One Rate Cut In 2025: Fed's Guidance Impacts US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Guidance Impacts US Treasury Yields

The Federal Reserve's (Fed) latest projections sent ripples through the financial markets, with the central bank signaling a potential single interest rate cut in 2025. This cautious outlook, a departure from previous more hawkish stances, has significantly impacted US Treasury yields. Understanding this shift is crucial for investors navigating the current economic landscape.

The Fed's Dot Plot and Market Reaction:

The Fed's "dot plot," a chart showing individual policymakers' interest rate expectations, revealed a median forecast of one rate cut in 2025. This contrasts with earlier predictions of holding rates steady throughout the year. This subtle change, however, triggered a noticeable decline in US Treasury yields. Longer-term yields, particularly those on 10-year and 30-year Treasuries, experienced a more pronounced drop, reflecting the market's reassessment of future inflation and economic growth.

Why the Shift? A Balancing Act:

The Fed's revised outlook reflects a delicate balancing act. While inflation remains above the target rate of 2%, recent economic data suggests a potential slowdown. Factors contributing to this include softening consumer spending, a cooling housing market, and persistent supply chain issues. The Fed appears to be betting on a "soft landing," successfully reducing inflation without triggering a recession. However, this strategy hinges on several unpredictable economic variables.

Impact on US Treasury Yields:

The expectation of lower interest rates in 2025 has directly impacted Treasury yields. Yields and prices move inversely; lower yields signify higher prices for existing bonds. This is because investors are willing to pay more for bonds offering a lower return in anticipation of future rate cuts.

- Short-term yields: Remained relatively stable, reflecting the Fed's continued commitment to maintaining higher rates in the near term to combat inflation.

- Long-term yields: Experienced a more significant drop, reflecting investor confidence in the Fed's ability to manage inflation and eventually lower rates. This drop is particularly significant for long-term investors and pension funds relying on fixed-income investments.

What Does This Mean for Investors?

The Fed's guidance provides valuable information for investors, although it doesn't offer a crystal ball. The single rate cut projection indicates a potential shift towards a more accommodative monetary policy, but the timing and magnitude of any future rate changes remain uncertain. Investors should carefully consider their risk tolerance and investment horizon when making decisions.

Diversification and Risk Management:

Given the inherent uncertainties, diversification remains crucial. Investors might consider diversifying their portfolios across various asset classes, including stocks, bonds, and real estate, to mitigate risk and potentially capitalize on opportunities across different market sectors.

Looking Ahead:

The Fed's projection is just one piece of the puzzle. Future economic data releases, particularly inflation reports and employment figures, will play a critical role in shaping future monetary policy decisions. Keeping a close eye on these indicators is crucial for staying informed and making sound investment decisions.

Keywords: US Treasury Yields, Federal Reserve, Fed Rate Cut, Interest Rates, Bond Yields, 2025 Interest Rate Projections, Economic Outlook, Inflation, Monetary Policy, Investment Strategy, Risk Management, Diversification.

Call to Action: Stay updated on the latest economic news and consult with a financial advisor to develop a personalized investment strategy tailored to your individual needs and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Guidance Impacts US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Confirmed New Peaky Blinders Series Coming But With A Twist

