Preventing Taxpayer Exploitation: Key Takeaways From The Trump Tax Era

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Preventing Taxpayer Exploitation: Key Takeaways from the Trump Tax Era

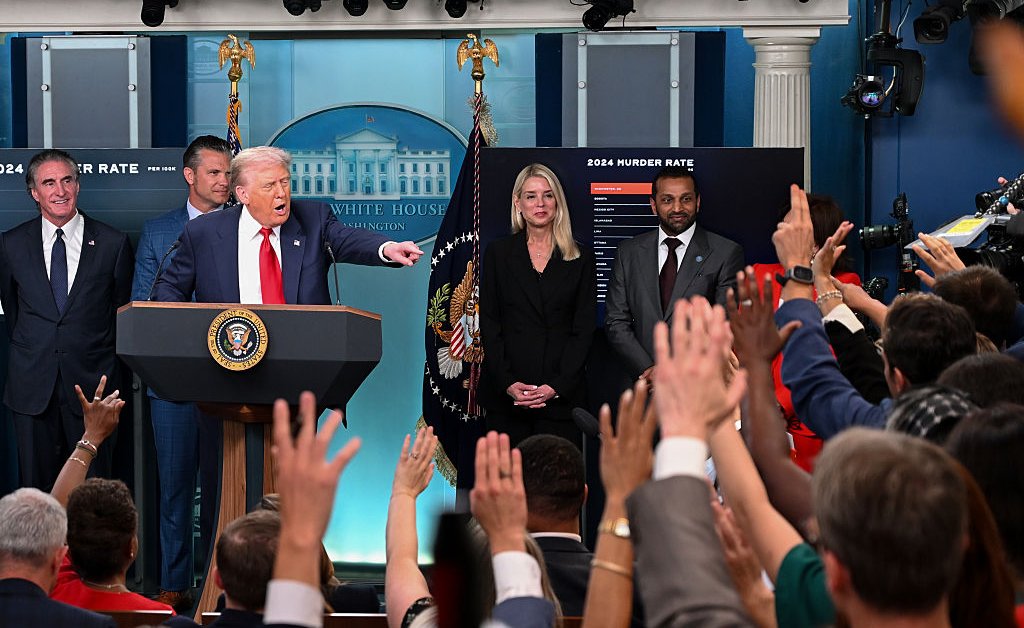

The Trump administration's tax reforms, enacted in 2017, significantly reshaped the American tax landscape. While touted as beneficial for businesses and individuals, the changes also presented new avenues for taxpayer exploitation. Analyzing the fallout from this era offers crucial lessons for safeguarding against future tax scams and ensuring fair tax practices. This article examines key takeaways and preventative measures for taxpayers.

H2: The 2017 Tax Cuts and Jobs Act: A Double-Edged Sword

The Tax Cuts and Jobs Act (TCJA) lowered corporate and individual income tax rates, increased the standard deduction, and made other significant changes. While intended to stimulate the economy, the complexity of the legislation created opportunities for exploitation. The rapid changes left many taxpayers and tax professionals scrambling to understand the implications, creating fertile ground for fraudulent schemes.

H2: Exploitation Tactics Emerged Post-TCJA

Several exploitation tactics flourished in the wake of the TCJA:

- Phishing Scams: Increased tax complexity led to a surge in phishing emails and text messages, designed to steal personal information under the guise of tax-related matters. These scams often preyed on taxpayers' anxieties about navigating the new tax laws.

- Identity Theft: The TCJA's changes made identity theft for tax purposes even more lucrative. Stolen identities were used to file fraudulent tax returns and claim refunds.

- Inflated Tax Credits and Deductions: The expanded standard deduction and changes to itemized deductions led to opportunities for inflating credits and deductions, particularly for those unfamiliar with the new rules.

- Misleading Tax Advice: The complexity of the new law created a market for misleading and inaccurate tax advice, often from unqualified individuals or businesses.

