One 2025 Rate Cut: Fed's Signal Impacts U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One 2025 Rate Cut: Fed's Signal Impacts U.S. Treasury Yields

The Federal Reserve's recent projections hinting at a single interest rate cut in 2025 sent ripples through the financial markets, significantly impacting U.S. Treasury yields. This seemingly subtle shift in the Fed's forward guidance has sparked considerable debate among economists and investors alike, raising questions about the future trajectory of inflation and economic growth.

The dot plot, a key tool used by the Fed to communicate its interest rate expectations, revealed a median forecast of one rate cut by the end of 2025. This marked a divergence from previous projections and immediately influenced investor sentiment. The implication is clear: the Fed anticipates a slower-than-expected economic slowdown, necessitating only a minor adjustment to monetary policy next year.

How did this impact Treasury yields?

U.S. Treasury yields, which move inversely to bond prices, reacted almost instantaneously to the Fed's signal. The expectation of lower interest rates in the future led to a decline in yields across the maturity spectrum. This is because investors, anticipating lower future returns from new bonds, are willing to accept lower yields on existing bonds.

- Short-term yields: These experienced a more pronounced decrease, reflecting the immediate market response to the anticipated rate cut.

- Long-term yields: While also declining, the impact was less dramatic, suggesting some uncertainty remains regarding the longer-term economic outlook.

This shift in yields has significant implications for various sectors of the economy:

- Mortgage rates: Lower Treasury yields often translate to lower mortgage rates, potentially boosting the housing market. However, the impact will depend on other factors, including the overall availability of credit.

- Corporate borrowing costs: Companies may find it cheaper to borrow money, stimulating investment and economic activity. This could, in turn, influence job growth and overall economic performance.

- Savings accounts and CD rates: Conversely, savers might see lower returns on their savings accounts and Certificates of Deposit (CDs) as interest rates decline.

Analyzing the Fed's Decision:

The Fed's decision to signal only one rate cut in 2025 is a complex one, reflecting a delicate balancing act between combating inflation and supporting economic growth. While inflation has cooled significantly from its peak, it remains above the Fed's target. The central bank likely believes that a single rate cut will suffice to navigate the anticipated economic slowdown without reigniting inflationary pressures.

However, several factors could influence the Fed's future decisions:

- Inflation data: Future inflation reports will be crucial in guiding the Fed's policy decisions. A resurgence of inflation could prompt a reassessment of the projected rate cuts.

- Economic growth: The pace of economic growth will also play a significant role. A sharper-than-expected slowdown could necessitate further interest rate reductions.

- Global economic conditions: Global economic instability could impact the Fed's decision-making process, potentially influencing its approach to monetary policy.

Looking Ahead:

The market's response to the Fed's signal underscores the sensitivity of financial markets to central bank communications. While the projection of one rate cut in 2025 offers a degree of clarity, significant uncertainty remains. Investors and economists will closely monitor economic data and Fed communications in the coming months to gain a clearer picture of the future trajectory of interest rates and their impact on the U.S. economy. Staying informed about economic news and analysis from reputable sources like the is crucial for navigating this evolving landscape.

Call to Action: Stay informed on economic developments to make informed financial decisions. Consider consulting a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One 2025 Rate Cut: Fed's Signal Impacts U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

