Post-Musk Dogecoin: The Future Of Taxpayer Dividend Payments Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Musk Dogecoin: The Future of Taxpayer Dividend Payments Explained

The rollercoaster ride of Dogecoin, once propelled by Elon Musk's tweets, has left many wondering about its future, especially concerning its potential role in unconventional financial systems like taxpayer dividend payments. While the idea of receiving your tax refund in DOGE might seem fantastical, exploring the possibilities sheds light on the evolving landscape of cryptocurrency and government finance.

The Allure of Crypto Dividends:

The concept of distributing taxpayer dividends in cryptocurrency like Dogecoin isn't entirely new. Proponents argue it offers several advantages:

- Increased Financial Inclusion: Cryptocurrencies can bypass traditional banking systems, potentially reaching underserved populations who lack access to traditional financial services. This is especially pertinent in developing nations where banking infrastructure is limited.

- Faster Processing: Crypto transactions are often significantly faster than traditional bank transfers, meaning taxpayers could receive their refunds more quickly.

- Transparency and Security: Blockchain technology, the underlying framework of cryptocurrencies, offers a transparent and secure record of transactions, potentially reducing the risk of fraud and errors.

However, significant hurdles remain.

Challenges and Concerns:

- Volatility: Dogecoin's notorious price volatility is a major obstacle. A taxpayer receiving their dividend in DOGE today could see its value plummet tomorrow, leading to significant financial losses. This inherent risk makes it a highly unsuitable vehicle for a guaranteed payment.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving. Governments worldwide are grappling with how to regulate these digital assets, and the legal framework for distributing taxpayer dividends in crypto is largely undefined.

- Technological Infrastructure: Processing millions, if not billions, of crypto transactions for tax refunds would require substantial investment in new technological infrastructure and expertise, a significant undertaking for government agencies.

- Scalability: Current blockchain technology might struggle to handle the sheer volume of transactions involved in a nationwide taxpayer dividend program.

Beyond Dogecoin: Exploring Alternative Models:

While Dogecoin's volatility makes it impractical for dividend payments, the underlying principles – increased financial inclusion and faster processing – are worth exploring with more stable cryptocurrencies or blockchain-based systems. Stablecoins, pegged to fiat currencies like the US dollar, could offer a more stable alternative, mitigating the risk associated with volatile cryptocurrencies like Dogecoin. Central Bank Digital Currencies (CBDCs), digital versions of fiat currencies issued by central banks, are also gaining traction and could provide a more secure and controlled environment for government payments.

The Future of Taxpayer Payments:

The future of taxpayer dividend payments likely involves a gradual evolution rather than a sudden revolution. While the immediate adoption of Dogecoin (or any volatile cryptocurrency) is highly unlikely, the exploration of blockchain technology and alternative payment systems holds promise for improving efficiency and inclusivity. Further research and development are crucial to address the challenges and ensure the security and stability of any such system. Governments need to carefully assess the risks and benefits before implementing any significant changes to their payment systems.

Call to Action: Stay informed about the latest developments in cryptocurrency and government finance by following reputable financial news sources and engaging in informed discussions about the future of financial technology. Understanding the implications of these evolving technologies is crucial for both taxpayers and policymakers.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Musk Dogecoin: The Future Of Taxpayer Dividend Payments Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unpacking The Us Role Israels Recent Attack On Iranian Targets

Jun 30, 2025

Unpacking The Us Role Israels Recent Attack On Iranian Targets

Jun 30, 2025 -

Disappointing Buff Omission In Monster Hunter Rise Sunbreaks Latest Patch

Jun 30, 2025

Disappointing Buff Omission In Monster Hunter Rise Sunbreaks Latest Patch

Jun 30, 2025 -

Charlie Woods Academic And Golf Journey Graduation Plans And Top 20 Ranking

Jun 30, 2025

Charlie Woods Academic And Golf Journey Graduation Plans And Top 20 Ranking

Jun 30, 2025 -

Addressing The Criticism Capcoms Response To Negative Monster Hunter Rise Reviews

