Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Bold Moves

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Analyzing the Bold Moves

The world of finance is buzzing. Over $5 billion has been poured into Bitcoin exchange-traded funds (ETFs) – a monumental shift signaling growing mainstream acceptance of the cryptocurrency. This unprecedented investment reflects a bold gamble on Bitcoin's future, prompting crucial questions about market stability, regulatory landscapes, and the long-term viability of Bitcoin as a significant asset class. This article delves into the key factors driving this surge and analyzes the potential implications.

The Surge in Bitcoin ETF Investments: A Paradigm Shift?

The recent influx of capital into Bitcoin ETFs represents a significant departure from previous hesitancy surrounding cryptocurrency investments. Several factors contribute to this dramatic increase:

- Regulatory Approvals: The approval of Bitcoin futures ETFs in the US marked a watershed moment. This paved the way for increased institutional investment, legitimizing Bitcoin in the eyes of many previously cautious investors. The SEC's cautious approach, however, highlights the ongoing regulatory scrutiny surrounding the asset class.

- Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating portions of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversification strategy. This institutional interest is a key driver behind the significant investment figures.

- Growing Mainstream Awareness: Bitcoin's increased visibility and broader public understanding have contributed to heightened investor interest. While volatility remains a concern, the perception of Bitcoin as a potentially lucrative investment is gaining traction.

- Technological Advancements: Developments in the Bitcoin ecosystem, including the Lightning Network, are improving scalability and transaction speeds, addressing previous concerns about its practical application.

Analyzing the Risks and Rewards

While the over $5 billion invested signifies a major leap of faith in Bitcoin, it's crucial to acknowledge the inherent risks:

- Volatility: Bitcoin's price remains highly volatile, susceptible to significant swings driven by market sentiment, regulatory changes, and technological developments. This inherent volatility presents considerable risk to investors.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving, and unpredictable changes could significantly impact Bitcoin's value and accessibility. This uncertainty is a primary concern for many institutional and individual investors.

- Security Concerns: The security of Bitcoin exchanges and wallets remains a crucial concern, with the potential for hacking and theft representing a significant risk. Robust security measures are essential for safeguarding investments.

The Future of Bitcoin ETFs and the Cryptocurrency Market

The massive investment in Bitcoin ETFs signals a potential paradigm shift in the financial landscape. However, the future remains uncertain. The long-term success of Bitcoin and its associated ETFs will hinge on:

- Continued Regulatory Clarity: Clear and consistent regulatory frameworks are crucial for fostering growth and stability within the cryptocurrency market.

- Technological Innovation: Continued technological advancements are necessary to address scalability and efficiency concerns, making Bitcoin a more viable option for everyday transactions.

- Market Adoption: Widespread adoption by businesses and consumers is key to solidifying Bitcoin's position as a mainstream asset.

Conclusion:

The over $5 billion invested in Bitcoin ETFs represents a bold bet on the future of cryptocurrency. While significant risks remain, the growing institutional adoption and increasing mainstream awareness suggest a potential long-term shift in the financial landscape. However, regulatory clarity and continued technological advancements are crucial for ensuring the sustainable growth and stability of the Bitcoin market. Only time will tell if this investment represents a visionary move or a speculative bubble. Stay tuned for further developments in this rapidly evolving market.

Keywords: Bitcoin ETF, Bitcoin investment, cryptocurrency, ETF investment, Bitcoin price, regulatory approval, institutional investors, cryptocurrency market, Bitcoin volatility, financial markets, SEC, Bitcoin futures ETF.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Bold Moves. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

