OKLO Stock Analysis: Evaluating The SMR NNE Breakout Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

OKLO Stock Analysis: Evaluating the SMR NNE Breakout Potential

OKLO Inc. (OKLO), a leading player in the advanced nuclear reactor technology space, has recently experienced significant market fluctuations. This analysis delves into OKLO's stock performance, focusing specifically on its potential for a breakout driven by its innovative Small Modular Reactor (SMR) technology, and its progress in the Nuclear Next Generation (NNGE) market. Understanding the company's strategy and the broader nuclear energy landscape is crucial for investors considering adding OKLO to their portfolios.

Understanding OKLO's Business Model and Technology

OKLO is pioneering the development and deployment of advanced, small modular reactors (SMRs). Unlike traditional large-scale nuclear power plants, SMRs are designed to be significantly smaller, more modular, and potentially safer. This approach offers several key advantages:

- Reduced upfront capital costs: The modular design allows for phased construction and deployment, lowering the initial financial burden.

- Enhanced safety features: OKLO's SMRs incorporate advanced safety technologies designed to mitigate risks and improve operational reliability.

- Increased flexibility and deployability: Their compact size allows for deployment in a wider range of locations, including remote areas with limited grid access.

- Focus on NNGE: OKLO's technology positions it squarely within the burgeoning Nuclear Next Generation (NNGE) energy sector, presenting significant long-term growth opportunities.

Recent Market Performance and Key Catalysts for Growth

OKLO's stock price has shown volatility, reflecting the inherent risks and uncertainties associated with investing in a relatively young company in the energy sector. However, several factors suggest potential for significant upside:

- Technological advancements: OKLO continues to make progress in its reactor design and testing, steadily de-risking its technology and increasing investor confidence. Successful demonstration projects will be key catalysts for future growth.

- Government support: Growing government interest in advanced nuclear technologies, driven by climate change concerns and energy security needs, creates a favorable regulatory environment for OKLO and its competitors. [Link to relevant government initiatives].

- Market demand for clean energy: The global push for decarbonization is creating strong demand for clean energy solutions, making advanced nuclear a potentially attractive alternative to fossil fuels.

- Strategic partnerships: Forming collaborations with industry leaders can help accelerate OKLO's development and market penetration. Closely monitoring any announced partnerships is crucial for assessing future potential.

Risks and Challenges Facing OKLO

While the potential for growth is significant, investors should also be aware of the risks:

- Regulatory hurdles: Navigating the complex regulatory landscape for nuclear technology can be time-consuming and costly.

- Competition: The advanced nuclear reactor market is becoming increasingly competitive, with several established and emerging players vying for market share.

- Financing challenges: Securing adequate funding for research, development, and deployment is a crucial challenge for OKLO.

- Public perception: Negative public perception of nuclear energy remains a significant hurdle, requiring effective communication and transparency.

Evaluating Breakout Potential: A Cautious Optimism

While OKLO's SMR technology offers considerable promise, predicting a definitive breakout is challenging. The company's success hinges on several factors, including successful regulatory approvals, securing sufficient funding, and overcoming public perception challenges. However, the long-term prospects for advanced nuclear energy, particularly within the NNGE sector, are generally positive.

Investors should conduct thorough due diligence, including reviewing OKLO's financial statements, understanding the risks involved, and staying abreast of industry developments, before making any investment decisions. The company's progress in demonstrating its technology's safety and efficiency will be crucial in determining its future market position.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market carries inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on OKLO Stock Analysis: Evaluating The SMR NNE Breakout Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

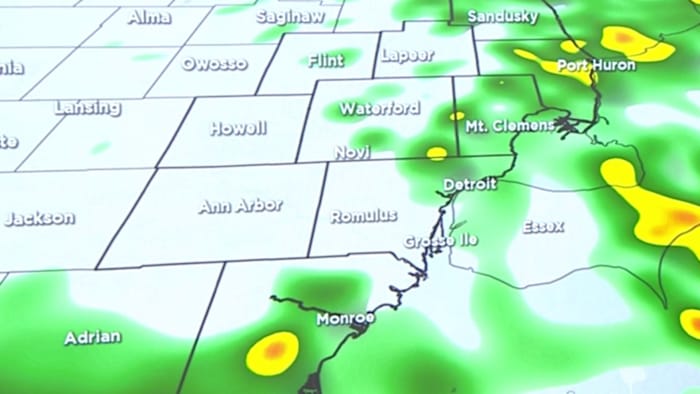

This Weeks Weather In Metro Detroit Prepare For Scattered Showers

May 28, 2025

This Weeks Weather In Metro Detroit Prepare For Scattered Showers

May 28, 2025 -

Food Distribution In Gaza Overwhelmed By Thousands Facing Severe Hunger

May 28, 2025

Food Distribution In Gaza Overwhelmed By Thousands Facing Severe Hunger

May 28, 2025 -

Fritz Laments Horrendous Tennis In Costly Roland Garros Loss

May 28, 2025

Fritz Laments Horrendous Tennis In Costly Roland Garros Loss

May 28, 2025 -

Medjedovics Roland Garros Journey Continues Second Round Berth Secured

May 28, 2025

Medjedovics Roland Garros Journey Continues Second Round Berth Secured

May 28, 2025 -

Second Round Berth For Medjedovic At Roland Garros

May 28, 2025

Second Round Berth For Medjedovic At Roland Garros

May 28, 2025