Powerball Jackpot Hits $449 Million – A Guide To After-Tax Payouts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Powerball Jackpot Hits $449 Million – A Guide to After-Tax Payouts

Dreams of early retirement just got a whole lot closer! The Powerball jackpot has soared to a staggering $449 million, igniting a frenzy of lottery ticket purchases across the nation. But before you start planning your lavish lifestyle upgrade, let's address the elephant in the room: taxes. That eye-popping $449 million prize is significantly reduced after Uncle Sam takes his cut. This guide will break down what you can realistically expect to receive after taxes.

Understanding the Tax Implications:

Winning the lottery is a life-changing event, but it's crucial to understand the substantial tax burden associated with such a massive windfall. The IRS treats lottery winnings as taxable income, meaning a significant portion will be deducted before you receive your prize. The tax rate depends on several factors, including your state of residence and your overall income level.

Federal Taxes:

The federal government imposes a flat 24% tax on lottery winnings. This means that on a $449 million jackpot, the federal tax alone would be approximately $107.76 million. Ouch!

State Taxes:

This is where things get a bit more complex. State tax rates on lottery winnings vary significantly. Some states, like California, don't have a state income tax, offering a considerable advantage. Others, however, can levy substantial taxes, ranging from a few percentage points to over 10%. For example, a high-tax state like New York could take an additional $40 million or more.

Calculating Your Potential Take-Home:

To illustrate, let's assume a winner resides in a state with a 5% state income tax. After federal and state taxes, the calculation would look something like this:

- Jackpot: $449,000,000

- Federal Tax (24%): -$107,760,000

- State Tax (5%): -$22,450,000

- Approximate Take-Home: $318,790,000

Important Considerations:

- Lump Sum vs. Annuity: Lottery winners typically have the option of receiving their winnings as a lump sum or an annuity paid out over several years. While a lump sum seems appealing, it will result in a much larger upfront tax bill. The annuity option spreads out the tax liability over time.

- Tax Withholding: The lottery organization will likely withhold a significant portion of your winnings to cover estimated taxes. This helps avoid a massive tax bill at the end of the year.

- Financial Advisors: It's absolutely crucial to consult with qualified financial advisors and tax professionals before making any decisions about your winnings. They can help you create a sound financial plan and navigate the complexities of tax laws.

Beyond the Numbers:

Winning the lottery is a life-altering event, filled with excitement and potential. However, it's equally important to approach this life-changing moment with a solid financial strategy. Don't let the initial euphoria overshadow the importance of careful planning. Remember to seek professional financial and legal advice.

What to do if you win:

- Sign the ticket immediately.

- Keep the ticket in a safe place.

- Consult with a financial advisor and attorney.

- Don't rush into any major decisions.

This information is for general guidance only and doesn't constitute financial or legal advice. Always consult with qualified professionals before making any financial decisions. Good luck to all Powerball players! May your numbers come up!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Powerball Jackpot Hits $449 Million – A Guide To After-Tax Payouts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alaskan Romantic Drama Dakota Fanning Jake Johnson And Cory Michael Smith Join Forces

Aug 07, 2025

Alaskan Romantic Drama Dakota Fanning Jake Johnson And Cory Michael Smith Join Forces

