One Rate Cut In 2025: Fed's Outlook Impacts US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Outlook Impacts US Treasury Yields

The Federal Reserve's (Fed) latest projections sent ripples through the financial markets, with its forecast of a single interest rate cut in 2025 significantly impacting US Treasury yields. This unexpected shift in the Fed's previously hawkish stance has investors re-evaluating their strategies and prompting questions about the future trajectory of the US economy.

The announcement, made following the Fed's September meeting, marked a subtle but important change in tone. While the central bank maintained its commitment to fighting inflation, the projected rate cut suggests a belief that inflation will cool sufficiently next year to warrant easing monetary policy. This divergence from earlier predictions of holding rates steady throughout 2025 has led to a noticeable decline in Treasury yields across the maturity spectrum.

Understanding the Impact on Treasury Yields

US Treasury yields are inversely correlated with bond prices. When investors expect interest rates to fall, they are less inclined to hold bonds offering relatively higher yields. This increased demand for existing bonds pushes their prices up, consequently lowering their yields. The Fed's forecast effectively communicated this expectation to the market, resulting in the observed yield decline.

This shift has significant implications for various market segments. For example:

- Mortgage Rates: Lower Treasury yields often translate to lower mortgage rates, potentially stimulating the housing market. However, the actual impact depends on several other factors, including lending standards and overall economic conditions.

- Corporate Bonds: Changes in Treasury yields influence the pricing of corporate bonds, as they are often benchmarked against government debt. A decline in Treasury yields might lead to lower borrowing costs for corporations.

- Investment Strategies: Investors are now reassessing their portfolios, considering the implications of lower yields on their investment returns. This could lead to shifts in asset allocation strategies, with some investors potentially moving towards riskier assets in search of higher yields.

The Fed's Reasoning and Uncertainties

The Fed's rationale for the projected rate cut hinges on its assessment of the inflation outlook. While inflation remains above its target, the central bank anticipates a gradual decline in the coming months and years. However, this prediction is not without its uncertainties. Geopolitical risks, unforeseen supply chain disruptions, and unexpected shifts in consumer spending could all impact the inflation trajectory.

Furthermore, the projected single rate cut leaves room for interpretation. Some analysts believe this signals a cautious approach by the Fed, acknowledging the possibility of needing further rate adjustments depending on economic data. Others view it as a sign of growing confidence in the Fed's ability to tame inflation without triggering a significant economic downturn.

What Lies Ahead for Treasury Yields?

Predicting future movements in Treasury yields remains challenging, even with the Fed's updated forecast. The market will continue to closely monitor key economic indicators, such as inflation data, employment figures, and consumer spending, to gauge the effectiveness of the Fed's monetary policy. Any significant deviation from the Fed's projected path could lead to further volatility in Treasury yields. Investors should remain vigilant and adjust their strategies accordingly.

Learn more: Stay updated on the latest economic news and analyses from reputable sources like the and . Understanding these complexities is crucial for navigating the ever-changing financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Outlook Impacts US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solo Levelings Award Winning Success A Look At Its Growing Recognition