H3: Examples of Exploitative Schemes:

Numerous examples emerged of taxpayers being tricked into paying inflated fees for tax services, investing in fraudulent tax shelters, or falling victim to scams promising unrealistic tax benefits. These schemes often targeted vulnerable populations, such as seniors and low-income individuals. The IRS issued numerous warnings throughout this period, highlighting common scams and urging taxpayers to exercise caution.

H2: Learning from the Past: Protecting Yourself Against Taxpayer Exploitation

The experience of the Trump tax era provides valuable lessons for preventing future exploitation:

- Understand the Tax Code: While daunting, a basic understanding of the tax code is crucial. Familiarize yourself with key changes and potential deductions to avoid falling prey to scams promising unrealistic tax benefits. Consider consulting a reputable tax professional for guidance.

- Verify Sources: Always verify the authenticity of any communication related to taxes. The IRS will never demand immediate payment via unconventional methods.

- File Early and Electronically: Filing electronically reduces the risk of identity theft and helps ensure your return is processed efficiently.

- Use Reputable Tax Professionals: Choose tax professionals with proper credentials and a strong reputation. Check their credentials with the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications (PTIN Directory).

- Monitor Your Credit Report: Regularly monitor your credit report for any suspicious activity. This can help detect identity theft early on.

- Stay Informed: Keep up-to-date on tax-related news and warnings issued by the IRS.

H2: The Ongoing Fight Against Tax Fraud:

The IRS continues its efforts to combat tax fraud and protect taxpayers. They offer various resources, including online guides, publications, and frequently asked questions (FAQs), to help taxpayers navigate the tax system. Staying informed and vigilant remains the best defense against exploitation.

H2: Conclusion: A Call for Vigilance

The Trump tax era highlighted the vulnerabilities created by complex tax legislation. By learning from the past and taking proactive steps to protect themselves, taxpayers can significantly reduce their risk of exploitation. Remember, vigilance and a proactive approach are your best tools in navigating the intricacies of the tax system. Stay informed, verify sources, and utilize reputable resources to safeguard your financial well-being.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Preventing Taxpayer Exploitation: Key Takeaways From The Trump Tax Era. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Five Year Dogecoin Return A 10 000 Investment Analysis

