One Rate Cut In 2025: Fed's Decision Impacts U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Decision Impacts U.S. Treasury Yields

The Federal Reserve's (Fed) projection of a single interest rate cut in 2025 sent ripples through the financial markets, significantly impacting U.S. Treasury yields. This decision, announced [insert date of announcement] at the conclusion of the Federal Open Market Committee (FOMC) meeting, marks a shift in the central bank's stance on inflation and economic growth, leaving investors and economists debating the implications.

The Fed's Rationale: A Balancing Act

The Fed's dot plot, a chart showing individual policymakers' interest rate projections, revealed a consensus favoring one rate cut in 2025. This follows a series of aggressive rate hikes throughout 2022 and 2023 aimed at curbing stubbornly high inflation. The rationale behind the projected cut hinges on a delicate balancing act: maintaining price stability while avoiding a recession. The Fed anticipates a gradual slowdown in economic activity, with inflation gradually easing towards its 2% target. However, the path to that target remains uncertain, and the single rate cut projection suggests a cautious approach.

Impact on U.S. Treasury Yields:

The announcement immediately influenced U.S. Treasury yields. Yields on 2-year and 10-year Treasury notes, key indicators of borrowing costs, decreased following the news. This reflects investor expectations of a less aggressive monetary policy stance in the future. Lower yields generally indicate increased demand for these safe-haven assets, as investors anticipate lower future interest rates. This trend is particularly noticeable in longer-term Treasury yields, suggesting that investors believe the projected rate cut will significantly impact future borrowing costs.

Understanding the Implications:

-

Economic Growth: The single rate cut projection suggests the Fed anticipates a moderate economic slowdown, but not a sharp recession. This is a crucial point for businesses and investors planning for the future. A slow and controlled cooling of the economy is preferred to a rapid and uncontrolled contraction.

-

Inflation Outlook: While the Fed expects inflation to decline, the single rate cut reflects a cautious approach. The central bank is clearly monitoring inflation closely and may adjust its policy if inflation proves more persistent than anticipated. This highlights the ongoing uncertainty surrounding inflation and its impact on the broader economy.

-

Market Volatility: The Fed's projection, while seemingly specific, doesn't eliminate market uncertainty. Unforeseen economic events, changes in inflation data, or geopolitical factors could easily alter the Fed's outlook and potentially lead to further market volatility. Investors should prepare for potential adjustments in the coming months.

What's Next? Keeping an Eye on Key Indicators:

The coming months will be crucial in observing the actual trajectory of inflation and economic growth. Key economic indicators like the Consumer Price Index (CPI), Producer Price Index (PPI), and employment data will be closely scrutinized to assess the effectiveness of the Fed's current monetary policy. These data points will provide valuable insights into whether the projected single rate cut in 2025 remains a realistic expectation.

Further Reading:

- [Link to Federal Reserve Website] - For official statements and data releases from the Fed.

- [Link to a reputable financial news source] - For in-depth analysis of the Fed's decision and its market implications.

Conclusion:

The Fed's decision to project only one rate cut in 2025 demonstrates a careful balancing act between curbing inflation and fostering economic growth. While the impact on U.S. Treasury yields is immediate, the long-term consequences will depend on how inflation and the economy evolve in the coming year. Investors and businesses should remain vigilant and closely monitor economic indicators to navigate the evolving landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Decision Impacts U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Juvenile Delinquency Two Boys Charged With Church Break In And Defecation

May 21, 2025

Juvenile Delinquency Two Boys Charged With Church Break In And Defecation

May 21, 2025 -

Concerns Over Price Of New Skin After Riot Unveils 2025 League Of Legends Hall Of Famer

May 21, 2025

Concerns Over Price Of New Skin After Riot Unveils 2025 League Of Legends Hall Of Famer

