Over $5 Billion Inflows: Bitcoin ETF Market Attracts Major Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Inflows: Bitcoin ETF Market Attracts Major Institutional Investors

The cryptocurrency market is buzzing with excitement as the Bitcoin ETF (Exchange-Traded Fund) space experiences a massive surge in investment. Recent data reveals over $5 billion in inflows, signifying a significant shift in institutional investor sentiment and a growing acceptance of Bitcoin as a mainstream asset. This unprecedented influx signals a potential turning point for Bitcoin's trajectory and the broader cryptocurrency market.

Institutional Investors Embrace Bitcoin ETFs

The allure of Bitcoin ETFs lies in their accessibility and regulatory compliance. Unlike directly investing in Bitcoin, which involves navigating the complexities of cryptocurrency exchanges and wallets, ETFs offer a familiar and regulated pathway for institutional investors to gain exposure to Bitcoin's price movements. This ease of access, coupled with the perceived lower risk associated with regulated investment vehicles, has driven the substantial inflow of capital.

This surge isn't just a fleeting trend; major financial institutions are actively participating. The recent approvals of several Bitcoin ETFs in major markets have opened the floodgates, allowing pension funds, hedge funds, and other large players to diversify their portfolios with Bitcoin exposure in a regulated and transparent manner. This institutional backing lends significant credibility to Bitcoin and contributes to its price stability.

Driving Factors Behind the Massive Inflows

Several factors contribute to this monumental investment surge:

- Regulatory Clarity: The gradual increase in regulatory clarity surrounding cryptocurrencies, particularly in major markets like the US and Canada, has boosted investor confidence. Clearer regulations reduce uncertainty and attract more institutional money.

- Inflation Hedge: With persistent inflation concerns globally, Bitcoin is increasingly viewed as a potential inflation hedge, much like gold. Its limited supply and decentralized nature make it an attractive alternative asset for investors seeking to protect their purchasing power.

- Growing Institutional Adoption: The increased adoption of Bitcoin by established financial institutions lends legitimacy to the cryptocurrency, encouraging further investment from both institutional and retail investors.

- Technological Advancements: Developments in the Bitcoin network's scalability and efficiency continue to bolster its long-term viability and appeal to sophisticated investors.

What Does This Mean for the Future of Bitcoin?

The over $5 billion influx into Bitcoin ETFs signifies a significant milestone for Bitcoin's journey towards mainstream adoption. It indicates a growing confidence in Bitcoin's long-term potential and its ability to withstand market volatility. This massive investment could lead to further price appreciation and solidify Bitcoin's position as a dominant player in the digital asset landscape.

Looking Ahead: Potential Challenges and Opportunities

While the current outlook is positive, challenges remain. Regulatory uncertainty in certain regions and potential market corrections could impact future inflows. However, the overall trend suggests a strong bullish sentiment towards Bitcoin, and the continued development of innovative products like Bitcoin ETFs will likely drive further growth in the space.

Call to Action: Stay informed about the evolving cryptocurrency landscape by following reputable news sources and conducting thorough research before making any investment decisions. Remember to consult with a financial advisor to assess your risk tolerance and investment goals. The information provided here is for educational purposes only and does not constitute financial advice.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency Investment, Institutional Investors, Bitcoin Price, Cryptocurrency Regulation, Bitcoin Adoption, Inflation Hedge, Digital Asset, Cryptocurrency Market, $5 Billion Inflows

(Note: This article includes keywords naturally within the text and avoids keyword stuffing. The external links mentioned are conceptual; actual links should be added based on relevant and reliable sources.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Inflows: Bitcoin ETF Market Attracts Major Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