Jun 30, 2025

Addressing The Criticism Capcoms Response To Negative Monster Hunter Rise Reviews

Jun 30, 2025 -

Solar Storm Research High School Involvement In Nasas Space Science Program

Jun 30, 2025

Solar Storm Research High School Involvement In Nasas Space Science Program

Jun 30, 2025

Latest Posts

-

Illinois Womens Golf Celebrates Five Wgca All American Scholars

Jul 01, 2025

Illinois Womens Golf Celebrates Five Wgca All American Scholars

Jul 01, 2025 -

Topuria Vs Makhachev Cormiers Bold Prediction Shakes Up The Ufc Lightweight Division

Jul 01, 2025

Topuria Vs Makhachev Cormiers Bold Prediction Shakes Up The Ufc Lightweight Division

Jul 01, 2025 -

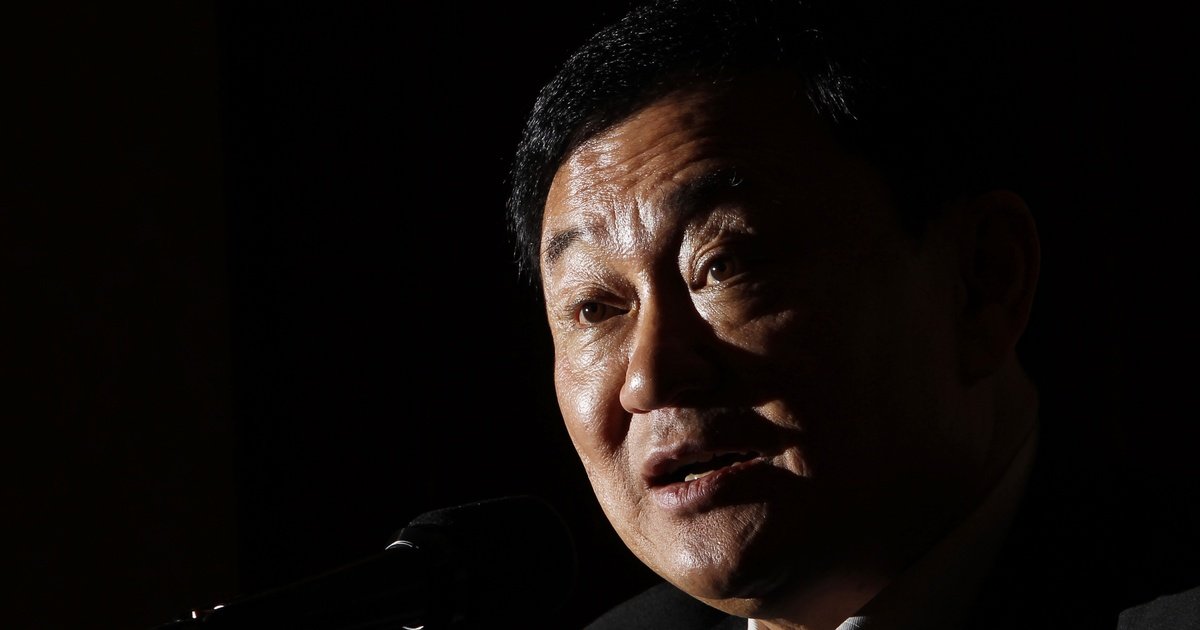

Understanding The Demise Of Thailands Powerful Shinawatra Family

Jul 01, 2025

Understanding The Demise Of Thailands Powerful Shinawatra Family

Jul 01, 2025 -

Ilia Topuria Rising Star Or Makhachevs Next Victim Cormier Offers Insight

Jul 01, 2025

Ilia Topuria Rising Star Or Makhachevs Next Victim Cormier Offers Insight

Jul 01, 2025 -

Jamal Roberts American Idol Winner Refuses Key To City Amidst Controversy

Jul 01, 2025

Jamal Roberts American Idol Winner Refuses Key To City Amidst Controversy

Jul 01, 2025