications For Global Security

Jun 04, 2025 -

Kerch Bridge Attack Ukraine Confirms Use Of Underwater Explosives

Jun 04, 2025

Kerch Bridge Attack Ukraine Confirms Use Of Underwater Explosives

Jun 04, 2025