May 21, 2025 -

Major Rayman Project Ubisoft Milan Is Hiring

May 21, 2025

Major Rayman Project Ubisoft Milan Is Hiring

May 21, 2025 -

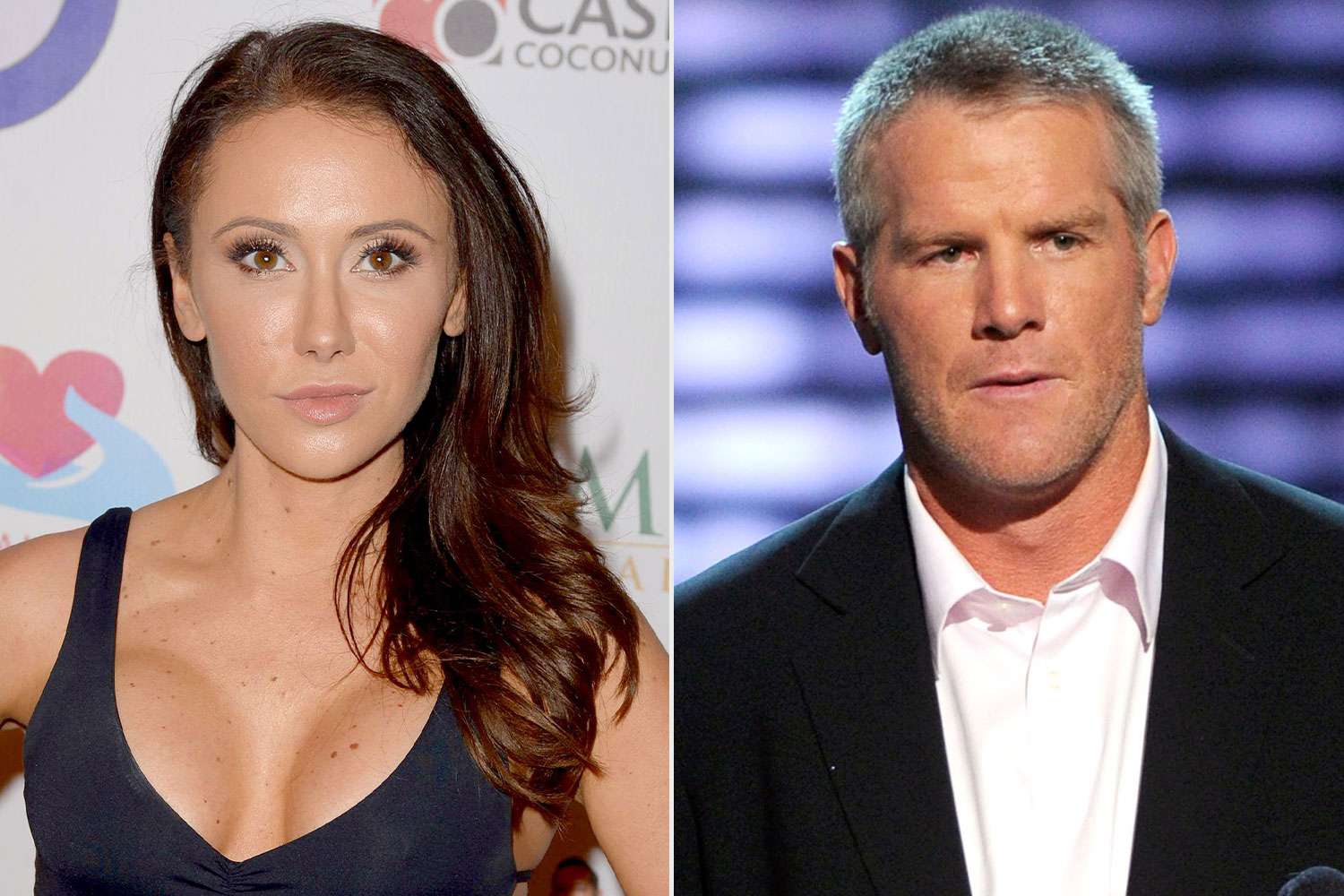

The Lasting Trauma Jenn Sterger Details Brett Favre Scandal Aftermath

May 21, 2025

The Lasting Trauma Jenn Sterger Details Brett Favre Scandal Aftermath

May 21, 2025 -

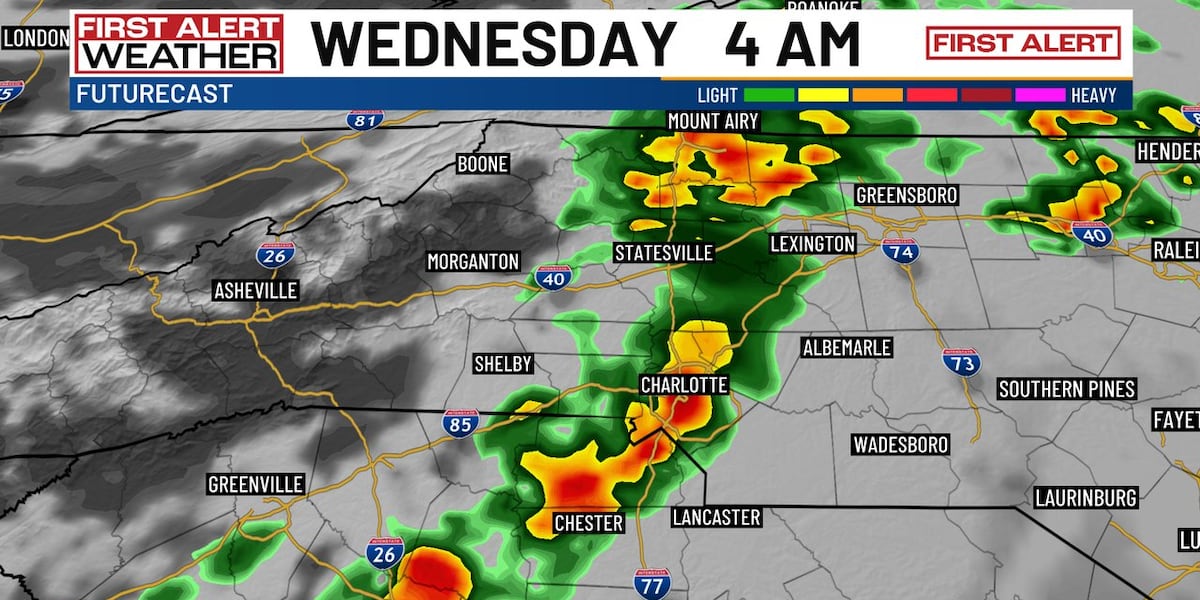

Charlotte Storm Warning Heavy Rainfall And Potential Flooding Expected Overnight

May 21, 2025

Charlotte Storm Warning Heavy Rainfall And Potential Flooding Expected Overnight

May 21, 2025