Oklo (OKLO) Receives Price Target Hike From Wedbush To $55

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oklo (OKLO) Stock Soars: Wedbush Raises Price Target to $55, Fueling Investor Optimism

Oklo, Inc. (OKLO), a leading developer of advanced nuclear fission technology, is experiencing a surge in investor confidence following a significant price target hike from Wedbush Securities. The investment firm boosted its price target for OKLO stock from $25 to $55, representing a substantial increase and signaling strong bullish sentiment surrounding the company's future prospects. This news sent ripples through the market, highlighting the growing interest in Oklo's innovative approach to nuclear energy.

This impressive price target hike reflects Wedbush's confidence in Oklo's potential to revolutionize the energy sector. The company is pioneering a new generation of nuclear reactors designed for enhanced safety, efficiency, and sustainability. This technology holds the promise of providing a clean and reliable energy source, addressing critical global challenges related to climate change and energy security.

What's Driving the Optimism?

Several factors contribute to Wedbush's increased price target for OKLO stock:

- Technological Breakthroughs: Oklo continues to make significant strides in its reactor development, demonstrating consistent progress towards commercialization. Recent advancements in reactor design and safety protocols have impressed analysts and investors alike.

- Growing Demand for Clean Energy: The global push for decarbonization is fueling increased demand for clean and sustainable energy sources. Oklo's technology aligns perfectly with this trend, positioning the company for significant market growth.

- Favorable Regulatory Environment: The regulatory landscape for advanced nuclear reactors is evolving positively, creating a more favorable environment for companies like Oklo to deploy their technology. This regulatory support is crucial for the successful commercialization of their innovative reactors.

- Strategic Partnerships: Oklo has been actively forging strategic partnerships with key players in the energy industry, further strengthening its position and accelerating its path to market. These alliances provide access to valuable resources and expertise.

Oklo's Vision for a Sustainable Energy Future

Oklo's vision extends beyond simply providing a clean energy source. The company is committed to developing a sustainable and responsible approach to nuclear energy, minimizing waste and maximizing safety. Their advanced reactor designs incorporate innovative features that address long-standing concerns about nuclear waste disposal and reactor safety.

This commitment to sustainability resonates strongly with environmentally conscious investors, further contributing to the growing appeal of OKLO stock.

Investing in Oklo: Considerations for Investors

While the increased price target is encouraging, potential investors should conduct thorough due diligence before making any investment decisions. The nuclear energy sector is inherently complex and subject to various regulatory and technological challenges. Understanding these risks is crucial before investing in OKLO stock. It's always advisable to consult with a qualified financial advisor before making any investment choices.

Looking Ahead:

The upward revision of Oklo's price target by Wedbush represents a significant vote of confidence in the company's future. With continued technological advancements, strategic partnerships, and a supportive regulatory environment, Oklo is well-positioned to play a significant role in shaping the future of clean energy. The journey towards commercialization remains dynamic, but the current trajectory suggests significant potential for investors willing to embrace the risks and rewards associated with this cutting-edge technology. Keep an eye on OKLO – this is a company to watch in the evolving landscape of sustainable energy solutions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oklo (OKLO) Receives Price Target Hike From Wedbush To $55. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Midweek Storms Possible In Orlando As Heat And Humidity Build

May 27, 2025

Midweek Storms Possible In Orlando As Heat And Humidity Build

May 27, 2025 -

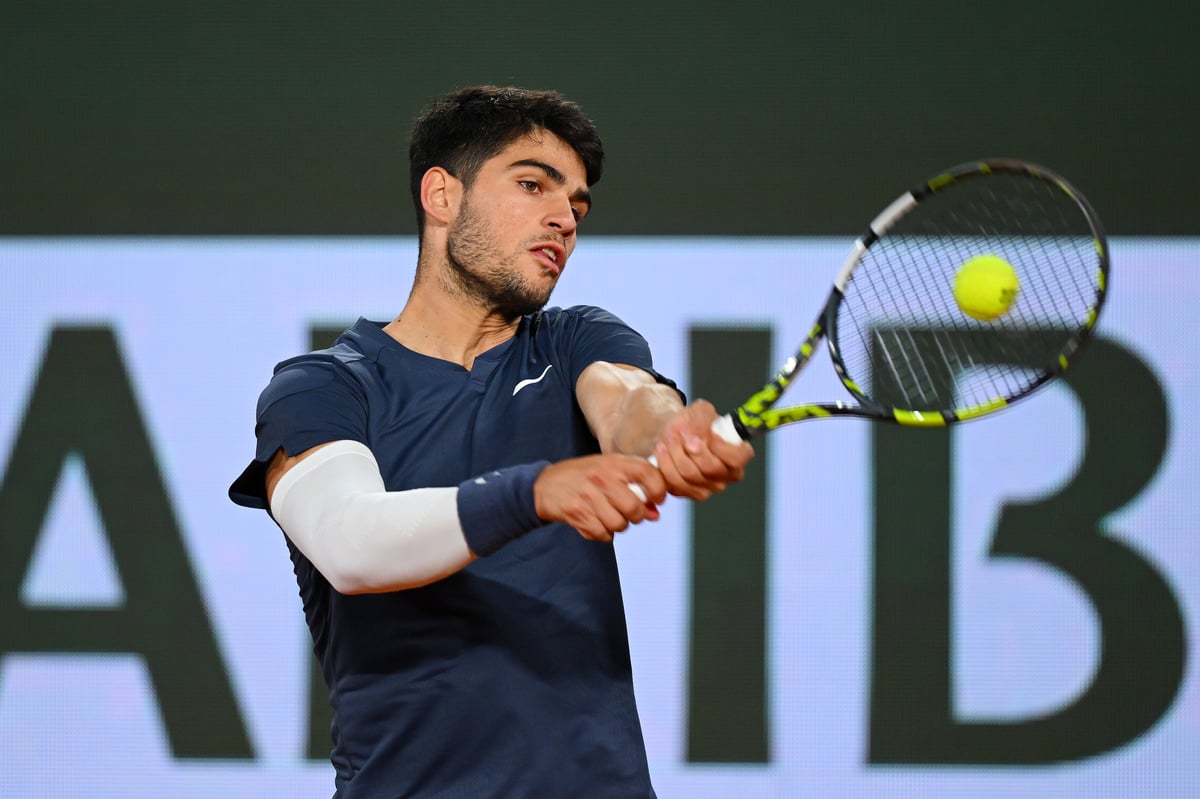

Roland Garros 2025 Live Stream Watch The French Open In The Uk

May 27, 2025

Roland Garros 2025 Live Stream Watch The French Open In The Uk

May 27, 2025 -

Phil Robertson 79 Death Of Duck Dynasty Patriarch Leaves Lasting Impact

May 27, 2025

Phil Robertson 79 Death Of Duck Dynasty Patriarch Leaves Lasting Impact

May 27, 2025 -

French Open 2025 Follow Live Updates From Day Two Featuring Top Players

May 27, 2025

French Open 2025 Follow Live Updates From Day Two Featuring Top Players

May 27, 2025 -

May 24 Powerball Results Check Winning Numbers 167 Million Prize

May 27, 2025

May 24 Powerball Results Check Winning Numbers 167 Million Prize

May 27, 2025