Oklo Inc. Stock Analysis: Evaluating The Future Of Advanced Nuclear Reactors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oklo Inc. Stock Analysis: Evaluating the Future of Advanced Nuclear Reactors

The energy sector is undergoing a seismic shift, with a growing emphasis on clean and sustainable alternatives. Amidst this transformation, Oklo Inc., a company pioneering advanced nuclear reactors, has emerged as a focal point for investors intrigued by both the potential rewards and inherent risks of this burgeoning field. This article provides a comprehensive stock analysis of Oklo Inc., exploring its technology, market position, and the factors influencing its future prospects.

Oklo's Innovative Approach to Nuclear Energy

Oklo's core business revolves around developing and deploying advanced, small modular reactors (SMRs). Unlike traditional large-scale nuclear power plants, SMRs offer several advantages, including:

- Enhanced Safety: Their smaller size and inherent design features significantly reduce the risk of meltdowns and other catastrophic accidents.

- Reduced Costs: SMR construction is potentially cheaper and faster than traditional reactors, leading to lower overall energy production costs.

- Improved Waste Management: SMRs produce less nuclear waste, simplifying disposal and minimizing long-term environmental impact.

- Flexibility and Deployability: Their compact size allows for deployment in a wider range of locations, including remote areas with limited infrastructure.

Oklo's technology focuses on using enriched uranium fuel in a unique reactor design. This approach promises higher efficiency and potentially lower operating costs compared to traditional reactor designs. Their Aurora reactor is currently undergoing licensing and development, representing a crucial milestone for the company's future.

Market Potential and Competitive Landscape

The market for advanced nuclear reactors is poised for significant growth. The global demand for clean energy is rapidly increasing, and nuclear power offers a reliable, carbon-free alternative to fossil fuels. However, Oklo faces competition from other companies developing SMR technology, including established players and innovative startups. The success of Oklo will depend on its ability to secure regulatory approvals, attract investment, and successfully bring its Aurora reactor to market ahead of its competitors. [Link to article on SMR market growth]

Analyzing Oklo Inc. Stock: Factors to Consider

Investing in Oklo Inc. stock involves a high degree of risk. The company is still in the development phase, and there's no guarantee that its technology will be commercially successful. Investors should carefully consider several factors before investing:

- Regulatory Hurdles: Navigating the complex regulatory landscape for nuclear power is a significant challenge. Delays in obtaining necessary approvals could impact Oklo's timeline and financial performance.

- Technological Risks: Unforeseen technical challenges during the development and deployment of the Aurora reactor could lead to cost overruns and delays.

- Financial Stability: Oklo's financial performance will be crucial in determining its long-term viability. Investors should analyze its cash flow, debt levels, and overall financial health.

- Market Competition: The competitive landscape for SMR technology is intense. Oklo's ability to differentiate its technology and capture market share will be critical to its success.

Conclusion: A High-Risk, High-Reward Investment

Oklo Inc. represents a compelling investment opportunity for those with a high risk tolerance and a long-term perspective. The potential rewards are substantial, given the growing demand for clean energy and the innovative nature of Oklo's technology. However, investors must carefully weigh the significant risks involved, including regulatory hurdles, technological challenges, and intense competition. Thorough due diligence is essential before investing in Oklo Inc. stock. Consult with a financial advisor to determine if this investment aligns with your risk profile and investment goals. [Link to Oklo Inc. investor relations page]

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oklo Inc. Stock Analysis: Evaluating The Future Of Advanced Nuclear Reactors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

150 Gain In 60 Days Is This Ai Stock The Investment Opportunity Of 2024

May 28, 2025

150 Gain In 60 Days Is This Ai Stock The Investment Opportunity Of 2024

May 28, 2025 -

French Open 2025 In Depth Prediction For Beatriz Haddad Maia Vs Hailey Baptiste

May 28, 2025

French Open 2025 In Depth Prediction For Beatriz Haddad Maia Vs Hailey Baptiste

May 28, 2025 -

Weeks Of Famine Culminate In Chaos During First Us Aid Drop In Gaza

May 28, 2025

Weeks Of Famine Culminate In Chaos During First Us Aid Drop In Gaza

May 28, 2025 -

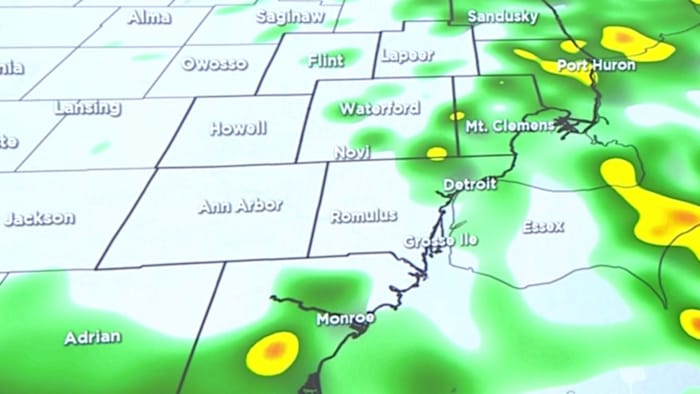

Scattered Showers To Hit Metro Detroit Your Week Ahead

May 28, 2025

Scattered Showers To Hit Metro Detroit Your Week Ahead

May 28, 2025 -

Mild Day Ahead Then A Cool Down Your Metro Detroit Weather Forecast

May 28, 2025

Mild Day Ahead Then A Cool Down Your Metro Detroit Weather Forecast

May 28, 2025