Oklo Stock Analysis: A Guide For Potential Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oklo Stock Analysis: A Guide for Potential Investors

Oklo (OKLO) is a relatively new player in the burgeoning nuclear energy sector, making it a high-risk, high-reward investment opportunity. This comprehensive analysis delves into the company's potential, its challenges, and what potential investors should consider before jumping in. The company's innovative approach to nuclear fission offers a compelling narrative, but a thorough understanding of the risks involved is crucial.

What is Oklo?

Oklo is developing advanced, small modular reactors (SMRs) for electricity generation. Their technology focuses on enhanced safety features and a significantly reduced environmental footprint compared to traditional nuclear power plants. This focus on smaller, safer reactors is a key differentiator in a market increasingly concerned about nuclear waste and safety. They aim to provide a cleaner and more efficient energy source, tapping into the growing global demand for sustainable alternatives.

Oklo's Technology and Business Model:

Oklo's core technology revolves around its proprietary reactor design. This design promises enhanced safety, reduced waste, and potentially lower construction costs compared to traditional reactors. This innovative approach is a major factor driving investor interest. Their business model involves designing, constructing, and potentially operating these SMRs, either independently or in partnership with utilities and energy companies.

Key Factors to Consider for Potential Investors:

- Regulatory hurdles: The nuclear energy industry is heavily regulated. Navigating these regulations, securing licensing, and demonstrating the safety and efficacy of their technology will be crucial for Oklo's success. Delays in regulatory approvals could significantly impact the company's timeline and profitability.

- Market competition: The nuclear energy sector is witnessing increased competition from other SMR developers and renewable energy sources. Oklo's ability to differentiate itself and secure market share will be vital for long-term growth.

- Financing and capital requirements: Developing and deploying nuclear reactors requires substantial capital investment. Oklo's ability to secure funding and manage its financial resources effectively will be a significant determinant of its success.

- Technological risks: While Oklo's technology shows promise, there's inherent risk associated with any new technology. Unforeseen technical challenges or delays could impact project timelines and costs.

- Public perception: Public opinion on nuclear energy remains a significant factor. Oklo will need to effectively communicate the safety and environmental benefits of its technology to garner public support and acceptance.

Oklo Stock Performance and Valuation:

Analyzing Oklo's stock performance requires a nuanced approach. Given its relatively recent entry into the public market, historical data is limited. However, examining factors such as the company's progress on regulatory approvals, technological advancements, and securing partnerships will provide crucial insights into its future potential. Comparing Oklo's valuation to competitors in the nuclear energy and renewable energy sectors can also offer a benchmark for assessing its investment potential. It's crucial to consult with a financial advisor before making any investment decisions.

Conclusion:

Oklo presents an interesting opportunity for investors interested in the nuclear energy sector and sustainable energy solutions. However, it's essential to acknowledge the inherent risks associated with this high-growth, early-stage company. Thorough due diligence, a long-term investment horizon, and a clear understanding of the potential challenges are crucial for anyone considering investing in Oklo stock. Remember to always consult a financial professional before making any investment decisions. This analysis should not be considered financial advice.

Further Research:

- Visit Oklo's official investor relations website for more detailed financial information and company updates.

- Consult financial news sources and analyst reports for independent perspectives on Oklo's prospects.

This article provides a general overview and is not intended as financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oklo Stock Analysis: A Guide For Potential Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

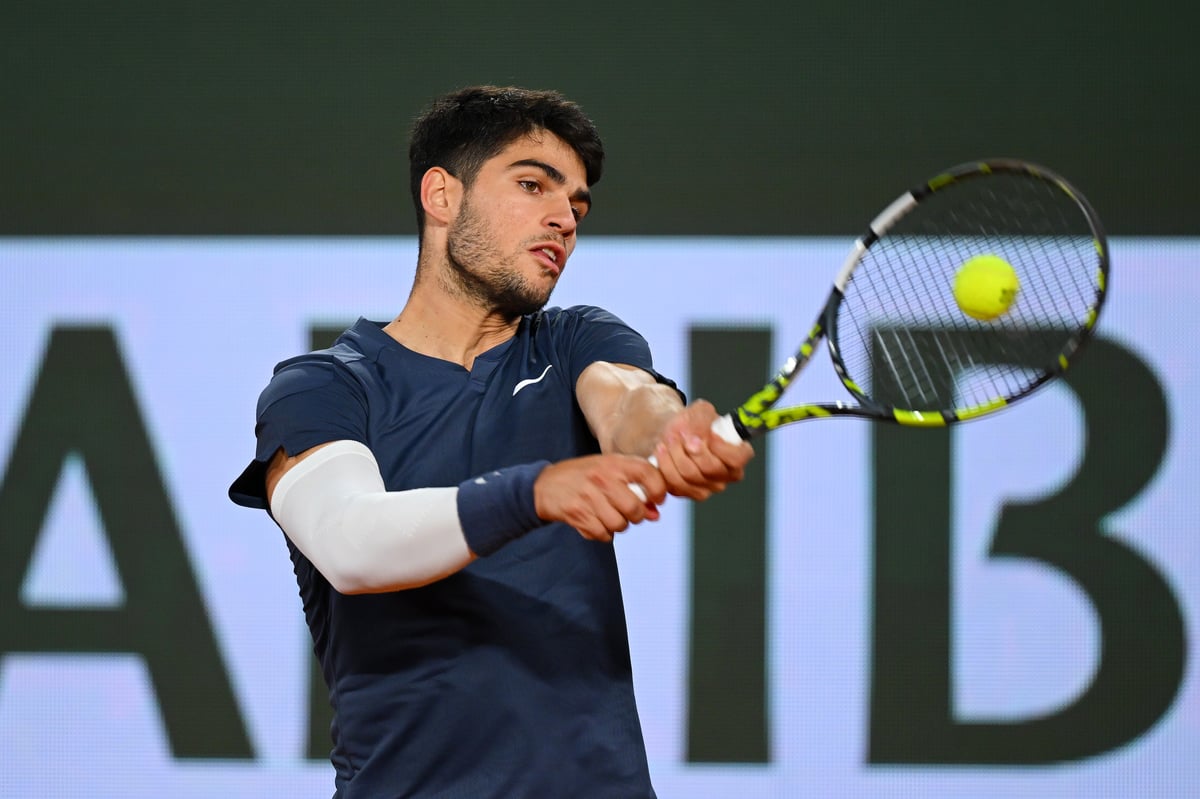

French Open 2025 Uk Coverage Find Your Best Live Stream And Tv Channel

May 27, 2025

French Open 2025 Uk Coverage Find Your Best Live Stream And Tv Channel

May 27, 2025 -

Oregon Man Quits Job Cashes 401 K Sails To Hawaii With Cat

May 27, 2025

Oregon Man Quits Job Cashes 401 K Sails To Hawaii With Cat

May 27, 2025 -

Njat Mejzh Asay Nwjwan Tbryzy Az Myan Dywar Tlash By Wqfh Atsh Nshanan

May 27, 2025

Njat Mejzh Asay Nwjwan Tbryzy Az Myan Dywar Tlash By Wqfh Atsh Nshanan

May 27, 2025 -

Can Nvidia Maintain Its Ai Growth Trajectory The 43 Billion Challenge

May 27, 2025

Can Nvidia Maintain Its Ai Growth Trajectory The 43 Billion Challenge

May 27, 2025 -

Nathan Fielders Boldest Stunt Unpacking The The Rehearsal Season 2 Finale

May 27, 2025

Nathan Fielders Boldest Stunt Unpacking The The Rehearsal Season 2 Finale

May 27, 2025