Aug 13, 2025

Five Year Dogecoin Return A 10 000 Investment Analysis

Aug 13, 2025 -

Trumps Actions In Dc Echoes Of The Tumultuous Summer Of 2020

Aug 13, 2025

Trumps Actions In Dc Echoes Of The Tumultuous Summer Of 2020

Aug 13, 2025 -

Early Winter Predicted For Maine Farmers Almanac Details Cold And Snow

Aug 13, 2025

Early Winter Predicted For Maine Farmers Almanac Details Cold And Snow

Aug 13, 2025 -

Performance Analysis Hellblade Ii On Play Station 5

Aug 13, 2025

Performance Analysis Hellblade Ii On Play Station 5

Aug 13, 2025 -

Stay Safe Severe Thunderstorm Advisory Impacts Metro Detroit

Aug 13, 2025

Stay Safe Severe Thunderstorm Advisory Impacts Metro Detroit

Aug 13, 2025

Latest Posts

-

O Rourke Faces Jail Time Paxtons Lawsuit Over Democratic Walkout Fundraising

Aug 13, 2025

O Rourke Faces Jail Time Paxtons Lawsuit Over Democratic Walkout Fundraising

Aug 13, 2025 -

Bright Lights Are They Harming Your Vision

Aug 13, 2025

Bright Lights Are They Harming Your Vision

Aug 13, 2025 -

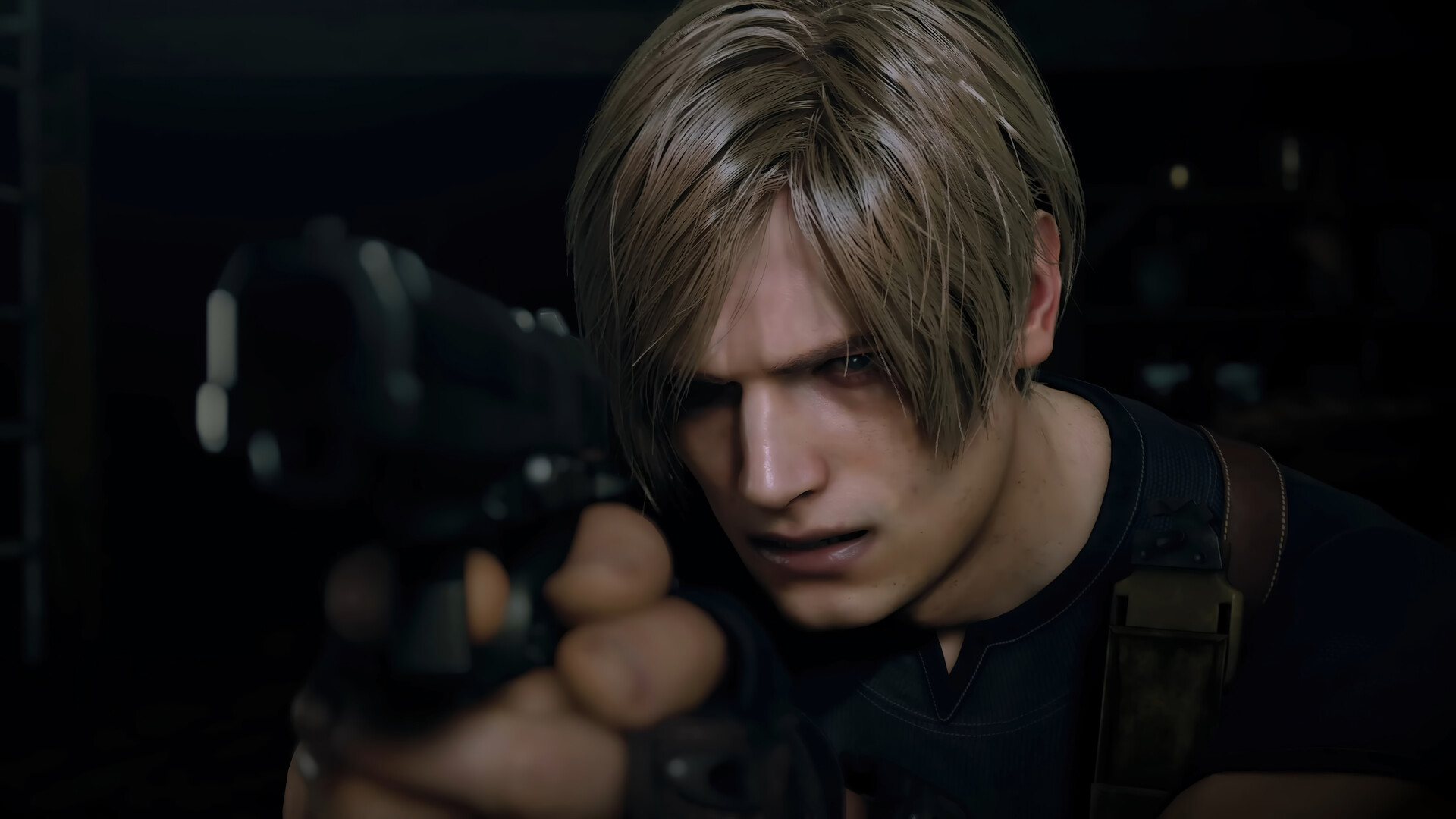

Resident Evil 4 Remake Leak Leons Final Major Role

Aug 13, 2025

Resident Evil 4 Remake Leak Leons Final Major Role

Aug 13, 2025 -

After Resident Evil 9 An Insider Leaks Leon Kennedys Fate In The Franchise

Aug 13, 2025

After Resident Evil 9 An Insider Leaks Leon Kennedys Fate In The Franchise

Aug 13, 2025 -

Record Breaking Heat Southern Nevada Issues 114 F Extreme Heat Warning

Aug 13, 2025

Record Breaking Heat Southern Nevada Issues 114 F Extreme Heat Warning

Aug 13, 2025