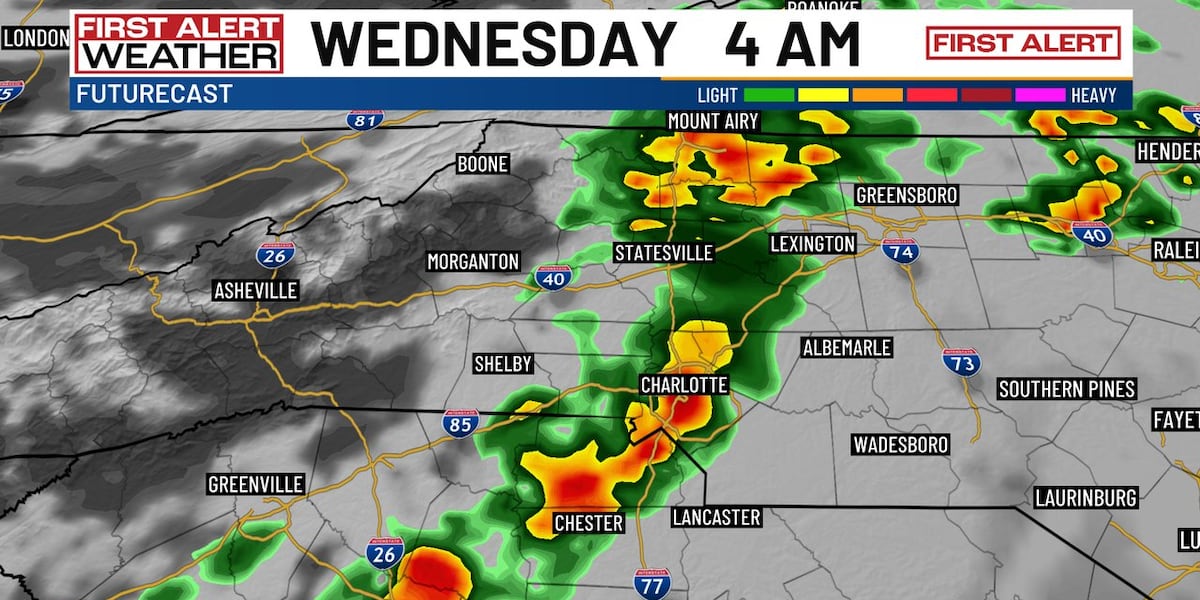

Severe Storms Predicted For Charlotte Tonight Prepare For Temperature Drop

May 21, 2025

Severe Storms Predicted For Charlotte Tonight Prepare For Temperature Drop

May 21, 2025 -

Putin Signals Unwavering Strength Minimizing Trumps Influence

May 21, 2025

Putin Signals Unwavering Strength Minimizing Trumps Influence

May 21, 2025 -

Ubisoft Milan Expands Team New Rayman Game Project Announced

May 21, 2025

Ubisoft Milan Expands Team New Rayman Game Project Announced

