Over $5 Billion Inflows: Bitcoin ETF Investment Surge Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Inflows: Bitcoin ETF Investment Surge Explained

The world of finance is buzzing. Bitcoin exchange-traded funds (ETFs) have seen a staggering surge in investment, attracting over $5 billion in inflows in recent weeks. This unprecedented influx raises crucial questions: What's driving this massive investment? Is this a temporary trend or the beginning of a new era for Bitcoin adoption? Let's delve into the details.

The Catalyst: SEC Approval and Market Sentiment

The primary driver behind this monumental surge is the recent approval of the first spot Bitcoin ETF by the Securities and Exchange Commission (SEC). This landmark decision, after years of deliberation and numerous rejected applications, has dramatically shifted market sentiment. The approval signifies a significant level of regulatory acceptance for Bitcoin, legitimizing it in the eyes of many institutional and retail investors.

This regulatory green light has opened the floodgates. Previously hesitant investors, particularly large institutional players who require regulatory clarity before committing substantial capital, are now entering the market with confidence. The ease of access through a traditional ETF structure, rather than navigating the complexities of direct Bitcoin purchases, has further fueled this growth.

Beyond the SEC Approval: Other Contributing Factors

While the SEC approval is the undeniable catalyst, other factors contribute to this massive inflow:

- Growing Institutional Adoption: More and more institutional investors, including pension funds and hedge funds, are recognizing Bitcoin as a viable asset class for diversification and potential long-term growth.

- Inflation Hedge Potential: With persistent inflation in many global economies, Bitcoin, often touted as a hedge against inflation, is becoming an increasingly attractive investment option.

- Technological Advancements: Continued development within the Bitcoin ecosystem, such as the Lightning Network for faster and cheaper transactions, is enhancing its usability and appeal.

- Increased Media Coverage: The positive media coverage surrounding the ETF approval has further amplified investor interest and fueled the surge in inflows.

What Does This Mean for the Future of Bitcoin?

The $5 billion inflow represents a significant milestone for Bitcoin's integration into mainstream finance. It suggests a growing acceptance of cryptocurrency as a legitimate asset class, potentially paving the way for broader adoption. However, it's crucial to remember that market volatility remains inherent to Bitcoin. While this surge indicates strong positive momentum, investors should remain aware of the inherent risks.

Potential Challenges and Considerations

Despite the positive outlook, several challenges remain:

- Regulatory Uncertainty: While the SEC approval is a significant step, regulatory landscapes vary across jurisdictions, and future regulatory changes could impact the market.

- Market Volatility: Bitcoin's price remains volatile, and significant price swings are still to be expected.

- Security Concerns: Security remains a critical concern within the cryptocurrency space, and investors need to be aware of potential risks.

Conclusion: A New Era for Bitcoin Investment?

The over $5 billion in inflows into Bitcoin ETFs signifies a potential paradigm shift in cryptocurrency investment. The SEC approval has acted as a powerful catalyst, legitimizing Bitcoin and making it more accessible to a wider range of investors. While challenges remain, this massive influx suggests a bright future for Bitcoin, potentially ushering in a new era of mainstream adoption and investment. However, investors should always conduct thorough research and understand the inherent risks before investing in any cryptocurrency. Stay tuned for further developments in this rapidly evolving market.

Keywords: Bitcoin ETF, Bitcoin, ETF, SEC approval, cryptocurrency investment, Bitcoin price, cryptocurrency, investment surge, institutional investors, regulatory approval, market sentiment, inflation hedge, Bitcoin adoption.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Inflows: Bitcoin ETF Investment Surge Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Marsh And Markram Power Srh To 206 Must Win Game For Lsg

May 20, 2025

Marsh And Markram Power Srh To 206 Must Win Game For Lsg

May 20, 2025 -

Federal Reserves 2025 Rate Cut Outlook Implications For Us Treasury Yields

May 20, 2025

Federal Reserves 2025 Rate Cut Outlook Implications For Us Treasury Yields

May 20, 2025 -

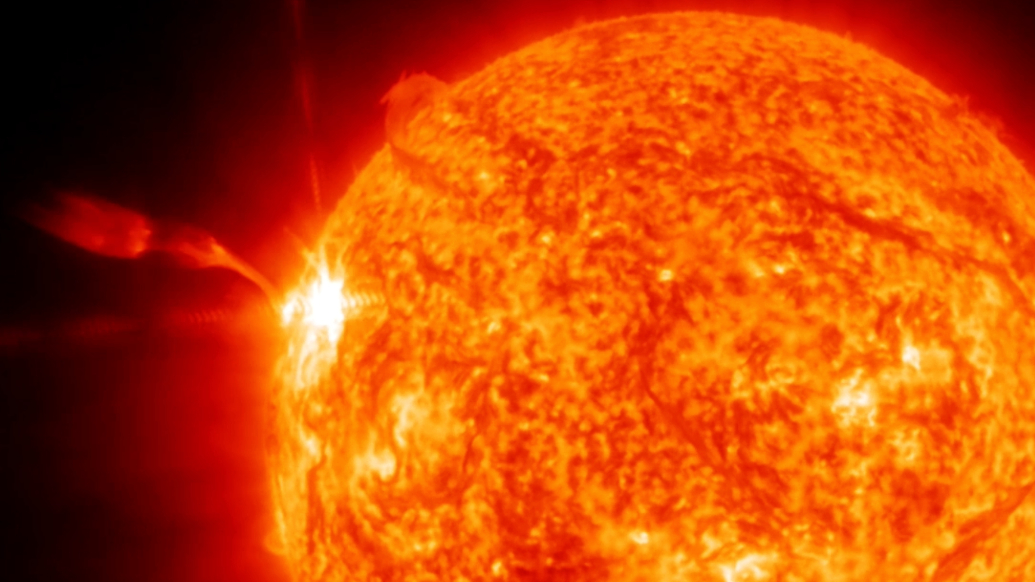

2025s Biggest Solar Flare Impact On Radio Communication And Global Systems

May 20, 2025

2025s Biggest Solar Flare Impact On Radio Communication And Global Systems

May 20, 2025 -

Lsg Vs Srh Ipl 2025 Live Score And Post Match Controversy

May 20, 2025

Lsg Vs Srh Ipl 2025 Live Score And Post Match Controversy

May 20, 2025 -

Major Setback For Spains Holiday Rental Market 65 000 Listings Removed

May 20, 2025

Major Setback For Spains Holiday Rental Market 65 000 Listings Removed

May 20, 2025