Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Analyzing the Surge

The cryptocurrency market is buzzing with excitement as investments in Bitcoin exchange-traded funds (ETFs) recently surpassed the $5 billion mark. This monumental surge signifies a significant shift in investor sentiment and underscores the growing institutional acceptance of Bitcoin as a viable asset class. But what's driving this incredible influx of capital, and what does it mean for the future of Bitcoin and the broader crypto market? Let's delve into the details.

The Rise of Bitcoin ETFs: A Game Changer for Institutional Investors

Until recently, institutional investors faced significant hurdles in directly investing in Bitcoin. The complexities of managing private keys, security concerns, and regulatory uncertainties often deterred large-scale participation. Bitcoin ETFs, however, offer a more accessible and regulated pathway. These funds allow investors to gain exposure to Bitcoin's price movements without the need to directly hold the cryptocurrency. This streamlined approach has been instrumental in attracting significant institutional capital.

Factors Fueling the $5 Billion Surge:

Several key factors have converged to create this perfect storm of investment in Bitcoin ETFs:

- Regulatory Approvals: The recent approval of several Bitcoin ETFs in major markets, such as the United States, has dramatically increased investor confidence and opened the floodgates for institutional money. This regulatory clarity is a crucial element in attracting traditionally risk-averse investors.

- Inflation Concerns: Persistent inflation globally continues to push investors towards alternative assets perceived as hedges against inflation. Bitcoin, with its limited supply and decentralized nature, has gained traction as a potential inflation hedge.

- Increased Institutional Adoption: Beyond ETFs, we've seen a broader trend of institutional adoption of Bitcoin. Major corporations are adding Bitcoin to their treasury reserves, further legitimizing it as a legitimate asset class. This broader trend fuels confidence in the ETF market.

- Technological Advancements: The ongoing development of the Bitcoin network, including improvements in scalability and transaction speed, has also contributed to increased investor confidence.

What Does This Mean for the Future?

The $5 billion milestone is a powerful indicator of Bitcoin's growing mainstream acceptance. This surge in ETF investments suggests a potential for further growth and increased price volatility. However, it's crucial to remember that the cryptocurrency market remains volatile, and investors should proceed with caution and conduct thorough research before investing.

Potential Risks and Considerations:

While the future looks promising, it's important to acknowledge the inherent risks associated with Bitcoin and cryptocurrencies in general:

- Volatility: Bitcoin's price can fluctuate dramatically in short periods, leading to significant gains or losses.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and future regulations could impact the market significantly.

- Security Risks: Although ETFs mitigate some security risks, the underlying technology remains susceptible to hacking and other security breaches.

Conclusion: A Milestone in Bitcoin's Journey

The investment surge exceeding $5 billion in Bitcoin ETFs marks a pivotal moment in the history of Bitcoin. It signifies a growing acceptance of Bitcoin as a mainstream asset and highlights the transformative power of regulated investment vehicles. While risks remain, the trend towards institutional adoption and increased regulatory clarity points to a potentially bright future for Bitcoin and the broader cryptocurrency market. However, investors should always approach the market with informed decision-making and a keen awareness of the risks involved. Stay informed and continue to follow developments in the ever-evolving world of cryptocurrency. What are your thoughts on this significant milestone? Share your opinions in the comments below!

Related Articles:

- [Link to an article about Bitcoin price predictions]

- [Link to an article about Bitcoin regulation]

- [Link to an article about other crypto ETFs]

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency ETF, Bitcoin Investment, Institutional Investment, Bitcoin Price, Crypto Market, ETF Investments, $5 Billion Bitcoin ETF, Regulatory Approval, Bitcoin Volatility, Inflation Hedge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Streaming Movie A Powerful Ww 1 Story With Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025

New Streaming Movie A Powerful Ww 1 Story With Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025 -

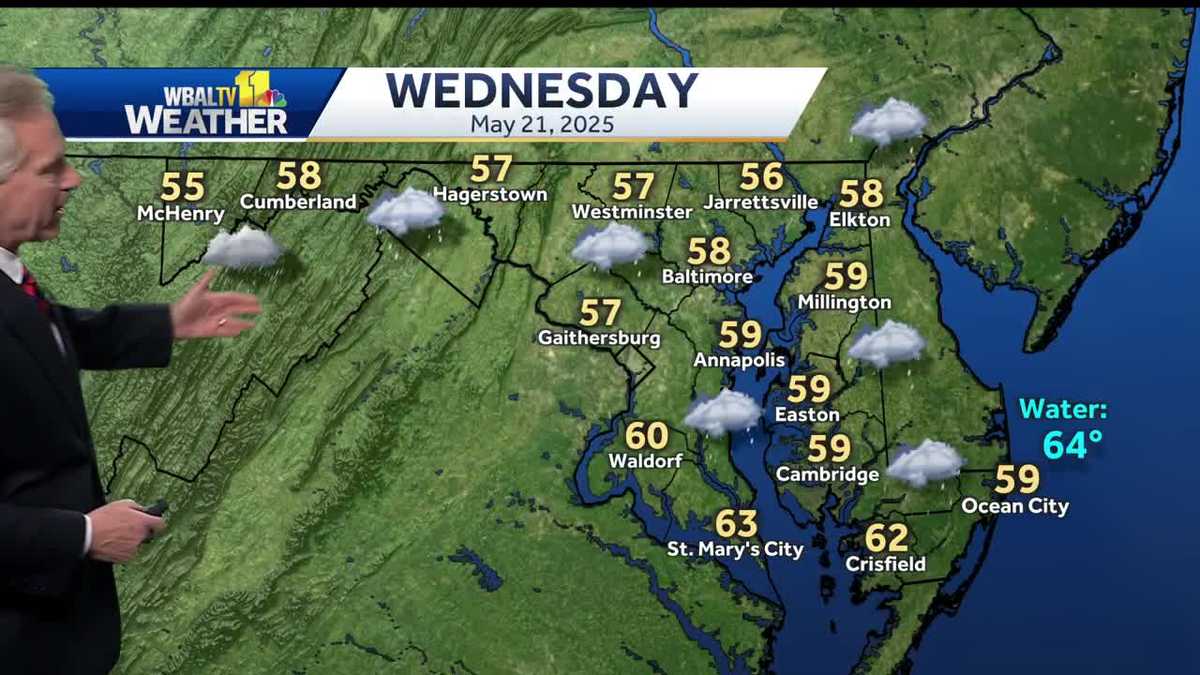

Chilly Rain To Blanket Region Throughout Wednesday

May 21, 2025

Chilly Rain To Blanket Region Throughout Wednesday

May 21, 2025 -

Japanese Businesses Prioritize Nature Conservation 160 Companies Compete For Enhanced Corporate Value Across 13 Sectors

May 21, 2025

Japanese Businesses Prioritize Nature Conservation 160 Companies Compete For Enhanced Corporate Value Across 13 Sectors

May 21, 2025 -

Trump To Intervene Dialogue With Putin And Zelensky Sought As Russia Escalates Ukraine Offensive

May 21, 2025

Trump To Intervene Dialogue With Putin And Zelensky Sought As Russia Escalates Ukraine Offensive

May 21, 2025 -

160 Japanese Firms Compete In Nature Conservation Initiatives New Industry Benchmarks

May 21, 2025

160 Japanese Firms Compete In Nature Conservation Initiatives New Industry Benchmarks

May 21, 2025