Preventing Tax Fraud: Key Lessons From The Trump Tax Controversy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Preventing Tax Fraud: Key Lessons from the Trump Tax Controversy

The protracted legal and political battles surrounding Donald Trump's tax returns have offered a stark, albeit controversial, case study in tax fraud prevention. While the specifics of his case remain complex and subject to ongoing legal proceedings, the controversy highlights crucial lessons for individuals and businesses alike on how to navigate the complexities of tax law and avoid potential pitfalls. This article explores key takeaways from the Trump tax controversy, focusing on best practices for preventing tax fraud and ensuring tax compliance.

H2: Unveiling Loopholes and Aggressive Tax Strategies:

The Trump tax saga exposed the use of aggressive tax strategies, including deductions and write-offs that stretched the boundaries of legal interpretation. Experts point to the utilization of complex financial instruments and deductions related to business losses as areas of particular scrutiny. This underscores the importance of consulting with qualified tax professionals who understand current regulations and can advise on ethical and legally sound tax planning. Simply minimizing your tax burden isn't enough; it's crucial to ensure that your strategies are fully compliant with the law.

H2: The Importance of Accurate Record Keeping:

One consistent theme emerging from the Trump tax controversy is the critical role of meticulous record-keeping. Accurate documentation of all income, expenses, and deductions is essential for withstanding scrutiny from the Internal Revenue Service (IRS). Maintaining detailed records, including invoices, receipts, and bank statements, provides irrefutable evidence of financial transactions and significantly reduces the risk of audit-related penalties. Consider using accounting software to streamline the process and ensure data accuracy.

H2: Understanding the Risks of Charitable Donations:

The Trump tax returns also revealed complexities surrounding charitable donations. While charitable contributions can significantly reduce taxable income, improperly documenting or exaggerating these donations can lead to severe legal consequences. Always obtain proper receipts and maintain detailed records of all charitable donations. Understanding the limitations and regulations surrounding charitable deductions is paramount to avoid potential tax fraud accusations.

H3: Transparency and Full Disclosure:

Transparency and full disclosure are fundamental principles in preventing tax fraud. Withholding information or attempting to conceal financial activities significantly increases the risk of penalties and legal repercussions. A proactive approach that prioritizes complete and accurate reporting is the most effective strategy.

H2: Seeking Professional Tax Advice:

Navigating the intricacies of the tax code can be challenging, even for experienced financial professionals. The Trump tax controversy reinforces the critical need to consult with qualified tax advisors, CPAs, and legal professionals. These experts can provide guidance on legal tax strategies, help ensure compliance, and assist in navigating complex financial transactions. Regular consultations are crucial, especially for high-net-worth individuals and businesses with intricate financial structures.

H2: Staying Informed About Tax Law Changes:

Tax laws are constantly evolving, requiring individuals and businesses to remain informed about updates and changes. Staying abreast of the latest regulations is crucial for ensuring ongoing compliance. Subscribing to reputable tax news sources and attending relevant seminars or workshops can help keep you updated. Ignoring changes in tax law is a recipe for disaster.

H2: Conclusion: Proactive Prevention is Key

The Trump tax controversy serves as a cautionary tale, underscoring the significance of proactive tax planning and meticulous record-keeping. While the specifics of the case remain debated, the lessons are clear: meticulous record-keeping, transparency, professional advice, and staying informed about tax laws are critical for preventing tax fraud and ensuring compliance. Remember, proactive prevention is far less costly and stressful than facing the consequences of an IRS audit or a criminal investigation. Consult with a tax professional today to ensure your financial affairs are in order.

(Note: This article is for informational purposes only and does not constitute legal or financial advice. Consult with qualified professionals for personalized guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Preventing Tax Fraud: Key Lessons From The Trump Tax Controversy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Adhd Medication New Study Links Lower Suicidal Behaviors Risk