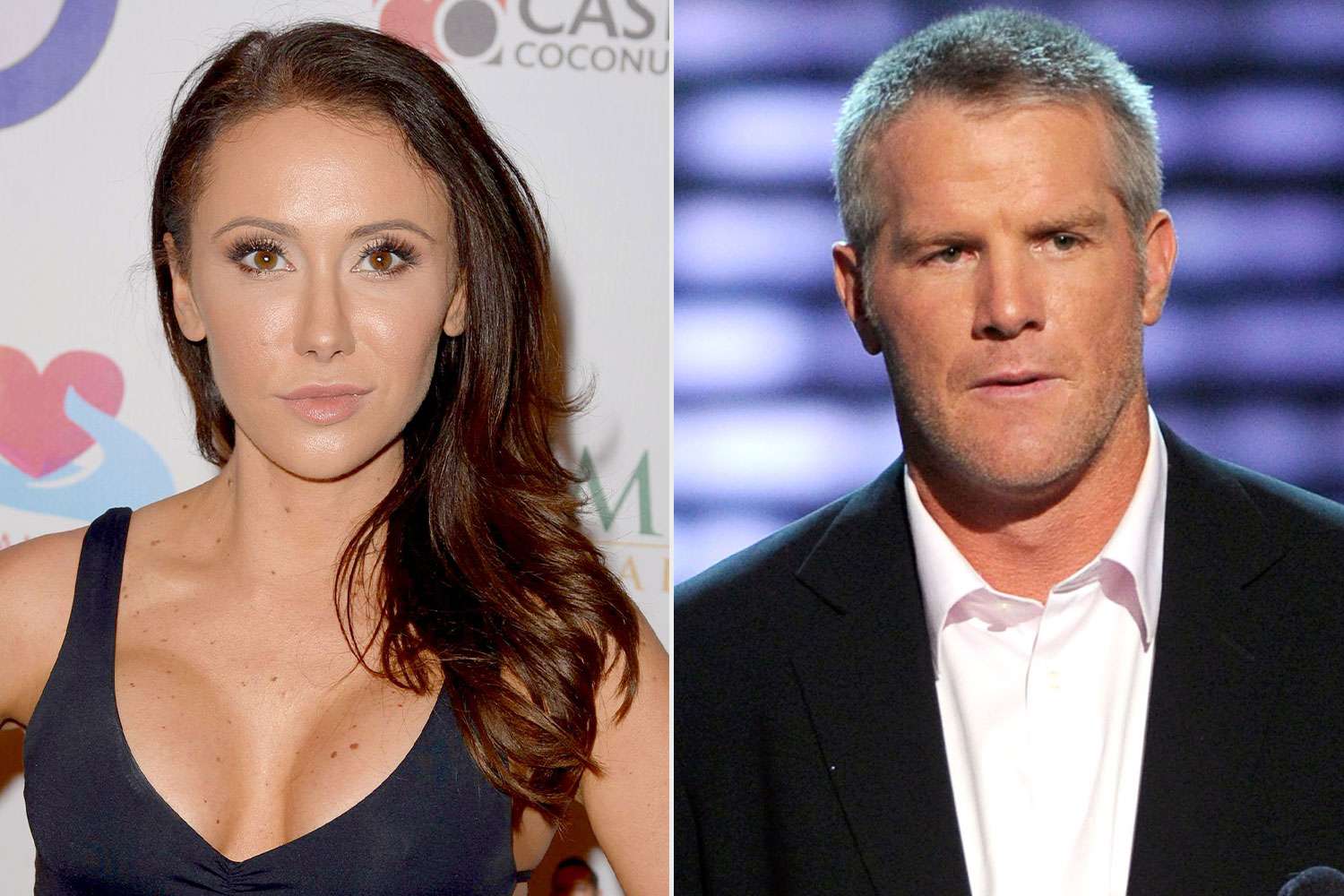

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Recounts Emotional Toll Of Brett Favre Sexting Scandal

