Popular Fried Chicken Chain Sold For $1 Billion To Private Equity Firm

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Popular Fried Chicken Chain, "Crispy King," Sold for $1 Billion to Private Equity Firm, Zenith Equity Partners

Headline: Crispy King Fried Chicken Sold for $1 Billion – Private Equity Giant Zenith Takes the Reigns

Introduction: In a deal that's sending shockwaves through the fast-food industry, Crispy King, the beloved fried chicken chain known for its [mention a signature item, e.g., "crispy, juicy tenders and mouthwatering signature sauces"], has been acquired by Zenith Equity Partners for a staggering $1 billion. This significant acquisition marks a major milestone for both Crispy King and the private equity firm, raising questions about the future direction of the popular restaurant chain.

The Acquisition: The sale, announced late yesterday, confirms Zenith Equity Partners' acquisition of 100% of Crispy King's outstanding shares. While the exact terms of the deal remain undisclosed, sources close to the negotiation confirm the final price tag reached a billion dollars. This significant investment underscores Zenith's confidence in Crispy King's brand recognition and future growth potential.

Zenith Equity Partners: A Look at the Buyer: Zenith Equity Partners is a prominent private equity firm with a history of successfully investing in and scaling consumer brands. Their portfolio includes several well-known companies in the food and beverage sector, suggesting a strategic acquisition rather than a purely financial one. [Optional: Insert a brief, factual statement about Zenith's investment strategy or a similar successful acquisition]. This acquisition reinforces Zenith's commitment to the fast-food market and their belief in Crispy King's potential for expansion and innovation.

What This Means for Crispy King: While immediate changes remain to be seen, the acquisition is likely to trigger significant shifts within Crispy King's operations. Zenith's expertise in brand management and strategic growth could lead to:

- Expansion: Increased franchising opportunities and potential for international expansion.

- Menu Innovation: The introduction of new menu items and potentially healthier options to cater to evolving consumer preferences.

- Technological Upgrades: Investment in improved technology, such as mobile ordering and delivery services, to enhance customer experience.

- Operational Efficiency: Streamlining operations to improve profitability and customer service.

The Future of Fried Chicken: This multi-billion dollar deal highlights the ongoing consolidation within the fast-food industry and the enduring appeal of fried chicken. The acquisition of Crispy King by Zenith Equity Partners signals a potentially significant shift in the competitive landscape, with other chains likely to face increased pressure to innovate and adapt.

Industry Experts Weigh In: [Include quotes from 1-2 industry analysts or experts on the implications of this acquisition. This adds credibility and authority to the article.]

Conclusion: The $1 billion acquisition of Crispy King by Zenith Equity Partners is a landmark deal that promises significant changes for the beloved fried chicken chain. While the future remains uncertain, the involvement of a seasoned private equity firm like Zenith suggests a bright outlook for Crispy King, potentially leading to expansion, innovation, and heightened competition within the fast-food market. Only time will tell the full impact of this significant transaction.

Keywords: Crispy King, Fried Chicken, Fast Food, Acquisition, Zenith Equity Partners, Private Equity, Billion Dollar Deal, Restaurant Industry, Franchise, Expansion, Menu Innovation, Food and Beverage

Internal Links (examples - adapt these to your website structure):

- [Link to another article about fast food industry trends] - "Fast Food Industry Trends: A Look at the Future"

- [Link to another article about private equity] - "Private Equity Investments: Shaping the Future of Business"

External Links (examples - ensure these are reputable sources):

- [Link to Zenith Equity Partners website (if available)]

- [Link to a relevant news source covering the acquisition]

Call to Action (subtle): Stay tuned for further updates on this developing story as we continue to monitor the impact of this major acquisition on the fast-food industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Popular Fried Chicken Chain Sold For $1 Billion To Private Equity Firm. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

England Vs West Indies Womens Cricket Odi Live Match Updates

Jun 04, 2025

England Vs West Indies Womens Cricket Odi Live Match Updates

Jun 04, 2025 -

Corporate Readiness For A 2 C Future A Timely Strategy

Jun 04, 2025

Corporate Readiness For A 2 C Future A Timely Strategy

Jun 04, 2025 -

Hims And Hers Hims Share Price Surge 3 02 Rise Reported May 30

Jun 04, 2025

Hims And Hers Hims Share Price Surge 3 02 Rise Reported May 30

Jun 04, 2025 -

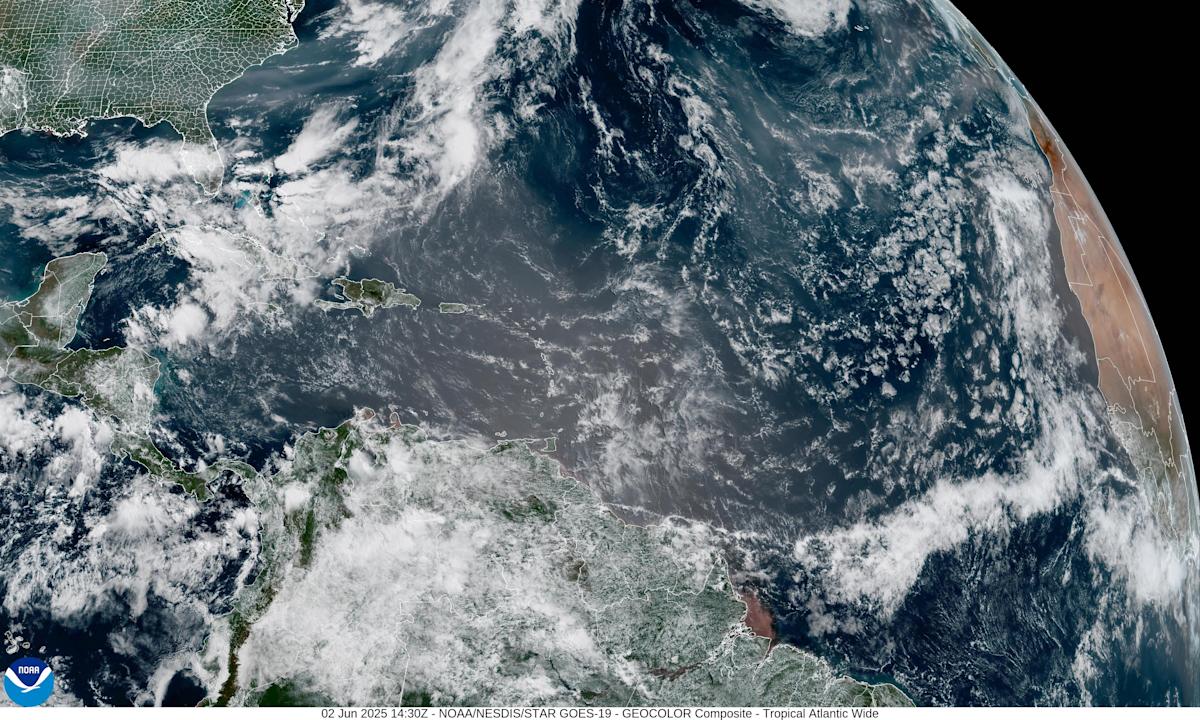

Canadian Wildfires Send Smoke Saharan Dust Blankets Florida Health Impacts

Jun 04, 2025

Canadian Wildfires Send Smoke Saharan Dust Blankets Florida Health Impacts

Jun 04, 2025 -

India Vs Thailand Live Score Commentary And Match Highlights

Jun 04, 2025

India Vs Thailand Live Score Commentary And Match Highlights

Jun 04, 2025