One Rate Cut In 2025: Fed's Guidance Impacts U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Guidance Impacts U.S. Treasury Yields

The Federal Reserve's (Fed) latest projections, hinting at a single interest rate cut in 2025, sent ripples through the U.S. Treasury market, impacting yields across the curve. This seemingly subtle shift in guidance carries significant implications for investors and the broader economy. Understanding the nuances of this decision and its market consequences is crucial for navigating the current financial landscape.

The Fed's Dot Plot and Market Reaction:

The Fed's "dot plot," a chart showing individual policymakers' interest rate projections, revealed a consensus leaning towards one rate cut in 2025. This follows a period of aggressive interest rate hikes aimed at curbing persistent inflation. The market's reaction was swift, with U.S. Treasury yields experiencing a noticeable decline. This suggests that investors are interpreting the Fed's projection as a signal of easing monetary policy in the future, leading to decreased demand for higher-yielding bonds.

Why the Single Rate Cut Projection Matters:

The single rate cut projection communicates several key messages:

- Inflation is Expected to Moderate: The Fed believes inflation, while still above its target, is likely to cool down sufficiently to allow for a rate reduction next year. This is a significant departure from previous projections that anticipated a more prolonged period of high rates.

- Economic Growth Remains a Concern: While fighting inflation is paramount, the Fed is also mindful of the risks of overly aggressive tightening that could trigger a recession. A single rate cut suggests a cautious approach, aiming to balance inflation control with economic stability.

- Uncertainty Remains: The projection itself carries a degree of uncertainty. Economic data is constantly evolving, and unforeseen events could easily alter the Fed's outlook. This inherent uncertainty makes it difficult to predict the precise timing and magnitude of future rate changes.

Impact on U.S. Treasury Yields:

The expectation of a future rate cut has directly influenced U.S. Treasury yields. Lower yields indicate increased investor demand for these relatively safe assets. This is driven by the anticipation of lower interest rates in the future, making existing bonds more attractive. The impact is felt across the yield curve, with shorter-term yields generally showing a more pronounced response.

What This Means for Investors:

The Fed's guidance presents a mixed bag for investors:

- Bond Investors: The lower yields might seem less appealing on the surface, but they offer a degree of stability and security, particularly in an uncertain economic climate. Long-term bond investors may want to reassess their strategies based on this shift in expectations.

- Stock Investors: Lower interest rates can boost stock valuations as borrowing becomes cheaper for companies and investors are encouraged to invest in riskier assets. However, the overall economic outlook remains crucial.

- Real Estate Investors: The impact on real estate is less direct but still significant. Lower rates can potentially stimulate the housing market, though other economic factors play a larger role.

Looking Ahead:

The Fed's projection is just one piece of the puzzle. Economic data releases, geopolitical events, and unforeseen circumstances will continue to shape the trajectory of interest rates and treasury yields. Investors should closely monitor key economic indicators like inflation, employment data, and GDP growth to gain a better understanding of the future monetary policy landscape.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: Federal Reserve, Fed, interest rates, rate cut, U.S. Treasury yields, bond yields, inflation, economic growth, monetary policy, dot plot, investment strategy, financial markets, economic outlook.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Guidance Impacts U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I M Done Jon Jones Cryptic Tweet Fuels Ufc Retirement Speculation

May 20, 2025

I M Done Jon Jones Cryptic Tweet Fuels Ufc Retirement Speculation

May 20, 2025 -

Walmart To Raise Prices Amid Trumps Tariff Standoff

May 20, 2025

Walmart To Raise Prices Amid Trumps Tariff Standoff

May 20, 2025 -

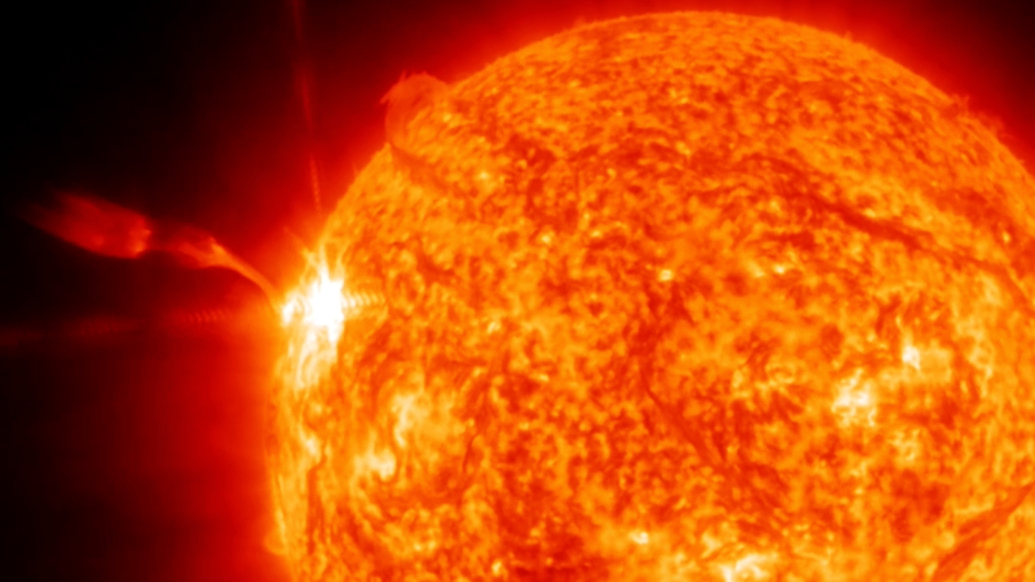

Geomagnetic Storm Major Solar Flare Impacts Radio Communications Globally

May 20, 2025

Geomagnetic Storm Major Solar Flare Impacts Radio Communications Globally

May 20, 2025 -

Analyzing The Changes Joel And Ellies Relationship In The Last Of Us Season 2 A Comparative Look

May 20, 2025

Analyzing The Changes Joel And Ellies Relationship In The Last Of Us Season 2 A Comparative Look

May 20, 2025 -

Peaky Blinders Future Creator Reveals New Series And A Pivotal Twist

May 20, 2025

Peaky Blinders Future Creator Reveals New Series And A Pivotal Twist

May 20, 2025