May 21, 2025

Solo Levelings Award Winning Success A Look At Its Growing Recognition

May 21, 2025 -

160 Japanese Firms Compete In Nature Conservation For Enhanced Corporate Value Industry Best Practices Unveiled

May 21, 2025

160 Japanese Firms Compete In Nature Conservation For Enhanced Corporate Value Industry Best Practices Unveiled

May 21, 2025 -

Breaking Trump Claims Russia Ukraine Truce Talks Will Begin Immediately

May 21, 2025

Breaking Trump Claims Russia Ukraine Truce Talks Will Begin Immediately

May 21, 2025 -

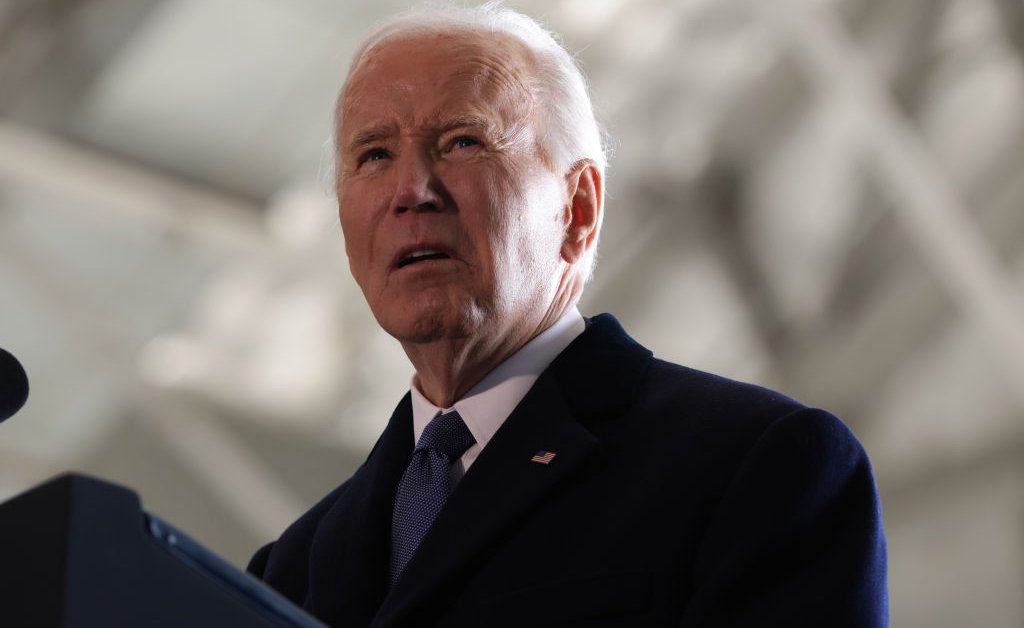

Health Concerns For Biden J D Vance Challenges Presidents Fitness For Duty

May 21, 2025

Health Concerns For Biden J D Vance Challenges Presidents Fitness For Duty

May 21, 2025 -

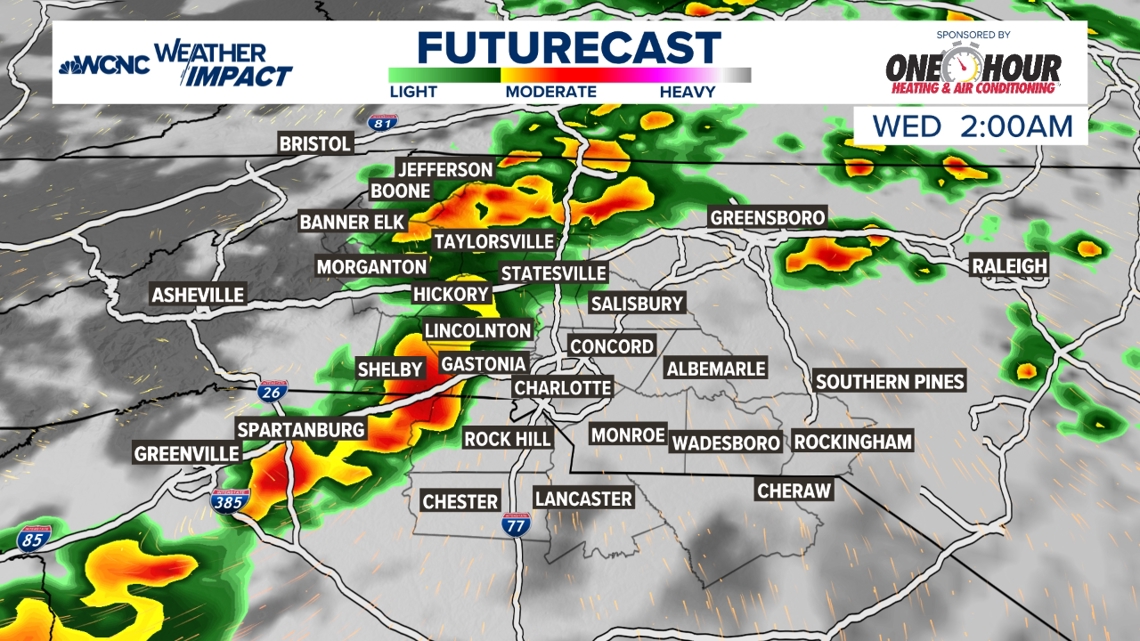

Few Strong Storms Expected Late Tuesday Very Isolated Risk

May 21, 2025

Few Strong Storms Expected Late Tuesday Very Isolated Risk

May 21, 2025