Aug 14, 2025

Adhd Medication New Study Links Lower Suicidal Behaviors Risk

Aug 14, 2025 -

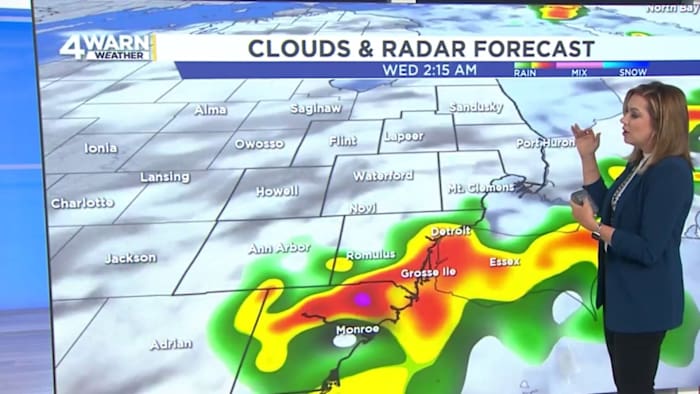

Tuesday Thunderstorms Detailed Timeline For Southeast Michigan

Aug 14, 2025

Tuesday Thunderstorms Detailed Timeline For Southeast Michigan

Aug 14, 2025 -

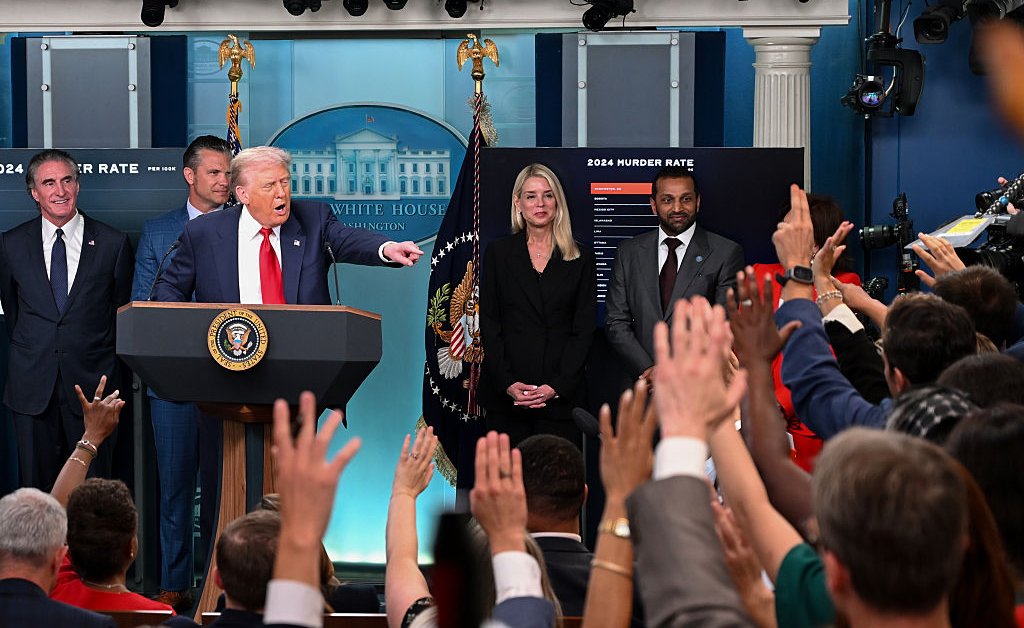

Is Trumps D C Power Grab A Replay Of His 2020 Tactics

Aug 14, 2025

Is Trumps D C Power Grab A Replay Of His 2020 Tactics

Aug 14, 2025 -

Patch 25 16 Notes Full Update Details And Gameplay Changes

Aug 14, 2025

Patch 25 16 Notes Full Update Details And Gameplay Changes

Aug 14, 2025 -

Inside The White House The Backchannel That Shaped The Trump Putin Talks

Aug 14, 2025

Inside The White House The Backchannel That Shaped The Trump Putin Talks

Aug 14, 2025

Latest Posts

-

West Virginia Lottery Powerball And Lotto America Winning Numbers August 13 2025

Aug 14, 2025

West Virginia Lottery Powerball And Lotto America Winning Numbers August 13 2025

Aug 14, 2025 -

Hurricane Erins Path Latest Forecast From Bryan Norcross

Aug 14, 2025

Hurricane Erins Path Latest Forecast From Bryan Norcross

Aug 14, 2025 -

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025 -

Increased Light Levels Impact On Eye Health

Aug 14, 2025

Increased Light Levels Impact On Eye Health

Aug 14, 2025 -

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025