One Rate Cut In 2025: Fed's Projection Impacts US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Projection Impacts US Treasury Yields

The Federal Reserve's (Fed) latest projections, hinting at a single interest rate cut in 2025, have sent ripples through the US Treasury market, impacting yields across the curve. This unexpected shift in the Fed's anticipated trajectory has left investors grappling with the implications for future economic growth and inflation. The announcement, following a period of consistent rate hikes aimed at curbing inflation, marks a significant recalibration of monetary policy expectations.

The Fed's Dot Plot and Market Reaction:

The Fed's "dot plot," a summary of individual policymakers' interest rate projections, revealed a median expectation of one rate cut by the end of 2025. This contrasts with previous forecasts that predicted interest rates remaining elevated for a longer period. The market reacted swiftly, with Treasury yields falling across maturities. Longer-term yields, which are more sensitive to changes in long-term interest rate expectations, experienced a more pronounced decline.

This drop in yields reflects investors' reassessment of the economic outlook. A single rate cut suggests the Fed anticipates a moderation in inflation and a potential slowdown in economic growth, justifying a less aggressive monetary policy stance.

What Does This Mean for Investors?

The revised forecast presents both opportunities and challenges for investors. Lower yields on Treasury bonds might seem less attractive to income-seeking investors in the short term. However, the decreased yields could also be seen as a sign of reduced risk, potentially making Treasuries a safer haven in a more uncertain economic climate.

-

For bond investors: The shift could mean re-evaluating bond portfolios, considering the potential for capital appreciation as bond prices rise with falling yields. However, it's crucial to carefully assess the risk-reward profile, considering the potential for future interest rate hikes if inflation remains stubbornly high.

-

For stock investors: Lower yields can sometimes boost equity markets, as lower borrowing costs can stimulate corporate investment and economic growth. However, the underlying economic conditions need careful consideration, as a rate cut could also signal concerns about economic weakness.

Analyzing the Underlying Factors:

Several factors contributed to the Fed's revised projections. Recent data suggesting a cooling inflation rate, albeit still above the Fed's target, played a significant role. Furthermore, concerns about potential economic slowdowns, both domestically and globally, likely influenced the committee's decision. The resilience of the labor market, while positive for employment, also adds complexity to the situation, as a strong labor market can contribute to upward pressure on wages and inflation.

Looking Ahead:

The market will closely scrutinize upcoming economic data releases for further clues on the future path of interest rates. Inflation figures, employment data, and consumer spending numbers will be particularly important in shaping expectations. While the Fed's projection of one rate cut in 2025 offers a glimpse into the future, uncertainty remains, highlighting the need for investors to adopt a flexible and adaptable investment strategy. The evolving economic landscape necessitates continuous monitoring and proactive adjustments to portfolio allocations.

Call to Action: Consult with a financial advisor to discuss how the Fed's latest projections might impact your individual investment strategy. Understanding your risk tolerance and investment goals is crucial in navigating these changing market conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Projection Impacts US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thousands Of Spanish Holiday Rentals Face Closure Under New Ruling

