One Rate Cut In 2025? Fed's Guidance Impacts Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025? Fed's Guidance Impacts Treasury Yields

The Federal Reserve's (Fed) latest pronouncements on interest rates have sent ripples through the financial markets, impacting Treasury yields and leaving investors grappling with the implications. While the central bank maintained its commitment to combating inflation, its subtle shift in forward guidance – hinting at a potential single rate cut in 2025 – has sparked considerable debate and uncertainty. This article delves into the details of the Fed's announcement, its impact on Treasury yields, and what it means for investors.

The Fed's Dot Plot: A Single Rate Cut Emerges

The Fed's widely watched "dot plot," a chart showing individual policymakers' projections for future interest rates, revealed a significant change. While the majority still anticipate rates remaining steady through the end of 2024, a notable shift emerged for 2025. Several policymakers now foresee a single rate cut next year, a stark contrast to previous projections that suggested rates would remain elevated for a longer period. This subtle alteration, however, carries significant weight in the financial world.

Impact on Treasury Yields: A Cautious Response

The projection of a single rate cut in 2025 has already begun to impact Treasury yields. Yields, which move inversely to prices, have experienced a moderate decline following the announcement. Investors, anticipating potentially lower rates in the future, are adjusting their portfolios accordingly. This shift suggests a growing belief amongst market participants that the Fed's aggressive rate-hiking cycle might finally be nearing its end. However, this is not a unanimous view.

Uncertainty Remains: Inflation and Economic Outlook

Despite the hinted rate cut, significant uncertainty persists. The Fed's primary focus remains on taming inflation, and future policy decisions will heavily depend on incoming economic data. Factors like core inflation, employment figures, and consumer spending will play a critical role in determining the Fed's next steps. A resurgence in inflation could easily derail expectations of a rate cut, prompting the Fed to maintain a more hawkish stance.

Navigating the Shifting Landscape: Advice for Investors

The evolving interest rate environment presents both challenges and opportunities for investors. The potential for a rate cut in 2025 introduces a degree of uncertainty that requires careful consideration.

- Diversification: A well-diversified portfolio is crucial to mitigate risks associated with shifting interest rates.

- Risk Tolerance: Investors should assess their risk tolerance and adjust their investment strategies accordingly. A more conservative approach might be warranted in this period of uncertainty.

- Professional Advice: Seeking guidance from a financial advisor can provide personalized insights and help navigate the complexities of the current market.

Conclusion: A Cautiously Optimistic Outlook

The Fed's recent guidance, hinting at a potential rate cut in 2025, has injected a degree of cautious optimism into the markets. While Treasury yields have responded accordingly, considerable uncertainty remains. Inflationary pressures and economic growth will be key determinants of future policy decisions. Investors should carefully monitor economic indicators and consider seeking professional financial advice to navigate this dynamic environment. The coming months will be crucial in determining whether the Fed's projection of a single rate cut materializes or if further adjustments are necessary. Stay tuned for further updates and analysis as the situation unfolds. [Link to related article on inflation] [Link to resource on managing investment risk].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025? Fed's Guidance Impacts Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Brett Favre Sexting Scandal Jenn Stergers Account Of Disrespect And Neglect

May 21, 2025

The Brett Favre Sexting Scandal Jenn Stergers Account Of Disrespect And Neglect

May 21, 2025 -

Novavax Covid 19 Vaccine Fda Approval And Its Specific Usage Guidelines

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval And Its Specific Usage Guidelines

May 21, 2025 -

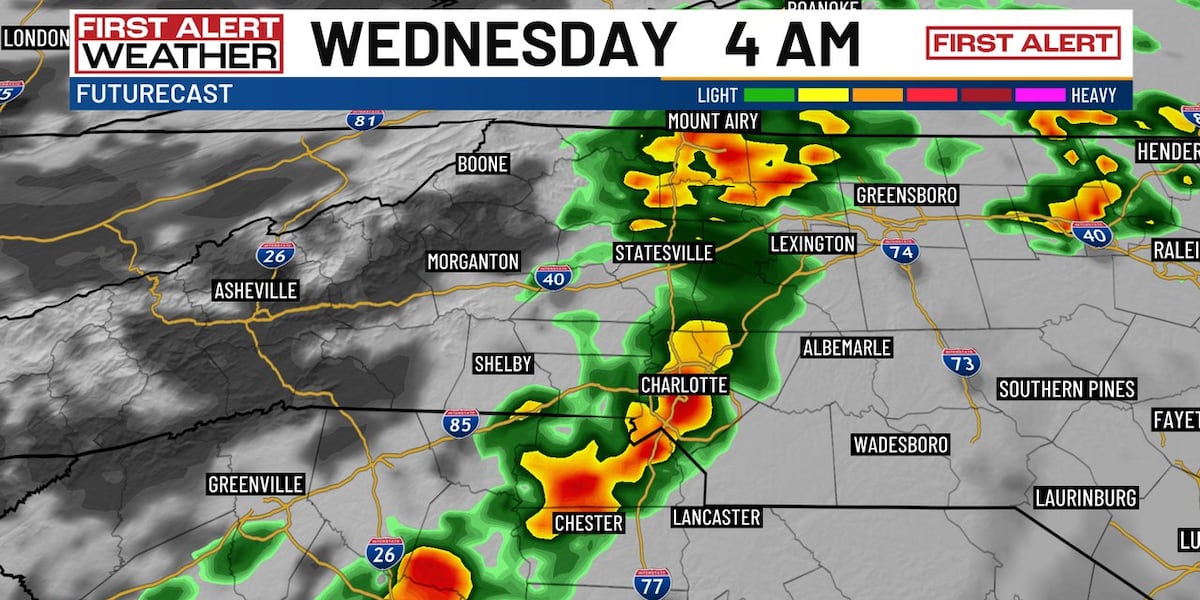

Temperature Drop And Increased Rain Probability This Weeks Weather Outlook

May 21, 2025

Temperature Drop And Increased Rain Probability This Weeks Weather Outlook

May 21, 2025 -

Revealed The Truth Behind Jamie Lee Curtis And Lindsay Lohans Relationship

May 21, 2025

Revealed The Truth Behind Jamie Lee Curtis And Lindsay Lohans Relationship

May 21, 2025 -

Severe Weather Alert Overnight Storms Predicted For Charlotte

May 21, 2025

Severe Weather Alert Overnight Storms Predicted For Charlotte

May 21, 2025