Oklo (OKLO) Stock: Wedbush Maintains Outperform Rating, Raises Target To $55

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oklo (OKLO) Stock Soars: Wedbush's Buoyant Forecast Fuels Investor Confidence

Oklo, Inc. (OKLO), a pioneering company in advanced nuclear fission technology, saw its stock price surge following a positive outlook from Wedbush Securities. The investment firm maintained its "Outperform" rating on OKLO stock and significantly raised its price target to $55, igniting optimism among investors about the company's future prospects. This bullish prediction comes amidst a period of significant advancements for Oklo and growing interest in advanced nuclear energy solutions.

Wedbush's Rationale: A Vote of Confidence in Oklo's Technology

Wedbush's decision to elevate its price target underscores its confidence in Oklo's innovative approach to nuclear energy. The firm highlighted several key factors contributing to its positive assessment:

-

Technological Breakthroughs: Oklo's progress in developing its enriched uranium-fueled reactors has been impressive. The company is pushing boundaries in reactor design, aiming for enhanced safety and efficiency compared to traditional nuclear power plants. This focus on innovation is a major draw for investors seeking exposure to cutting-edge technology.

-

Growing Demand for Clean Energy: The global shift towards decarbonization is creating a significant demand for clean and reliable energy sources. Oklo's advanced nuclear technology is well-positioned to capitalize on this trend, offering a potential solution to reduce carbon emissions while providing a consistent energy supply. This aligns perfectly with the broader ESG (Environmental, Social, and Governance) investing trend.

-

Strategic Partnerships and Government Support: Oklo has secured key partnerships and is receiving increasing support from government agencies focused on advancing clean energy initiatives. These collaborations provide crucial validation and demonstrate the potential for widespread adoption of Oklo's technology. Such partnerships often de-risk investments for analysts and investors.

What Does This Mean for Investors?

The Wedbush upgrade represents a strong endorsement of Oklo's potential. The raised price target of $55 suggests significant upside potential for investors currently holding OKLO stock. However, it's crucial to remember that investing in the stock market always involves risk. While the outlook is positive, the nuclear energy sector is subject to regulatory changes and technological challenges.

Oklo's Path Forward: Challenges and Opportunities

While the future looks bright, Oklo faces challenges inherent in the development and deployment of advanced nuclear technology. These include:

-

Regulatory Hurdles: Navigating the regulatory landscape for new nuclear technologies can be complex and time-consuming. Securing the necessary approvals and licenses will be crucial for Oklo's success.

-

Competition: The clean energy sector is competitive, with various technologies vying for market share. Oklo will need to continue innovating and differentiating itself to maintain a leading position.

-

Capital Requirements: Developing and deploying advanced nuclear technology requires substantial capital investment. Oklo's ability to secure funding will be essential for its growth trajectory.

Investing in Oklo: A Risky but Potentially Rewarding Venture

Investing in Oklo presents a high-risk, high-reward opportunity. The company operates in a nascent but rapidly growing market, with the potential for substantial returns if its technology proves successful. However, investors should carefully consider the risks involved before making any investment decisions. It's always advisable to conduct thorough due diligence and seek professional financial advice before investing in any stock, especially those in emerging sectors.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oklo (OKLO) Stock: Wedbush Maintains Outperform Rating, Raises Target To $55. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nfl 2025 Schedule National Tv Exposure For Bengals Reflects High Expectations

May 27, 2025

Nfl 2025 Schedule National Tv Exposure For Bengals Reflects High Expectations

May 27, 2025 -

Roland Garros 2025 Emma Navarro Vs Jessica Bouzas Maneiro Match Analysis And Betting Tips

May 27, 2025

Roland Garros 2025 Emma Navarro Vs Jessica Bouzas Maneiro Match Analysis And Betting Tips

May 27, 2025 -

Phil Robertson Outspoken Christian And Duck Dynasty Patriarch Dies At 79

May 27, 2025

Phil Robertson Outspoken Christian And Duck Dynasty Patriarch Dies At 79

May 27, 2025 -

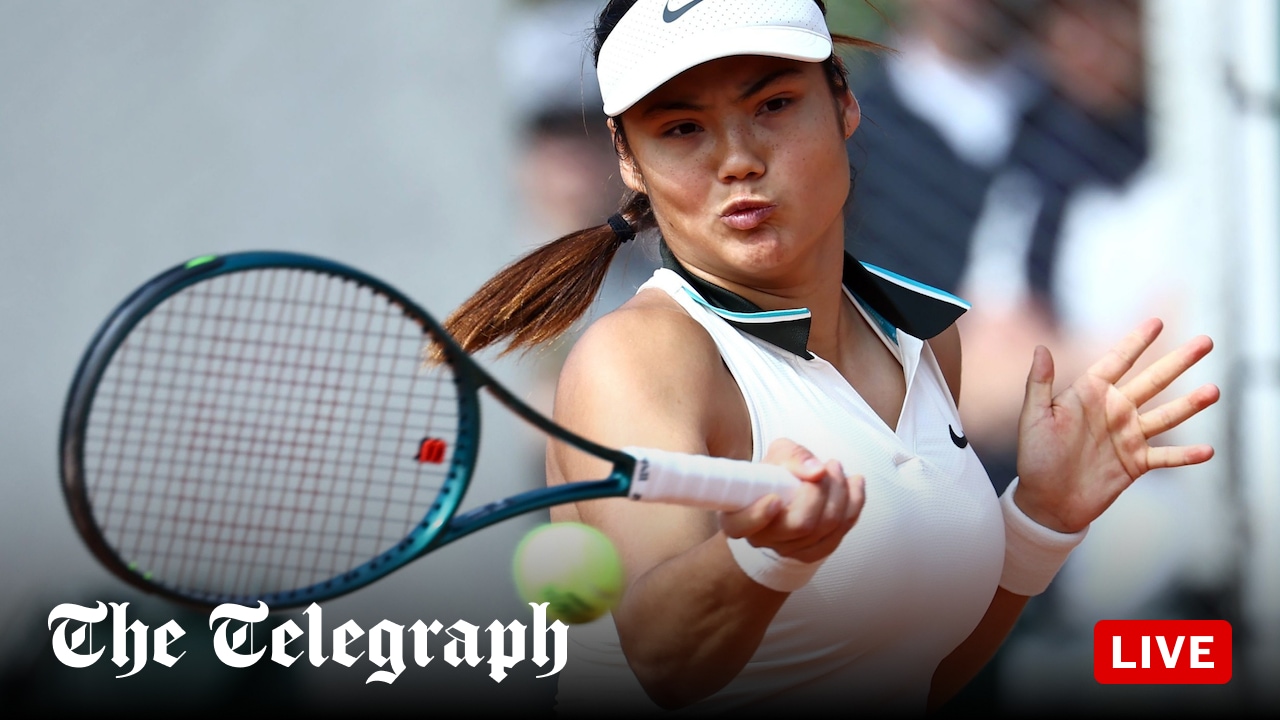

Raducanu Wang Xinyu French Open Clash Live Score Set Results And Analysis

May 27, 2025

Raducanu Wang Xinyu French Open Clash Live Score Set Results And Analysis

May 27, 2025 -

Investing In Oklo A Deep Dive Into Sustainable Energy And Stock Performance

May 27, 2025

Investing In Oklo A Deep Dive Into Sustainable Energy And Stock Performance

May 27, 2025