May 21, 2025 -

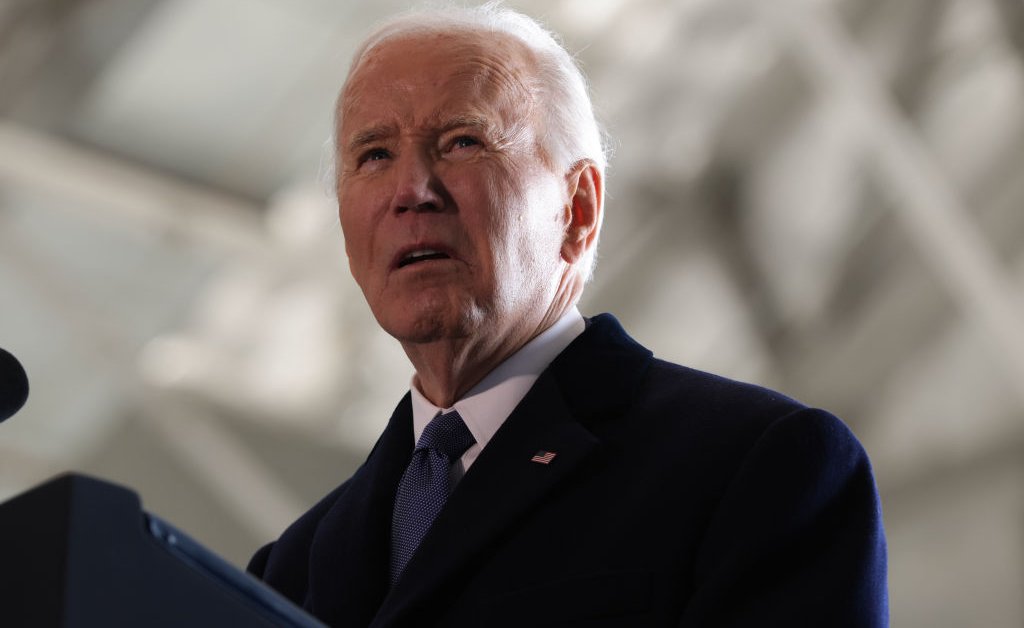

Health Concerns Emerge Vance Challenges Bidens Ability To Lead

May 21, 2025

Health Concerns Emerge Vance Challenges Bidens Ability To Lead

May 21, 2025 -

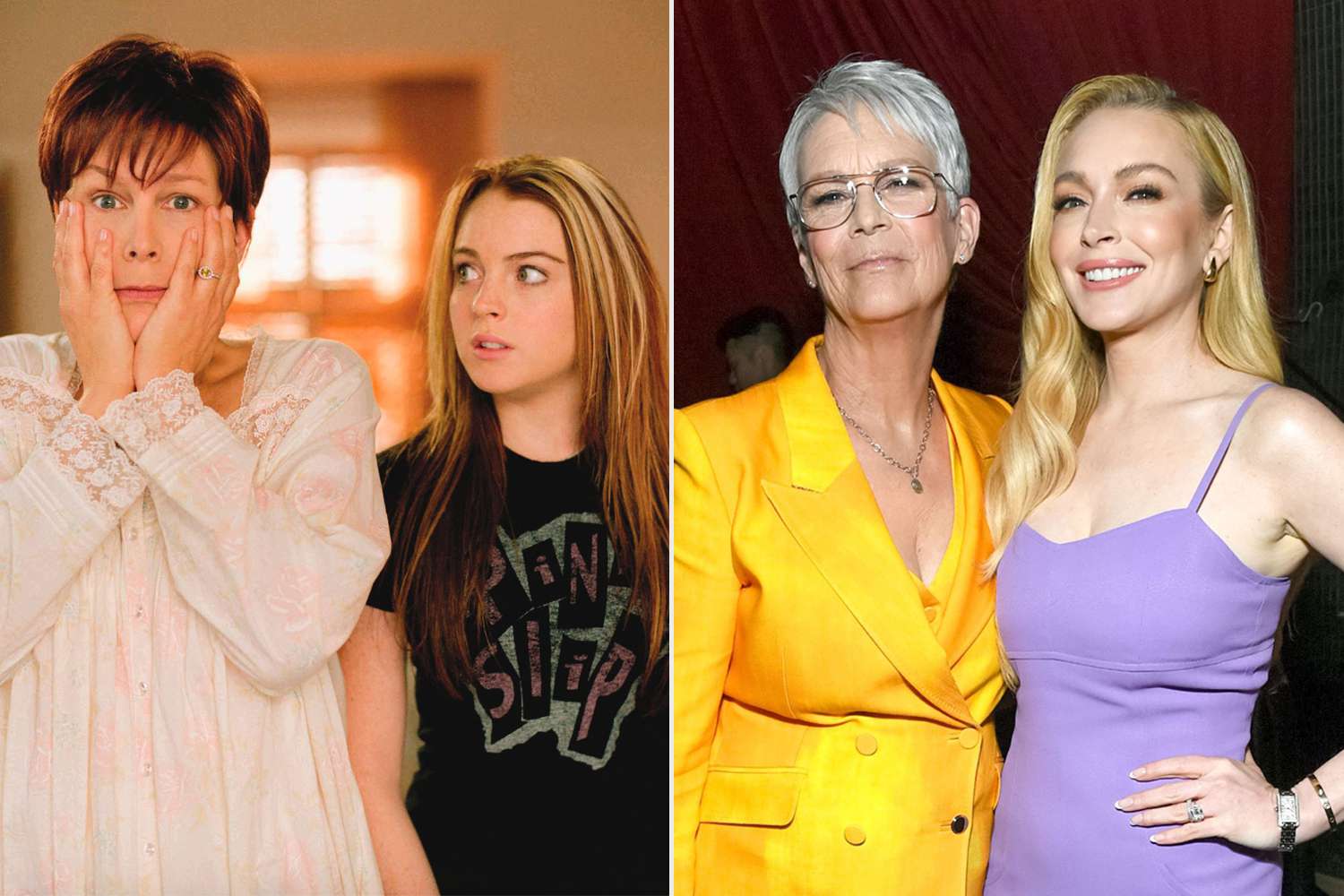

Freaky Friday Reunion Jamie Lee Curtis Reveals Update On Her Friendship With Lindsay Lohan

May 21, 2025

Freaky Friday Reunion Jamie Lee Curtis Reveals Update On Her Friendship With Lindsay Lohan

May 21, 2025