Powerball Jackpot Hits $449 Million: Your Guide To After-Tax Winnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Powerball Jackpot Hits $449 Million: Your Guide to After-Tax Winnings

The Powerball jackpot has soared to a staggering $449 million, igniting a frenzy of lottery ticket purchases across the nation. While dreaming of beachfront properties and early retirement is tempting, the reality of a massive win involves a significant chunk going to taxes. This guide will help you understand what you might realistically take home after the confetti settles and the celebrations end.

Understanding the Tax Implications of a Powerball Win

Winning the lottery is a life-changing event, but it’s crucial to understand the tax implications before you start planning your dream vacation. The IRS treats lottery winnings as ordinary income, meaning they're taxed at your highest marginal tax rate. This means that a significant portion of your $449 million prize will disappear before it even reaches your bank account.

Federal Taxes: The federal government will take a substantial cut. For 2023, the highest federal income tax bracket is 37%. However, depending on your state of residence and other income sources, your effective federal tax rate might differ. You can expect to pay a considerable amount in federal taxes alone.

State Taxes: This is where things get a bit more complicated. Each state has its own lottery tax laws. Some states don't tax lottery winnings, while others impose significant taxes, sometimes exceeding 8%. Therefore, your actual take-home amount will vary significantly depending on your state of residence. For example, California doesn't tax lottery winnings, while New York has a significant tax rate. It's essential to research your specific state's tax laws regarding lottery winnings.

How Much Will You Actually Get?

Let's break down a hypothetical example. Assuming a 37% federal tax rate and a 5% state tax rate (this varies widely – research your state!), the calculation would look something like this:

- Before Taxes: $449,000,000

- Federal Taxes (37%): $166,130,000

- State Taxes (5%): $22,450,000

- Total Taxes: $188,580,000

- Approximate After-Tax Winnings: $260,420,000

Important Note: This is a simplified illustration. The actual amount will depend on your specific tax bracket, state taxes, and any potential deductions.

Seeking Professional Financial Advice

Winning the lottery is a complex financial event. It's strongly recommended to consult with a qualified financial advisor and tax attorney immediately after winning. They can help you navigate the complexities of taxes, estate planning, and investment strategies to maximize your after-tax winnings and secure your financial future.

Planning for the Future:

Beyond the immediate tax implications, careful planning is essential. Consider:

- Creating a budget: Establish a clear budget that outlines your spending and savings goals.

- Investing wisely: Diversify your investments across various asset classes to minimize risk.

- Charitable giving: If you plan on donating to charity, consider establishing a foundation to maximize tax benefits.

- Protecting your privacy: Be mindful of your privacy and avoid revealing your win publicly to prevent unwanted attention.

Conclusion:

While winning the Powerball jackpot is undoubtedly exciting, remember that a significant portion will go towards taxes. Proactive planning, professional advice, and sound financial decisions are crucial to ensuring you make the most of your newfound wealth. Don't let the thrill of the win overshadow the importance of careful financial management.

Disclaimer: This article provides general information and should not be considered financial or legal advice. Consult with qualified professionals for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Powerball Jackpot Hits $449 Million: Your Guide To After-Tax Winnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dont Ignore These 10 Critical Symptoms An Er Doctors Warning