May 20, 2025 -

Valley Outdoorsmen Dispute Georgia Womans Fresno County Survival Account

May 20, 2025

Valley Outdoorsmen Dispute Georgia Womans Fresno County Survival Account

May 20, 2025 -

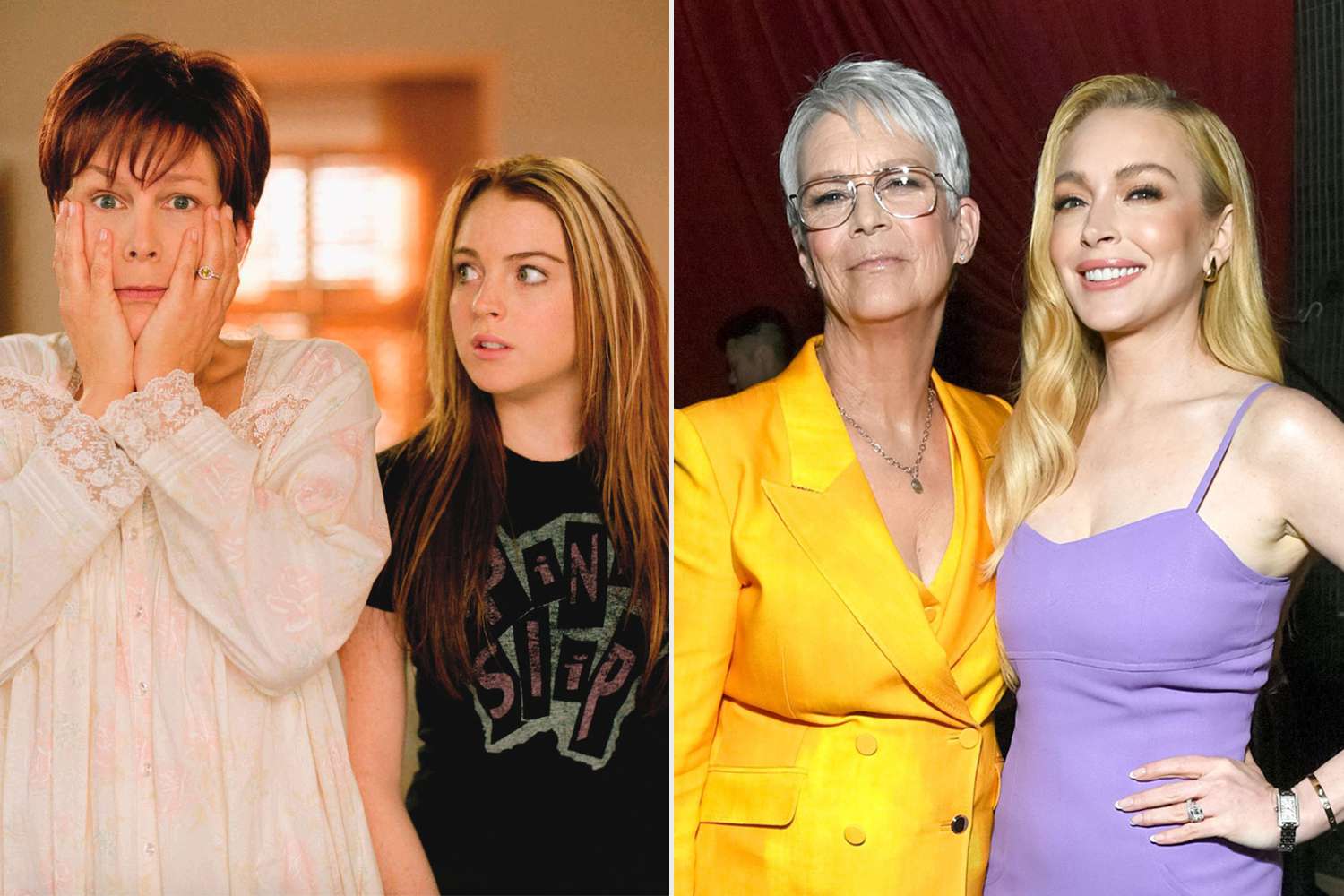

Freaky Friday Reunion Jamie Lee Curtis Talks About Her Relationship With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Talks About Her Relationship With Lindsay Lohan

May 20, 2025 -

Jones Vs Ufc Controversy Erupts Over Withheld Aspinall Information

May 20, 2025

Jones Vs Ufc Controversy Erupts Over Withheld Aspinall Information

May 20, 2025 -

Prostate Cancer And Gleason Score 9 What It Means For Biden And Others

May 20, 2025

Prostate Cancer And Gleason Score 9 What It Means For Biden And Others

May 20, 2025