Over $5 Billion Poured Into Bitcoin ETFs: Analyzing The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Poured into Bitcoin ETFs: Analyzing the Bold Investment Strategies

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) in recent months, marking a significant shift in institutional investment strategies and signaling a potential turning point in Bitcoin's journey toward mainstream acceptance. This unprecedented influx of capital raises crucial questions about the future of Bitcoin and the evolving landscape of digital asset investment. But what's driving this surge, and what does it mean for investors?

The Institutional Embrace of Bitcoin ETFs:

The recent surge in Bitcoin ETF investment is largely attributed to the approval of several Bitcoin futures ETFs by regulatory bodies like the Securities and Exchange Commission (SEC) in the United States. This regulatory green light has opened the floodgates for institutional investors – hedge funds, pension funds, and others – who previously faced significant hurdles in directly accessing the Bitcoin market. ETFs offer a regulated and relatively low-risk entry point compared to directly buying and holding Bitcoin, attracting a more conservative investor base.

Why the Bold Investment in Bitcoin ETFs?

Several factors contribute to this bold investment strategy:

- Reduced Risk and Regulation: ETFs offer a layer of regulatory compliance and security, mitigating some of the risks associated with directly holding Bitcoin. This is particularly attractive to institutional investors who must adhere to strict regulatory guidelines.

- Diversification and Portfolio Management: Bitcoin, despite its volatility, is increasingly viewed as a potential diversifier within traditional investment portfolios. ETFs allow for easier integration into existing asset allocation strategies.

- Growing Institutional Confidence: The growing adoption of Bitcoin by major corporations and financial institutions, along with the increasing maturity of the cryptocurrency infrastructure, boosts investor confidence.

- Inflation Hedge Potential: Many investors see Bitcoin as a potential hedge against inflation, especially in periods of economic uncertainty. Its limited supply and decentralized nature are key arguments in this narrative.

Analyzing the Investment Strategies:

The investment strategies behind this massive inflow are multifaceted:

- Long-Term Hold: Many institutional investors are taking a long-term view on Bitcoin, anticipating significant growth over the next decade.

- Strategic Allocation: Bitcoin is being integrated into diversified portfolios as part of a broader asset allocation strategy, often alongside traditional assets like stocks and bonds.

- Hedging Against Market Volatility: Some investors are utilizing Bitcoin ETFs as a hedge against potential downturns in traditional markets.

The Future of Bitcoin and ETF Investment:

The future of Bitcoin ETFs remains promising, though challenges persist. The SEC is still considering applications for spot Bitcoin ETFs, which would allow direct investment in Bitcoin rather than futures contracts. Approval of spot ETFs could further accelerate the inflow of capital into the Bitcoin market. However, regulatory uncertainty and market volatility remain significant factors.

Conclusion:

The over $5 billion poured into Bitcoin ETFs signifies a significant turning point in the mainstream acceptance of Bitcoin. This substantial investment reflects growing institutional confidence in Bitcoin's long-term potential and the appeal of regulated investment vehicles. While volatility remains a factor, the trend points toward continued growth and integration of cryptocurrencies into traditional finance. It's crucial for investors to conduct thorough research and understand the risks involved before investing in any cryptocurrency-related asset. Are you considering adding Bitcoin ETFs to your portfolio? Let us know your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Poured Into Bitcoin ETFs: Analyzing The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ny Ag James Trump Legal Battles Overshadow Dojs Real Estate Fraud Investigation

May 21, 2025

Ny Ag James Trump Legal Battles Overshadow Dojs Real Estate Fraud Investigation

May 21, 2025 -

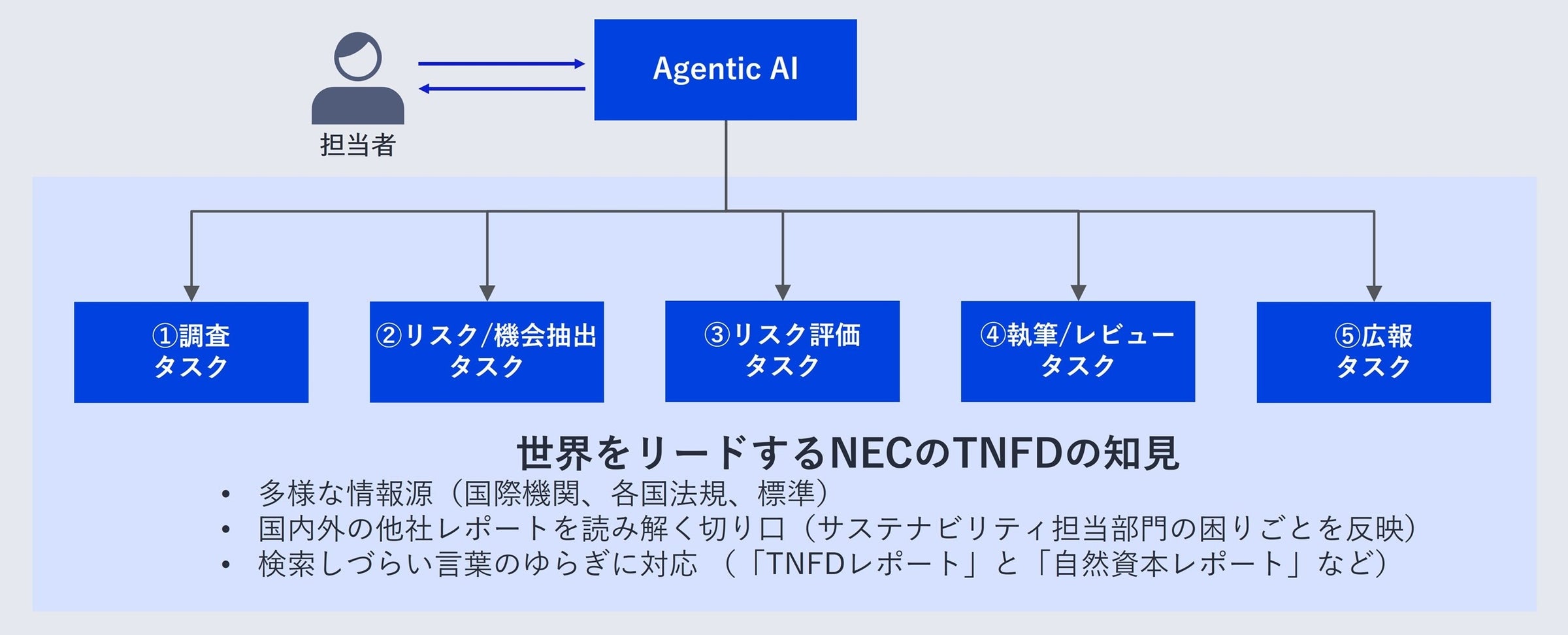

Nec Agentic Ai

May 21, 2025

Nec Agentic Ai

May 21, 2025 -

Assassins Creed Shadows Exploring The Absence Of Animal Killing

May 21, 2025

Assassins Creed Shadows Exploring The Absence Of Animal Killing

May 21, 2025 -

Investigation Underway Two Boys Accused Of Breaking Into Local Church

May 21, 2025

Investigation Underway Two Boys Accused Of Breaking Into Local Church

May 21, 2025 -

No Killing Animals In Assassins Creed Shadows Ubisoft Explains

May 21, 2025

No Killing Animals In Assassins Creed Shadows Ubisoft Explains

May 21, 2025