Oklo Inc. (OKLO): Wedbush Maintains Outperform Rating, Raises Target To $55

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oklo Inc. (OKLO): Wedbush's Vote of Confidence Sends Shares Soaring

Oklo Inc. (OKLO), a leading developer of advanced nuclear fission reactors, is experiencing a surge in investor confidence following a bullish upgrade from Wedbush Securities. The investment firm maintained its "Outperform" rating on Oklo stock, while simultaneously raising its price target from $40 to $55, representing a significant increase in projected value. This move underscores growing optimism surrounding Oklo's innovative technology and its potential to disrupt the energy sector.

Wedbush's Rationale: A Blend of Innovation and Market Potential

Wedbush's decision wasn't based on fleeting market trends. The firm highlighted Oklo's groundbreaking work in developing advanced, small modular reactors (SMRs). These reactors offer a compelling alternative to traditional nuclear power plants, boasting enhanced safety features, reduced waste production, and potentially lower construction costs. The analysts at Wedbush emphasized Oklo's progress in securing regulatory approvals and its strong potential for long-term growth within the burgeoning SMR market. Their report cited Oklo's technological advancements, experienced leadership team, and strategic partnerships as key factors contributing to their positive outlook.

What This Means for Investors:

This upgrade from a reputable firm like Wedbush carries significant weight in the investment community. The raised price target of $55 suggests a considerable upside potential for OKLO stock, attracting the attention of both current and prospective investors. However, it's crucial to remember that investing in the stock market always involves risk. While the outlook for Oklo appears promising, potential investors should conduct thorough due diligence and consider their individual risk tolerance before making any investment decisions.

Oklo's Progress: Beyond the Hype

Oklo's journey hasn't been without its challenges. The development and deployment of advanced nuclear technology is a complex undertaking, demanding significant investment and navigating stringent regulatory hurdles. However, the company has consistently demonstrated progress, achieving key milestones in its development program and securing crucial partnerships with industry leaders. This consistent progress is a significant factor contributing to Wedbush's optimistic assessment.

The Future of Nuclear Energy: Oklo's Role in the Transition

The global push towards cleaner and more sustainable energy sources presents a significant opportunity for companies like Oklo. As the world grapples with the need to reduce carbon emissions, advanced nuclear technologies, such as those developed by Oklo, could play a crucial role in powering a sustainable future. Oklo's SMRs offer a compelling solution, potentially providing a reliable, carbon-free energy source with reduced environmental impact compared to traditional fossil fuels.

Investing in Oklo: A Long-Term Perspective?

The Wedbush upgrade signifies a vote of confidence in Oklo's long-term prospects. While short-term market fluctuations are inevitable, the company's innovative technology and ambitious goals position it for potential significant growth in the years to come. However, investors should approach this opportunity with a long-term perspective, understanding that the development and deployment of advanced nuclear technology requires time and sustained effort.

Further Research and Disclaimer:

This article is for informational purposes only and should not be considered investment advice. Potential investors are strongly encouraged to conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. Always consider your own risk tolerance and investment objectives. Learn more about investing in the energy sector by exploring resources like the .

Keywords: Oklo Inc., OKLO stock, Wedbush Securities, Outperform rating, price target, small modular reactors (SMRs), advanced nuclear fission reactors, nuclear energy, sustainable energy, investment, stock market, energy sector, clean energy, renewable energy, investment advice, due diligence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oklo Inc. (OKLO): Wedbush Maintains Outperform Rating, Raises Target To $55. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cameron Brinks Return To The Los Angeles Sparks A Video Hints At Imminent Comeback

May 28, 2025

Cameron Brinks Return To The Los Angeles Sparks A Video Hints At Imminent Comeback

May 28, 2025 -

Fallen Troops Remembered Trumps Memorial Day Speech Sparks Political Debate

May 28, 2025

Fallen Troops Remembered Trumps Memorial Day Speech Sparks Political Debate

May 28, 2025 -

24 Analyst Predictions Forecasting Uber Technologies Growth Trajectory

May 28, 2025

24 Analyst Predictions Forecasting Uber Technologies Growth Trajectory

May 28, 2025 -

167 Million Powerball Winning Numbers Announced For May 24th Drawing

May 28, 2025

167 Million Powerball Winning Numbers Announced For May 24th Drawing

May 28, 2025 -

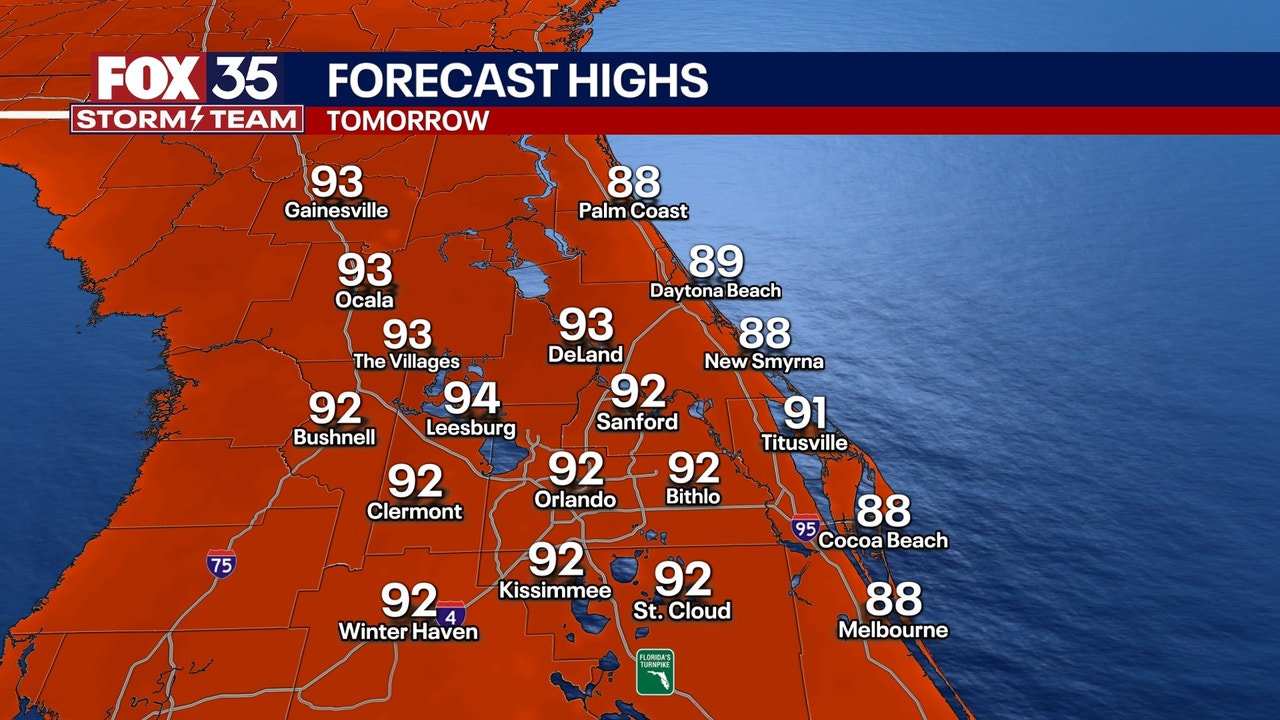

Orlando Weather Update Higher Temperatures Humidity And Elevated Storm Risk

May 28, 2025

Orlando Weather Update Higher Temperatures Humidity And Elevated Storm Risk

May 28, 2025