Plummeting Mortgage Refinance Rates: Your May 19, 2025, Update

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Plummeting Mortgage Refinance Rates: Your May 19, 2025, Update

Are you dreaming of lower monthly mortgage payments? The recent drop in mortgage refinance rates might make that dream a reality. As of May 19th, 2025, we're seeing significant shifts in the market, presenting a potentially lucrative opportunity for homeowners. This update breaks down the current landscape and helps you determine if refinancing is right for you.

The mortgage market has been experiencing a period of volatility, influenced by various economic factors including inflation rates, the Federal Reserve's monetary policy decisions, and shifts in investor confidence. This volatility has, surprisingly, led to a decrease in refinance rates for many borrowers. But what does this mean for you?

Understanding the Current Refinance Rate Landscape (May 19, 2025)

While specific rates vary depending on credit score, loan type, and the lender, we're seeing a general downward trend. Several key factors contribute to this:

- Decreased Demand: The recent slowdown in the housing market has lessened the demand for mortgages, putting downward pressure on interest rates.

- Federal Reserve Actions: The Federal Reserve's actions to manage inflation have indirectly impacted mortgage rates. While not a direct cause of the drop, their policies have contributed to the overall market adjustments.

- Increased Competition: Lenders are competing for your business, leading to more competitive rates. This competitive environment benefits borrowers seeking refinancing options.

Is Refinancing Right for You?

Before diving in, carefully consider these factors:

- Your Current Interest Rate: If your current interest rate is significantly higher than the current refinance rates, refinancing could save you substantial money over the life of your loan. Use an online mortgage calculator to compare potential savings.

- Your Credit Score: A higher credit score generally qualifies you for better interest rates. Check your credit report for accuracy and address any issues before applying.

- Closing Costs: Remember that refinancing involves closing costs, which can offset some of the savings. Factor these expenses into your calculations to determine your overall net savings.

- Loan Term: Consider whether a shorter or longer loan term aligns with your financial goals. A shorter term means higher monthly payments but less interest paid overall. A longer term offers lower monthly payments but increases total interest paid.

Finding the Best Refinance Rate:

Shopping around is crucial. Don't settle for the first offer you receive. Compare rates from multiple lenders, including:

- Major Banks: These institutions offer a wide range of mortgage products.

- Credit Unions: Credit unions often provide competitive rates and personalized service.

- Online Lenders: Online lenders can streamline the application process and offer competitive rates.

Helpful Resources:

- [Link to a reputable mortgage calculator]: Use this tool to estimate your potential savings.

- [Link to a resource on improving credit score]: Boosting your credit score can significantly improve your chances of securing a better rate.

- [Link to a comparison website for mortgage lenders]: Compare rates and lenders side-by-side.

Conclusion:

The plummeting mortgage refinance rates on May 19, 2025, present a valuable opportunity for many homeowners. By carefully assessing your current situation, comparing rates from different lenders, and understanding the associated costs, you can make an informed decision that could potentially save you thousands of dollars over the life of your mortgage. Don't hesitate to seek professional financial advice if needed. Remember to act quickly, as rates can change rapidly. Start exploring your options today!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Plummeting Mortgage Refinance Rates: Your May 19, 2025, Update. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unforgettable Images Capturing Trumps Middle Eastern Diplomatic Mission

May 19, 2025

Unforgettable Images Capturing Trumps Middle Eastern Diplomatic Mission

May 19, 2025 -

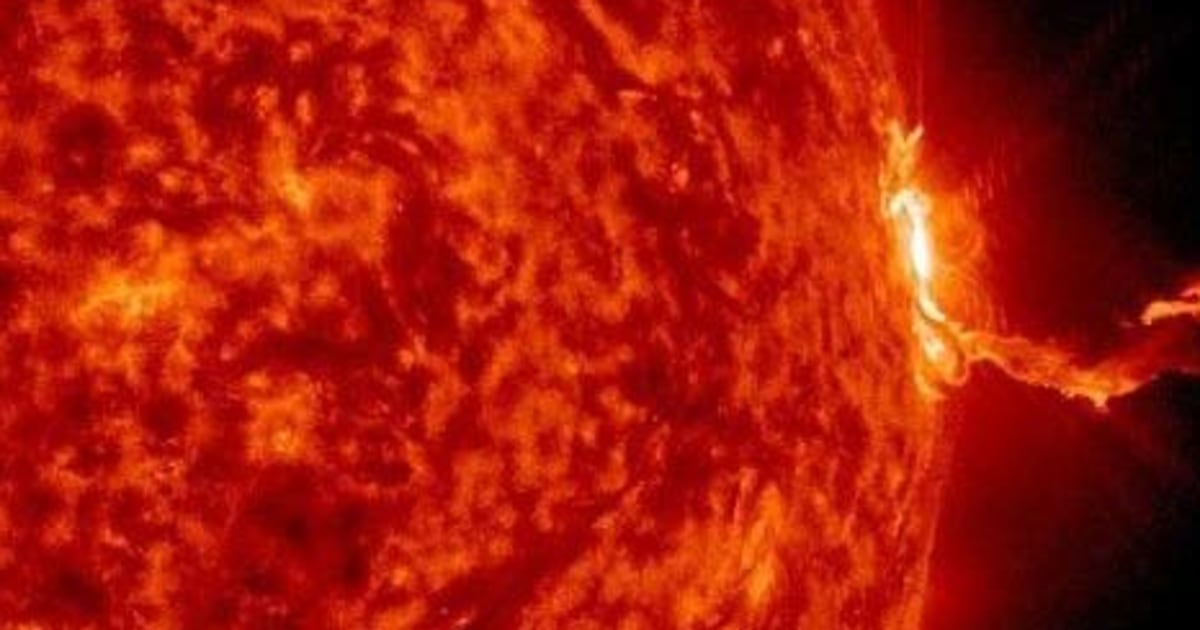

Global Communications Disrupted Massive Solar Storm Impacts Five Continents

May 19, 2025

Global Communications Disrupted Massive Solar Storm Impacts Five Continents

May 19, 2025 -

Top Golfers Struggle In Pga Opener After Costly Mistakes

May 19, 2025

Top Golfers Struggle In Pga Opener After Costly Mistakes

May 19, 2025 -

Brooklyn Half Marathon 2024 Runner Fatality Prompts Safety Concerns

May 19, 2025

Brooklyn Half Marathon 2024 Runner Fatality Prompts Safety Concerns

May 19, 2025 -

Orioles Roster Move Tyler O Neill To 10 Day Injured List

May 19, 2025

Orioles Roster Move Tyler O Neill To 10 Day Injured List

May 19, 2025