Aug 07, 2025

Dont Ignore These 10 Critical Symptoms An Er Doctors Warning

Aug 07, 2025 -

Mariners Julio Rodriguez Makes History Passans Analysis And Future Outlook

Aug 07, 2025

Mariners Julio Rodriguez Makes History Passans Analysis And Future Outlook

Aug 07, 2025 -

Powerball Lottery Results August 6 449 Million Jackpot Winner Announced

Aug 07, 2025

Powerball Lottery Results August 6 449 Million Jackpot Winner Announced

Aug 07, 2025 -

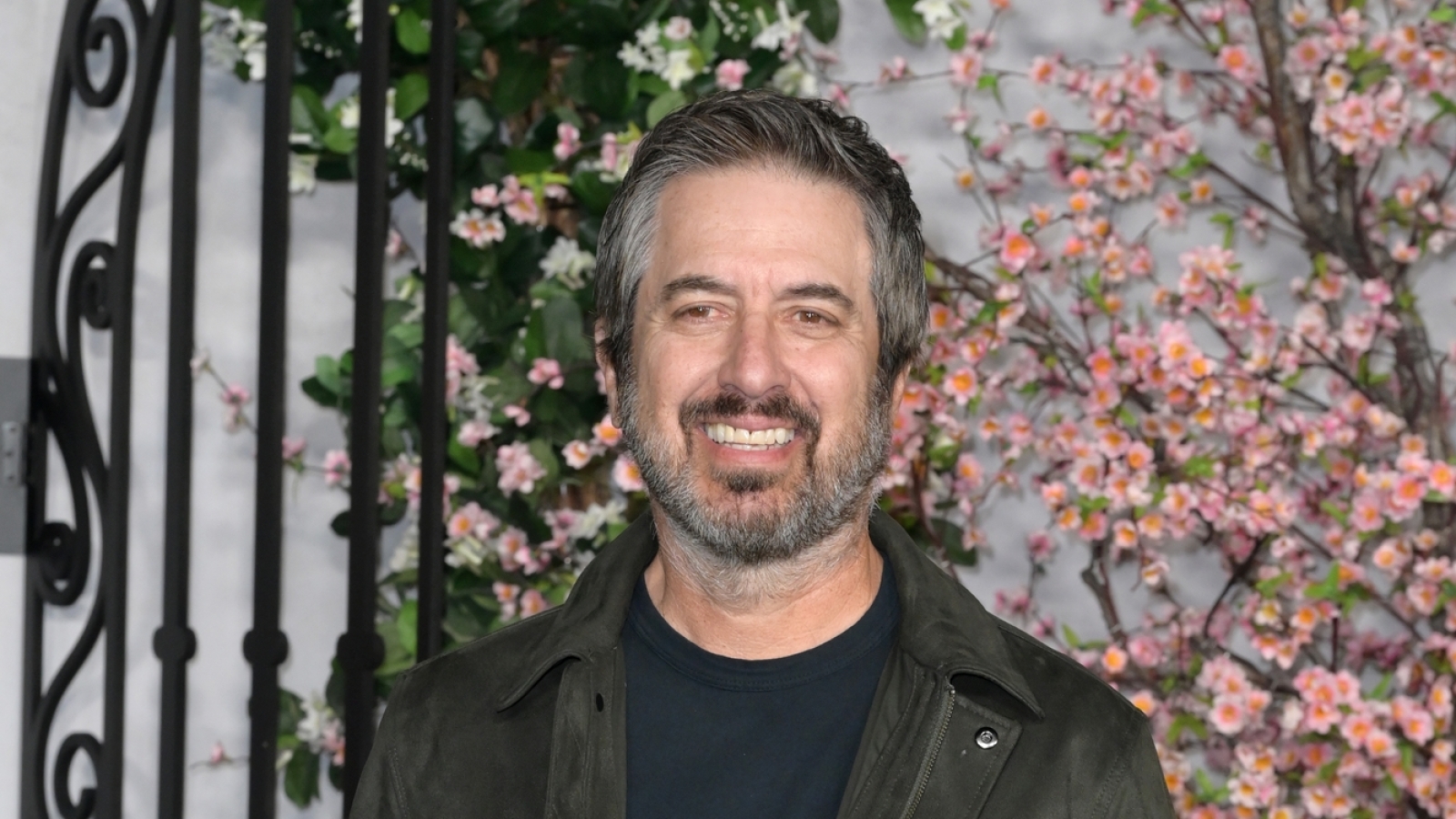

How Ray Romanos Everybody Loves Raymond Reshaped Kevin James Sitcom Approach

Aug 07, 2025

How Ray Romanos Everybody Loves Raymond Reshaped Kevin James Sitcom Approach

Aug 07, 2025 -

Actress Alexandra Daddarios Breathtaking Swimsuit Appearance

Aug 07, 2025

Actress Alexandra Daddarios Breathtaking Swimsuit Appearance

Aug 07, 2025

Latest Posts

-

Film Review Weapons Does It Live Up To The Barbarian Hype

Aug 08, 2025

Film Review Weapons Does It Live Up To The Barbarian Hype

Aug 08, 2025 -

Weapons A Review Of Creggers Latest Horror Thriller

Aug 08, 2025

Weapons A Review Of Creggers Latest Horror Thriller

Aug 08, 2025 -

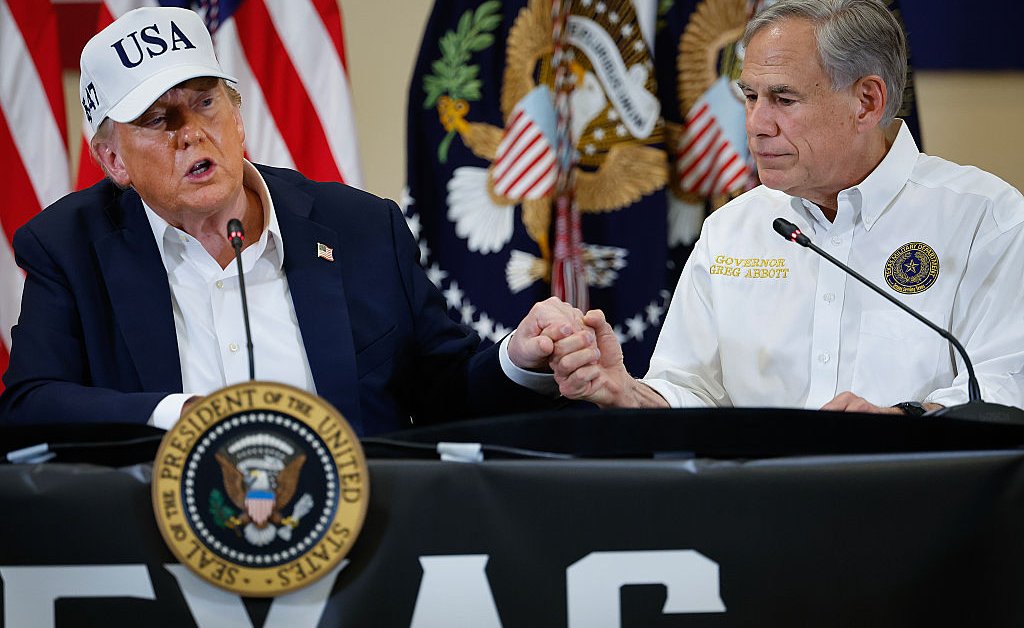

Did Texas Redistricting Swing The 2022 Midterms Towards Trump Analysis And Implications

Aug 08, 2025

Did Texas Redistricting Swing The 2022 Midterms Towards Trump Analysis And Implications

Aug 08, 2025 -

When To Go To The Er 10 Critical Symptoms To Watch For

Aug 08, 2025

When To Go To The Er 10 Critical Symptoms To Watch For

Aug 08, 2025