One Rate Cut In 2025: How The Fed's Decision Affects U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: How the Fed's Decision Affects U.S. Treasury Yields

The Federal Reserve's recent projections hint at a single interest rate cut in 2025, a decision sending ripples through the financial markets and significantly impacting U.S. Treasury yields. This move, while seemingly minor on the surface, has profound implications for investors, borrowers, and the overall U.S. economy. Understanding the interplay between Fed policy and Treasury yields is crucial for navigating the current economic landscape.

The Fed's Dot Plot and Market Reactions:

The Federal Open Market Committee (FOMC) publishes a "dot plot" – a chart showing individual policymakers' projections for future interest rates. The latest dot plot signaled a single rate cut in 2025, a shift from previous projections that suggested no cuts at all. This subtle change sparked immediate market reactions, with Treasury yields exhibiting noticeable fluctuations. The anticipation of lower interest rates generally pushes yields down, as investors seek higher-yielding bonds in a lower-rate environment. However, the situation is more nuanced than a simple cause-and-effect relationship.

Understanding the Relationship Between Fed Policy and Treasury Yields:

The Federal Reserve's actions significantly influence Treasury yields. When the Fed raises interest rates (like it has been doing to combat inflation), Treasury yields typically rise to match. Conversely, when the Fed lowers rates, yields generally fall. This relationship is based on several factors:

- Investor Demand: Lower interest rates make existing Treasury bonds more attractive, driving up demand and pushing prices higher. Since bond prices and yields move inversely, higher prices mean lower yields.

- Inflation Expectations: The Fed's actions reflect its assessment of inflation. A projected rate cut might signal the Fed's belief that inflation is under control, potentially impacting inflation expectations and influencing Treasury yields.

- Economic Growth Outlook: A single rate cut in 2025 could also reflect a more cautious outlook on economic growth. Investors will carefully analyze this signal, influencing their demand for Treasury securities and thus affecting yields.

Implications for Investors:

The projected rate cut presents a mixed bag for investors. While lower yields might initially seem less appealing, they can offer stability in a potentially volatile market. Furthermore, the anticipation of lower rates can influence investment strategies, encouraging shifts toward assets that might benefit from a less aggressive monetary policy. This might include a reassessment of strategies involving corporate bonds or equities.

The Bigger Picture: Navigating Uncertainty:

The Fed's projection is not a guarantee. Economic conditions are dynamic, and unforeseen events could easily alter the course of monetary policy. Geopolitical factors, unexpected inflation spikes, or a sudden downturn in economic growth could all influence the Fed's decision-making process. This inherent uncertainty necessitates a cautious approach for investors and requires careful consideration of risk tolerance and diversification strategies.

Conclusion:

The Fed's projected single rate cut in 2025 represents a subtle yet significant shift in monetary policy. Its impact on U.S. Treasury yields is complex and interconnected with broader economic forces. Staying informed about the evolving economic landscape, monitoring the Fed's communications, and seeking professional financial advice are crucial steps for investors and businesses alike to navigate the uncertainty and make informed decisions. Understanding this dynamic relationship between the Fed's actions and Treasury yields is paramount for success in the current market environment. Remember to consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: How The Fed's Decision Affects U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Biden Up To The Job Vance Responds To Presidents Cancer Diagnosis

May 21, 2025

Is Biden Up To The Job Vance Responds To Presidents Cancer Diagnosis

May 21, 2025 -

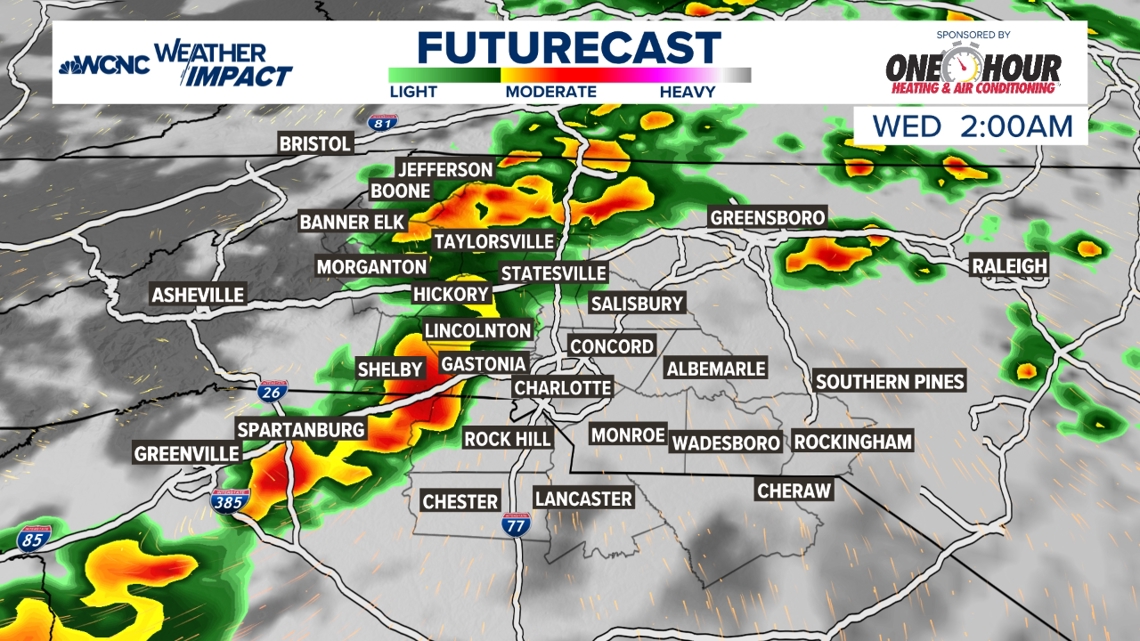

Late Tuesday Night Limited Chance Of Severe Weather

May 21, 2025

Late Tuesday Night Limited Chance Of Severe Weather

May 21, 2025 -

Break In And Defecation At Local Church Two Boys In Custody

May 21, 2025

Break In And Defecation At Local Church Two Boys In Custody

May 21, 2025 -

Ubisoft Milan Seeks Talent For Major Rayman Game

May 21, 2025

Ubisoft Milan Seeks Talent For Major Rayman Game

May 21, 2025 -

Rain And Falling Temperatures Expected Your Week Ahead

May 21, 2025

Rain And Falling Temperatures Expected Your Week Ahead

May 21, 2025