200 Million Invests In Ethereum Following Successful Pectra Upgrade

May 20, 2025

200 Million Invests In Ethereum Following Successful Pectra Upgrade

May 20, 2025 -

Repeated Backlash Lizzo On The Challenges And Controversies Of Her Career

May 20, 2025

Repeated Backlash Lizzo On The Challenges And Controversies Of Her Career

May 20, 2025 -

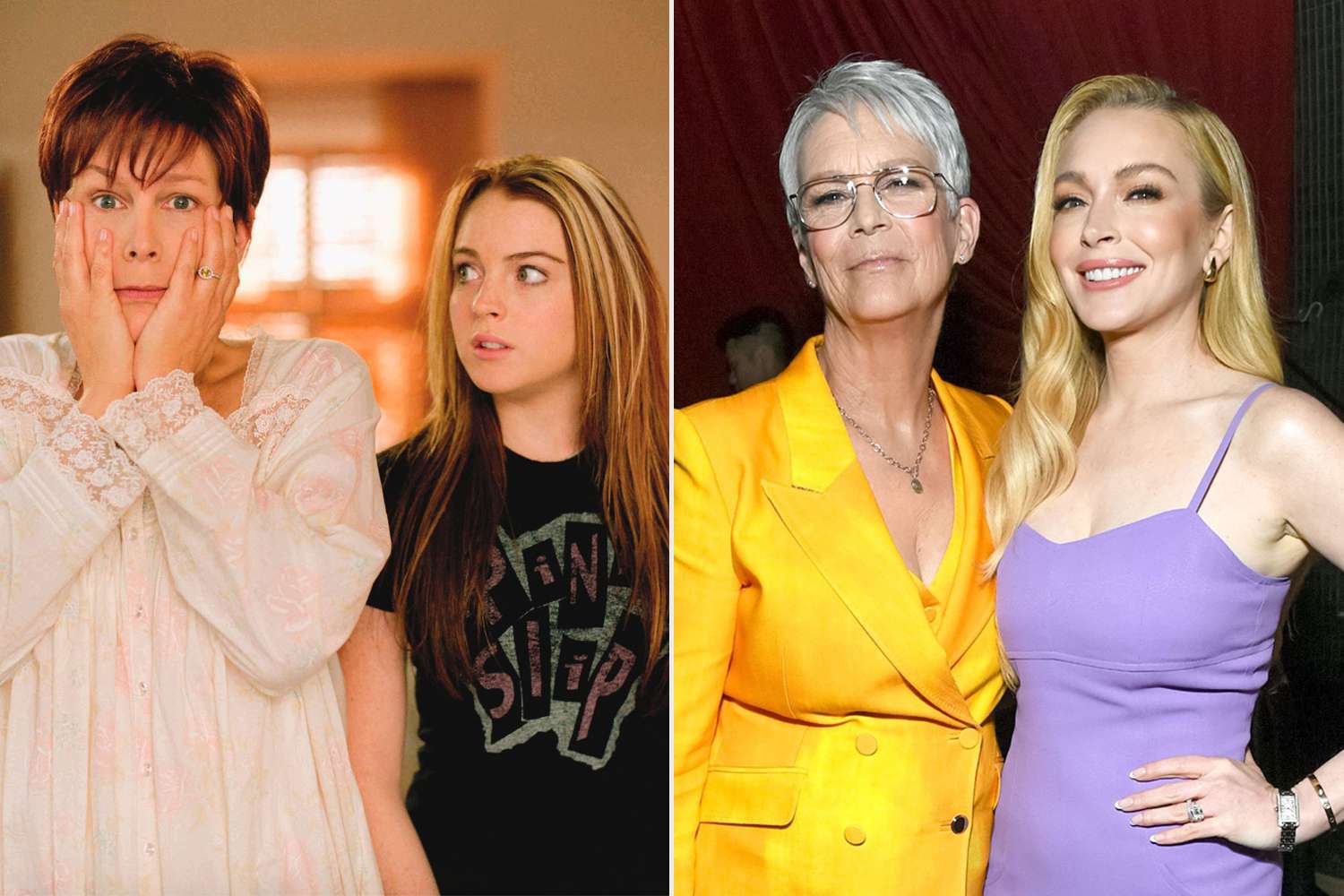

Jamie Lee Curtis On Lindsay Lohan A Longstanding Friendship Revealed

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan A Longstanding Friendship Revealed

May 20, 2025 -

The Lasting Friendship Of Jamie Lee Curtis And Lindsay Lohan A Post Freaky Friday Update

May 20, 2025

The Lasting Friendship Of Jamie Lee Curtis And Lindsay Lohan A Post Freaky Friday Update

May 20, 2025 -

Jamie Lee Curtis Reveals How She Stays Connected With Lindsay Lohan After Freaky Friday

May 20, 2025

Jamie Lee Curtis Reveals How She Stays Connected With Lindsay Lohan After Freaky Friday

May 20, 2025