Popular Fried Chicken Chain Sold In $1 Billion Private Equity Deal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Popular Fried Chicken Chain Sold in $1 Billion Private Equity Deal: A New Chapter Begins

Headline: Popular Fried Chicken Chain Sold in $1 Billion Private Equity Deal: What it Means for Consumers and the Future of Fast Food

Introduction: In a significant move shaking up the fast-food industry, [Name of Fried Chicken Chain], a beloved brand known for its [mention signature dish or unique selling point, e.g., crispy fried chicken, unique spice blends], has been acquired by [Name of Private Equity Firm] in a staggering $1 billion private equity deal. This acquisition marks a pivotal moment for the chain, raising questions about its future direction, menu innovations, and expansion plans. This article delves into the details of this landmark deal and explores its potential impact on the fast-food landscape.

The Deal's Details:

The sale, finalized on [Date], saw [Name of Private Equity Firm] acquire [Name of Fried Chicken Chain] for a reported $1 billion. This substantial investment underscores the continued appeal and market dominance of fried chicken in the fast-food sector. [Name of Private Equity Firm], known for its investments in [mention firm's industry focus or previous successful acquisitions], believes in the brand's potential for growth and expansion, both domestically and internationally. Specific details regarding the transaction, including the breakdown of equity and debt financing, remain undisclosed. However, industry analysts predict that this deal signals a significant shift in the competitive dynamics of the fried chicken market.

What this Means for Consumers:

While the immediate impact on consumers might be minimal, the acquisition could lead to several long-term changes. These potential changes include:

- Menu Innovations: Private equity firms often invest heavily in research and development, leading to the introduction of new menu items and flavor profiles. Expect potential additions to the existing menu, leveraging consumer trends and innovative culinary approaches.

- Restaurant Expansion: Increased capital injection typically leads to aggressive expansion strategies. Consumers can anticipate the opening of new restaurants in existing and potentially new markets, enhancing accessibility and convenience.

- Pricing Changes: While not immediately guaranteed, the increased operational efficiency often resulting from private equity involvement might influence pricing strategies. However, this depends on various market factors.

- Technological Advancements: Expect to see an increased focus on digital ordering platforms, mobile apps, and other technological improvements designed to streamline the ordering and delivery process.

The Future of [Name of Fried Chicken Chain]:

The acquisition marks a significant turning point for [Name of Fried Chicken Chain]. Its future success will depend on [Name of Private Equity Firm]'s ability to leverage its expertise in streamlining operations, driving innovation, and effectively managing expansion. The challenge will be to balance maintaining the brand's established identity with introducing changes that appeal to evolving consumer preferences. Maintaining the high quality and consistency of its signature fried chicken will be paramount to continued success.

Impact on the Fast Food Industry:

This deal highlights the continued attractiveness of established fast-food brands to private equity investors. It underscores the profitability and growth potential within the fast-food sector, particularly in the popular fried chicken segment. We can expect to see further consolidation and acquisitions within the industry as private equity firms seek to capitalize on the strong market demand.

Conclusion:

The $1 billion acquisition of [Name of Fried Chicken Chain] represents a significant milestone for both the company and the broader fast-food industry. While the immediate consequences for consumers remain to be seen, the deal signifies a new era of growth and potential transformation for this beloved fried chicken chain. Only time will tell how this acquisition shapes the future of [Name of Fried Chicken Chain] and its place in the competitive fast-food landscape. Stay tuned for further updates.

(Note: Remember to replace the bracketed information with the specific details of the actual acquisition.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Popular Fried Chicken Chain Sold In $1 Billion Private Equity Deal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

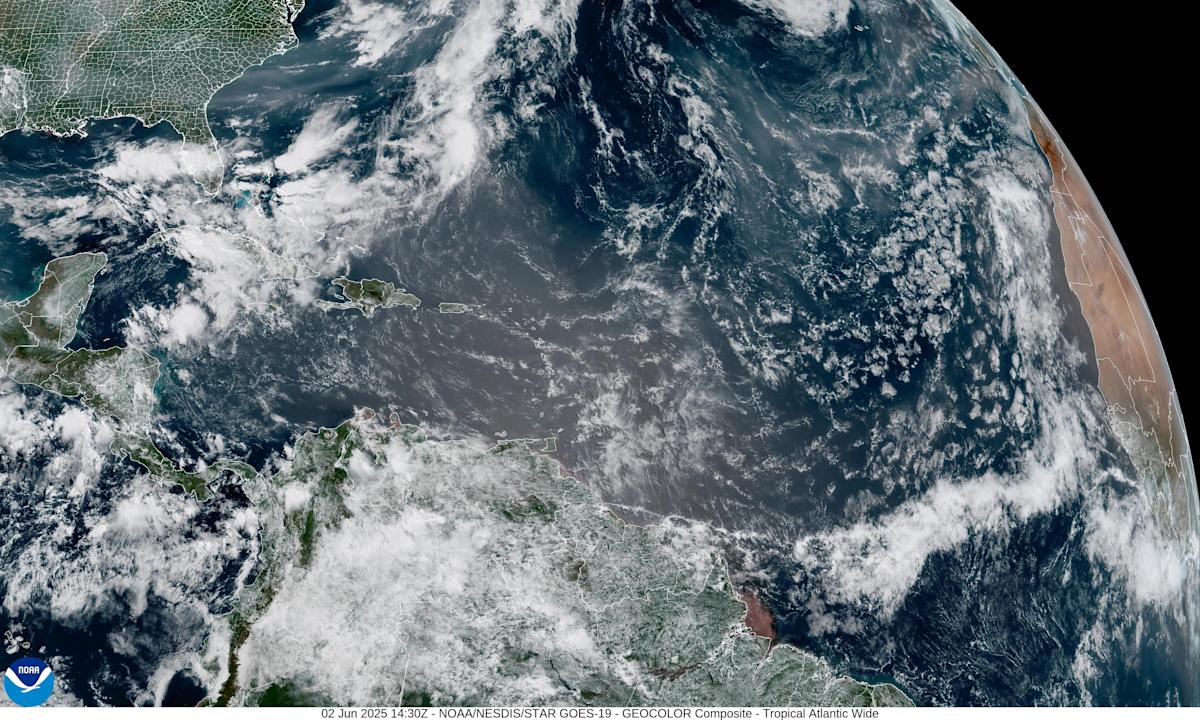

Wall Of Dust How Saharan Dust And Wildfire Smoke Affect Florida

Jun 04, 2025

Wall Of Dust How Saharan Dust And Wildfire Smoke Affect Florida

Jun 04, 2025 -

St Louis Tornado Aftermath Demolition Of 200 Lra Structures Planned

Jun 04, 2025

St Louis Tornado Aftermath Demolition Of 200 Lra Structures Planned

Jun 04, 2025 -

Sheinelle Jones And Family Finding Strength After Loss

Jun 04, 2025

Sheinelle Jones And Family Finding Strength After Loss

Jun 04, 2025 -

Ballerina Film Len Wiseman Explains Why Its Not A John Wick Spin Off

Jun 04, 2025

Ballerina Film Len Wiseman Explains Why Its Not A John Wick Spin Off

Jun 04, 2025 -

Successions Mountainhead Unveiling The Real Life Tech Executives

Jun 04, 2025

Successions Mountainhead Unveiling The Real Life Tech Executives

Jun 04, 2025