May 20, 2025

Thousands Of Spanish Holiday Rentals Face Closure Under New Ruling

May 20, 2025 -

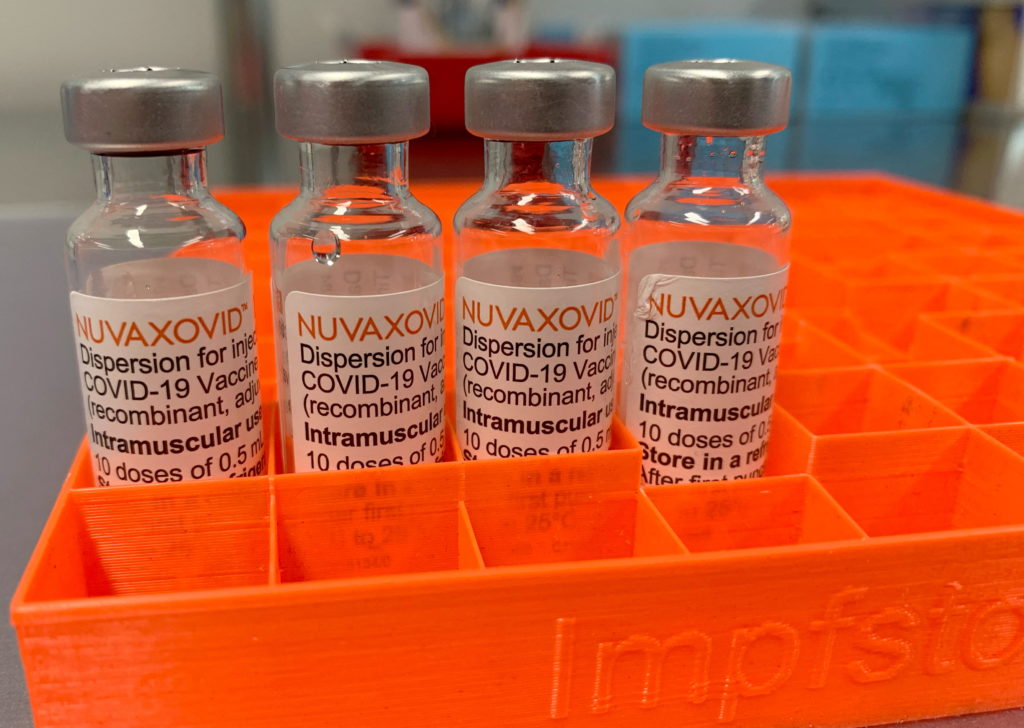

Conditional Fda Approval Understanding The Novavax Covid 19 Vaccines Limitations

May 20, 2025

Conditional Fda Approval Understanding The Novavax Covid 19 Vaccines Limitations

May 20, 2025 -

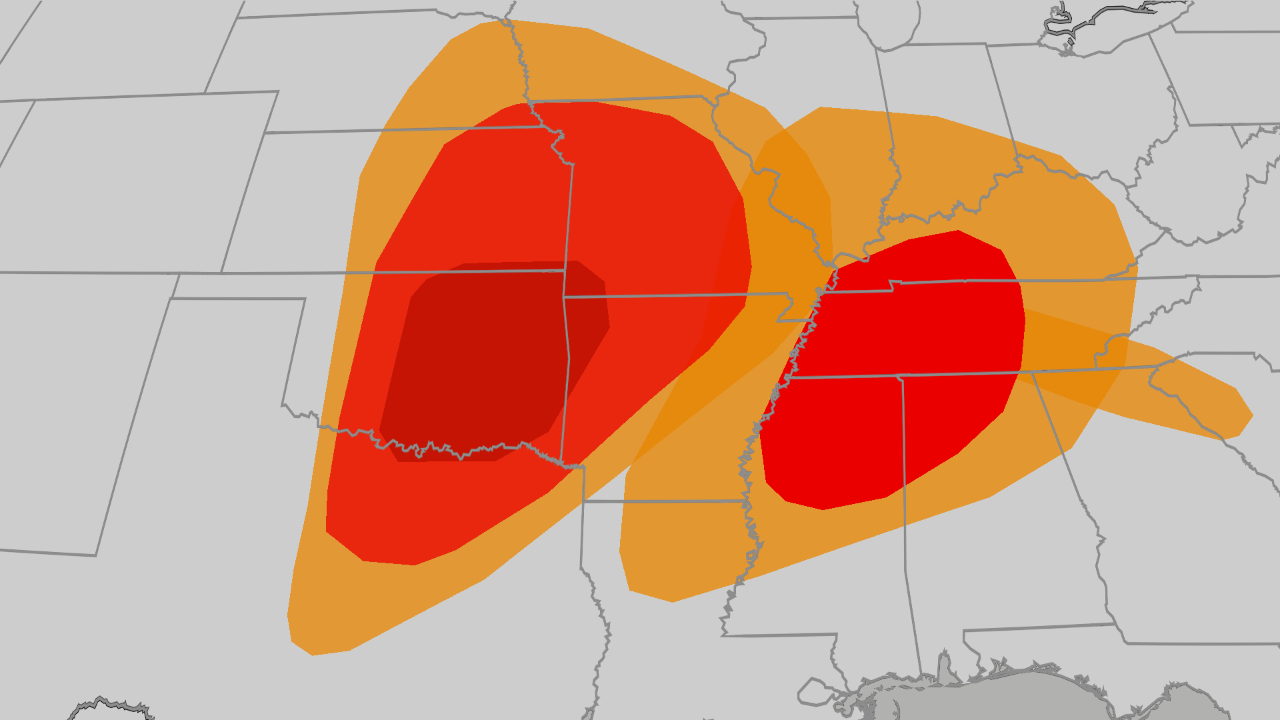

Severe Weather Outbreak Tornado Warnings Issued For Plains Midwest And South

May 20, 2025

Severe Weather Outbreak Tornado Warnings Issued For Plains Midwest And South

May 20, 2025 -

A J Perez Discusses The Fallout Threats Pressure And The Future Of Espns Untold

May 20, 2025

A J Perez Discusses The Fallout Threats Pressure And The Future Of Espns Untold

May 20, 2025 -

Brett Favres Untold Story A J Perez Reveals Threats And Production Challenges

May 20, 2025

Brett Favres Untold Story A J Perez Reveals Threats And Production Challenges

May 20, 2025