May 20, 2025

Confirmed New Peaky Blinders Series Coming But With A Twist

May 20, 2025 -

Spains New Tourism Law 65 000 Illegal Holiday Rentals Affected

May 20, 2025

Spains New Tourism Law 65 000 Illegal Holiday Rentals Affected

May 20, 2025 -

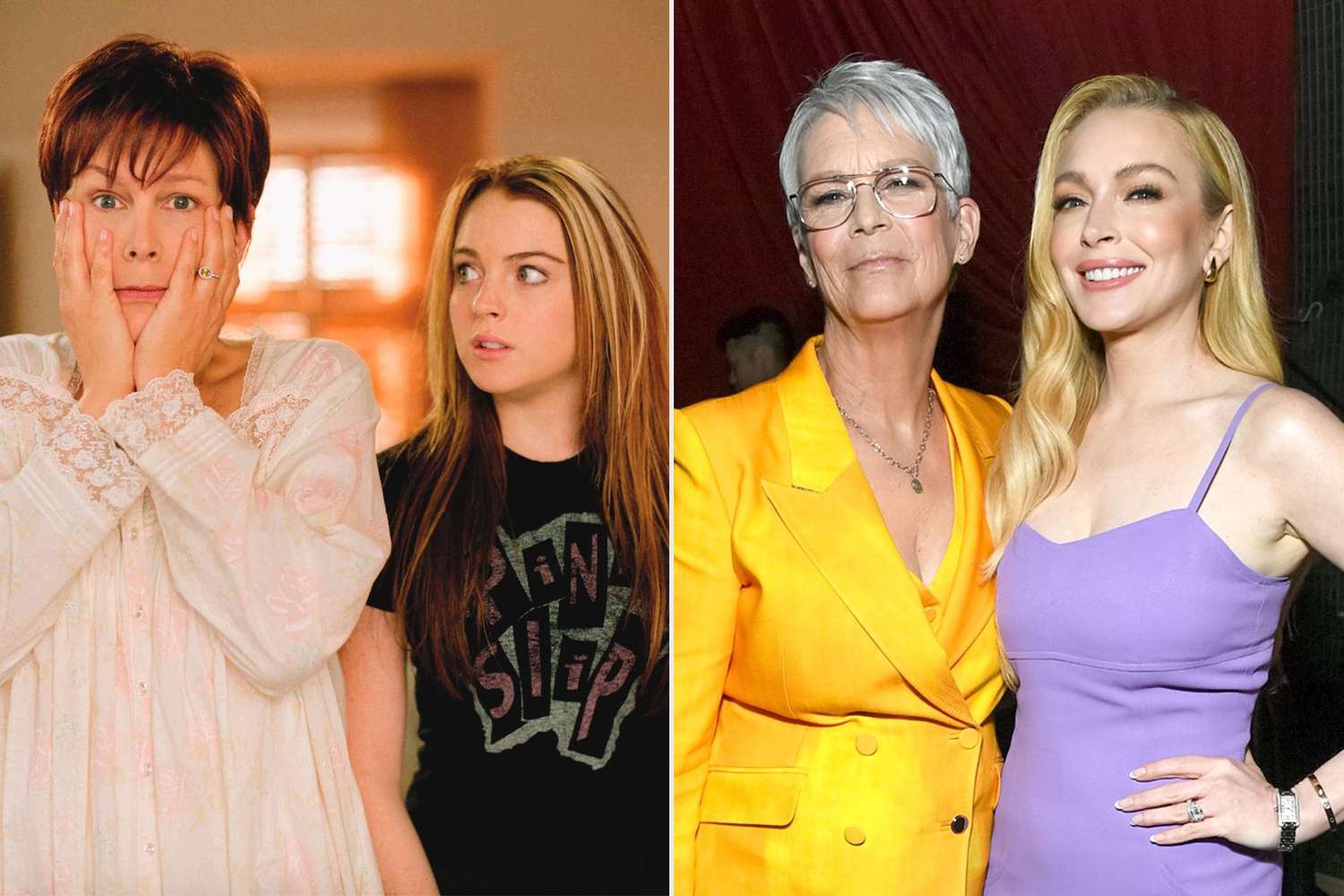

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Exclusive

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Exclusive

May 20, 2025 -

Lindsay Lohan And Jamie Lee Curtis Honest Friendship A Look Back

May 20, 2025

Lindsay Lohan And Jamie Lee Curtis Honest Friendship A Look Back

May 20, 2025 -

Record Bitcoin Etf Investment A Deeper Dive Into The Current Market Trend

May 20, 2025

Record Bitcoin Etf Investment A Deeper Dive Into The Current Market Trend

May 20, 2025