Powerball Soars: $449 Million Jackpot Awaits - After-Tax Breakdown

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Powerball Soars: $449 Million Jackpot Awaits – After-Tax Breakdown

Dreams of early retirement are closer than ever! The Powerball jackpot has skyrocketed to a staggering $449 million, captivating lottery players nationwide. This monumental prize is enough to spark serious daydreams, but before you start planning your lavish lifestyle, let's delve into the crucial aspect often overlooked: the after-tax reality of such a massive win.

Understanding the Tax Implications of a Powerball Win

Winning the lottery is exhilarating, but the Internal Revenue Service (IRS) has a significant share waiting. Federal taxes alone will take a substantial chunk of your winnings. For a jackpot of this size, expect to pay a hefty amount in federal income taxes, currently ranging from a minimum of 24% to a maximum of 37% depending on your overall income and tax bracket. This means that a $449 million win will be significantly less after the federal government takes its cut.

State Taxes: Another Slice of the Pie

Beyond federal taxes, many states also levy their own taxes on lottery winnings. State taxes vary considerably, ranging from 0% in some states (like California, Delaware, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming) to over 8% in others. Before you celebrate, you'll need to determine your state's tax rate to get a more accurate after-tax figure. For example, a winner in New York would face both hefty federal and state taxes. Consult a tax professional or refer to your state's lottery website for precise details.

Calculating Your After-Tax Powerball Winnings

Let's break down a potential scenario. Assuming a combined federal and state tax rate of 40% (a conservative estimate for many winners), the after-tax amount would be approximately $269.4 million. This is still a life-altering sum, but it highlights the importance of understanding the tax implications before purchasing your ticket.

Here’s a simplified example:

- Jackpot: $449 million

- Estimated Federal Tax (37%): $166.13 million

- Estimated State Tax (3%): $13.47 million (This is an average; your state tax may differ significantly).

- Approximate Total Taxes: $179.6 million

- Approximate After-Tax Winnings (40% Tax): $269.4 million

Disclaimer: This is a simplified example. Actual tax liability will depend on numerous factors, including your individual tax bracket, deductions, and state tax laws. Consult with a qualified financial advisor and tax professional for personalized advice.

Beyond the Numbers: Planning for Your Future

Winning the lottery presents unique financial challenges. Proper financial planning is paramount to ensure your wealth lasts a lifetime. Consider these important steps:

- Seek professional financial advice: A financial advisor can help you create a sound investment strategy and manage your newfound wealth.

- Establish a legal team: Protecting your assets is crucial. A lawyer can assist with estate planning and other legal matters.

- Avoid impulsive spending: Resist the temptation to make rash purchases. Develop a budget and stick to it.

The Powerball jackpot is a life-changing opportunity. However, understanding the tax implications is crucial to ensuring you make the most of this incredible windfall. Remember to play responsibly!

Powerball FAQs

- Where can I buy a Powerball ticket? Tickets are sold in participating lottery retailers in various states. Check your state's lottery website for authorized retailers.

- What are the odds of winning the Powerball jackpot? The odds are approximately 1 in 292.2 million.

- What happens if multiple people win? The jackpot will be split equally amongst all winning ticket holders.

Remember to play responsibly and within your means. Good luck!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Powerball Soars: $449 Million Jackpot Awaits - After-Tax Breakdown. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Caitlin Clarks Injury Coach Stephanie Whites Latest Update And Return Prospects

Aug 07, 2025

Caitlin Clarks Injury Coach Stephanie Whites Latest Update And Return Prospects

Aug 07, 2025 -

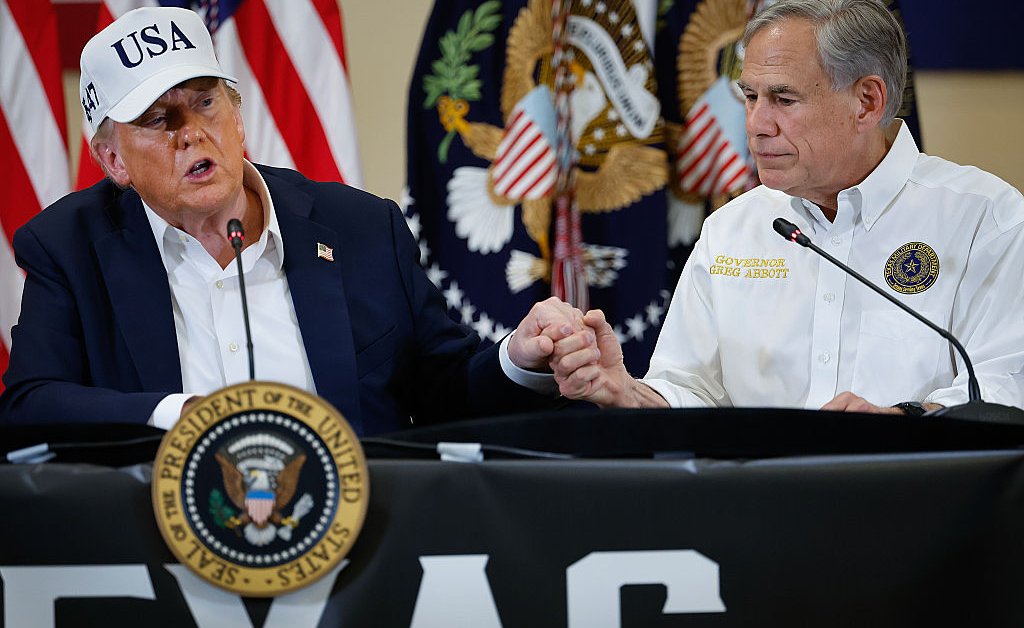

Did Texas Redistricting Favor Republicans In The 2022 Midterm Elections

Aug 07, 2025

Did Texas Redistricting Favor Republicans In The 2022 Midterm Elections

Aug 07, 2025 -

Expect Higher Car Insurance Premiums In 2025 Aaa Analysis

Aug 07, 2025

Expect Higher Car Insurance Premiums In 2025 Aaa Analysis

Aug 07, 2025 -

Last Nights Powerball Winning Numbers From The August 6 2025 Drawing

Aug 07, 2025

Last Nights Powerball Winning Numbers From The August 6 2025 Drawing

Aug 07, 2025 -

Zach Creggers Weapons Horror Redefined A Critical Look

Aug 07, 2025

Zach Creggers Weapons Horror Redefined A Critical Look

Aug 07, 2025