Aug 07, 2025 -

Seth Rogen And Rose Byrnes Platonic Season Twos Success

Aug 07, 2025

Seth Rogen And Rose Byrnes Platonic Season Twos Success

Aug 07, 2025 -

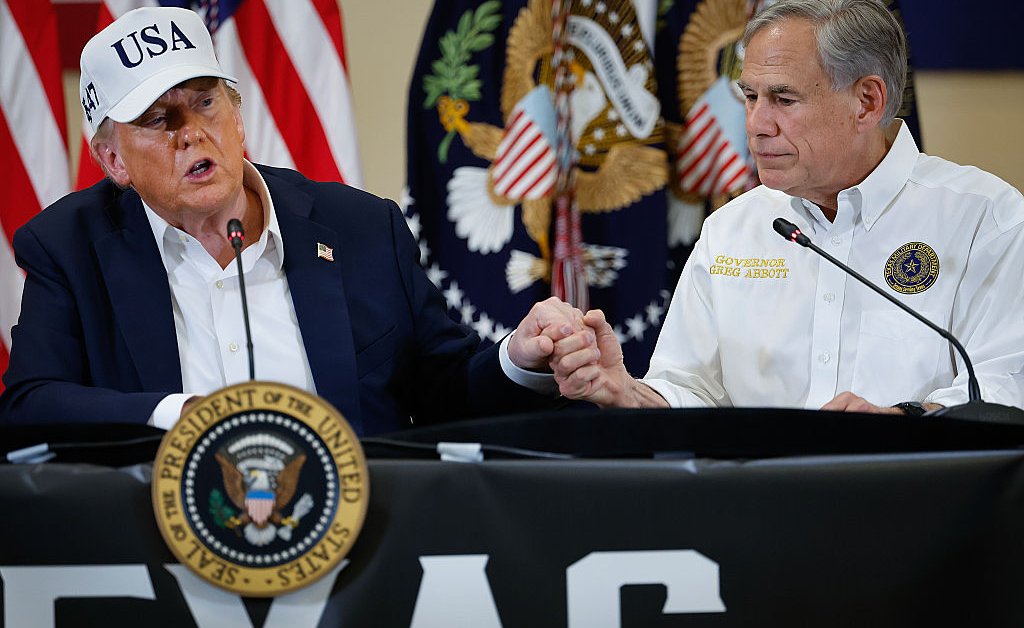

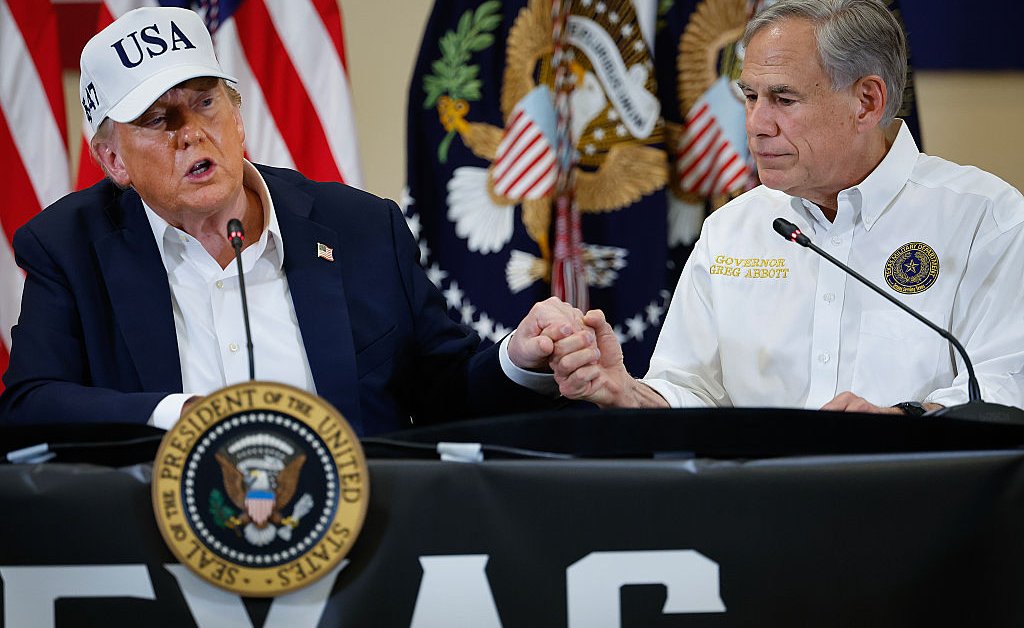

Trump Says He Likely Wont Seek Re Election In 2024

Aug 07, 2025

Trump Says He Likely Wont Seek Re Election In 2024

Aug 07, 2025 -

Dakota Fanning And Jake Johnson Join Forces In Joe Swanbergs Latest Feature

Aug 07, 2025

Dakota Fanning And Jake Johnson Join Forces In Joe Swanbergs Latest Feature

Aug 07, 2025 -

Did Texas Redistricting Favor Republicans In The 2022 Midterm Elections

Aug 07, 2025

Did Texas Redistricting Favor Republicans In The 2022 Midterm Elections

Aug 07, 2025

Latest Posts

-

Film Review Weapons Does It Live Up To The Barbarian Hype

Aug 08, 2025

Film Review Weapons Does It Live Up To The Barbarian Hype

Aug 08, 2025 -

Weapons A Review Of Creggers Latest Horror Thriller

Aug 08, 2025

Weapons A Review Of Creggers Latest Horror Thriller

Aug 08, 2025 -

Did Texas Redistricting Swing The 2022 Midterms Towards Trump Analysis And Implications

Aug 08, 2025

Did Texas Redistricting Swing The 2022 Midterms Towards Trump Analysis And Implications

Aug 08, 2025 -

When To Go To The Er 10 Critical Symptoms To Watch For

Aug 08, 2025

When To Go To The Er 10 Critical Symptoms To Watch For

Aug 08, 2025