One Rate Cut Projected In 2025: Impact On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut Projected in 2025: How Will This Impact U.S. Treasury Yields?

The whispers are growing louder: a single interest rate cut is projected by some economists for 2025. This forecast, while still tentative, carries significant implications for the U.S. Treasury market and investors keenly watching for shifts in yield. Understanding the potential impact requires examining the current economic landscape and the intricate relationship between interest rates and Treasury yields.

The Current Economic Climate: A Balancing Act

The Federal Reserve (Fed) has aggressively hiked interest rates throughout 2022 and 2023 to combat stubbornly high inflation. This has successfully cooled the economy, but the effects are complex. While inflation is showing signs of easing, concerns remain about potential recessionary pressures and the fragility of the economic recovery. The projected single rate cut in 2025 reflects a cautious optimism that inflation will continue its descent, allowing for some monetary policy loosening without reigniting inflationary pressures.

Understanding the Link Between Interest Rates and Treasury Yields

U.S. Treasury yields are fundamentally linked to the federal funds rate set by the Fed. When the Fed cuts rates, it generally signals a more accommodative monetary policy. This, in turn, puts downward pressure on Treasury yields. Investors, anticipating lower returns from other investments, may flock to the relative safety of U.S. Treasuries, potentially driving up their prices and lowering yields. However, the relationship isn't always straightforward. Other factors, including inflation expectations, global economic conditions, and investor sentiment, can significantly influence Treasury yields.

The Projected Rate Cut and its Potential Impact on Yields

A single rate cut in 2025, as projected by some analysts, is unlikely to trigger a dramatic plunge in Treasury yields. The market will likely react cautiously, assessing the Fed's reasoning behind the cut and the overall economic outlook. Several scenarios are possible:

- Moderate Yield Decline: A small decrease in yields across the Treasury curve is the most likely scenario. This would benefit investors who hold long-term Treasuries, as their bond values would appreciate.

- Yield Curve Flattening: The difference between short-term and long-term Treasury yields (the yield curve) might flatten. This is because short-term yields would likely fall more significantly than long-term yields in response to the rate cut.

- Limited Impact: If the economic data remains strong, or if inflation shows signs of resurgence, the impact on yields could be minimal.

What Investors Should Consider

The projection of a single rate cut in 2025 highlights the uncertainty inherent in economic forecasting. Investors should:

- Diversify their portfolios: Don't rely solely on Treasuries. Consider diversifying across asset classes to mitigate risk.

- Monitor economic indicators: Stay informed about key economic data releases, such as inflation reports and employment figures.

- Consult with a financial advisor: A professional can help you develop an investment strategy tailored to your risk tolerance and financial goals.

Conclusion: Navigating Uncertainty in the Treasury Market

The projected single rate cut in 2025 presents both opportunities and challenges for investors in the U.S. Treasury market. While a rate cut generally leads to lower yields, the magnitude of the impact will depend on various economic and market factors. Careful analysis, diversification, and professional guidance are crucial for navigating this complex landscape. Stay tuned for further updates as the economic picture clarifies and the Fed's policy decisions unfold. Learn more about . (This is an example external link - replace with a relevant and authoritative source)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut Projected In 2025: Impact On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Helldivers 2 Warbonds Masters Of Ceremony Event Starts May 15th

May 20, 2025

Helldivers 2 Warbonds Masters Of Ceremony Event Starts May 15th

May 20, 2025 -

Bitcoin Etf Boom Over 5 Billion Poured In Whats Driving The Surge

May 20, 2025

Bitcoin Etf Boom Over 5 Billion Poured In Whats Driving The Surge

May 20, 2025 -

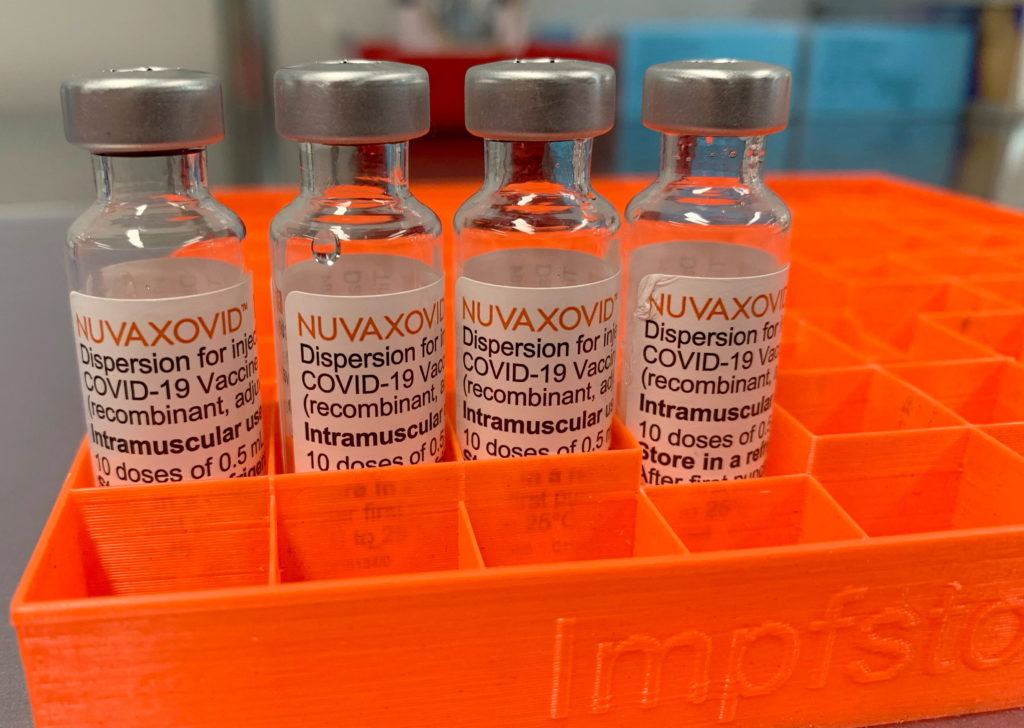

Conditional Fda Approval The Novavax Covid 19 Vaccine And Its Limitations

May 20, 2025

Conditional Fda Approval The Novavax Covid 19 Vaccine And Its Limitations

May 20, 2025 -

Sirianni Remains In Philadelphia Eagles Announce Contract Extension

May 20, 2025

Sirianni Remains In Philadelphia Eagles Announce Contract Extension

May 20, 2025 -

Latonya Pottain My 600 Lb Life Star Dead At Age 40

May 20, 2025

Latonya Pottain My 600 Lb Life Star Dead At Age 40

May 20, 2025