Oklo Inc. (OKLO) Stock Price Target Raised To $55 By Wedbush

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oklo Inc. (OKLO) Stock Price Target Soars to $55: Wedbush's Bullish Prediction Ignites Investor Interest

Oklo Inc. (OKLO), a leading player in the advanced nuclear reactor technology sector, is experiencing a surge in investor optimism following Wedbush Securities' significant upgrade of its price target. The investment firm boosted its target price for OKLO stock to $55, a substantial increase that reflects a bullish outlook on the company's future prospects. This move has sent ripples through the market, prompting increased interest and speculation about Oklo's potential for growth.

Why the Increased Optimism?

Wedbush's revised price target isn't simply a random guess; it's based on a comprehensive assessment of Oklo's technological advancements and the burgeoning demand for advanced nuclear energy solutions. The company's innovative approach to nuclear fission, focusing on smaller, safer, and more efficient reactors, is seen as a game-changer in the energy sector. Several factors contributed to Wedbush's decision:

-

Technological Breakthroughs: Oklo has consistently demonstrated progress in its reactor technology, successfully completing key milestones in design, development, and testing. These advancements have solidified investor confidence in the company's ability to deliver on its promises.

-

Growing Demand for Clean Energy: The global shift towards cleaner energy sources is undeniable. Oklo's advanced nuclear reactors offer a compelling alternative to traditional fossil fuels, providing a reliable and carbon-free baseload power source. This aligns perfectly with the growing global focus on sustainability and climate change mitigation.

-

Favorable Regulatory Environment: While navigating the regulatory landscape for nuclear technology can be complex, recent developments suggest a potentially more favorable environment for advanced reactor projects. This reduced regulatory uncertainty contributes to a more positive outlook for Oklo's future.

What Does This Mean for Investors?

The increased price target from Wedbush represents a significant vote of confidence in Oklo's long-term potential. However, it's crucial to remember that stock prices are inherently volatile and subject to market fluctuations. While this news is undeniably positive, investors should conduct their own thorough due diligence before making any investment decisions. Consider consulting with a qualified financial advisor to assess the risks and potential rewards associated with investing in OKLO stock.

Oklo's Future and the Advanced Nuclear Energy Sector:

Oklo is not alone in its pursuit of advanced nuclear energy solutions. The sector is attracting considerable attention and investment, fueled by the pressing need for clean and reliable energy. This increased interest is driving innovation and competition, ultimately benefiting consumers and the environment. Learn more about the future of advanced nuclear energy by exploring resources like the .

Beyond the Headlines: Understanding the Risks

While the $55 price target is exciting, it's important to acknowledge the inherent risks associated with investing in a company operating in a relatively new and complex sector. Potential challenges include:

-

Regulatory Hurdles: Navigating the regulatory landscape remains a significant undertaking for Oklo and other players in the advanced nuclear energy sector.

-

Technological Uncertainties: While progress has been significant, there are inherent risks associated with developing and deploying new technologies.

-

Market Competition: The advanced nuclear energy sector is becoming increasingly competitive, which could impact Oklo's market share.

Call to Action: Stay informed about Oklo Inc.'s progress and the evolving landscape of the advanced nuclear energy sector. Regularly review financial news and analyst reports to stay abreast of the latest developments and make informed investment decisions. Remember, this article is for informational purposes only and does not constitute financial advice.

This article aims to provide a comprehensive overview of the recent price target increase for Oklo Inc. (OKLO) stock. Remember to always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oklo Inc. (OKLO) Stock Price Target Raised To $55 By Wedbush. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dionne Polites Lauderhill Juneteenth 2025 Performance Announced

May 27, 2025

Dionne Polites Lauderhill Juneteenth 2025 Performance Announced

May 27, 2025 -

French Open 2025 Day 2 Live Scores Highlights And Match Results

May 27, 2025

French Open 2025 Day 2 Live Scores Highlights And Match Results

May 27, 2025 -

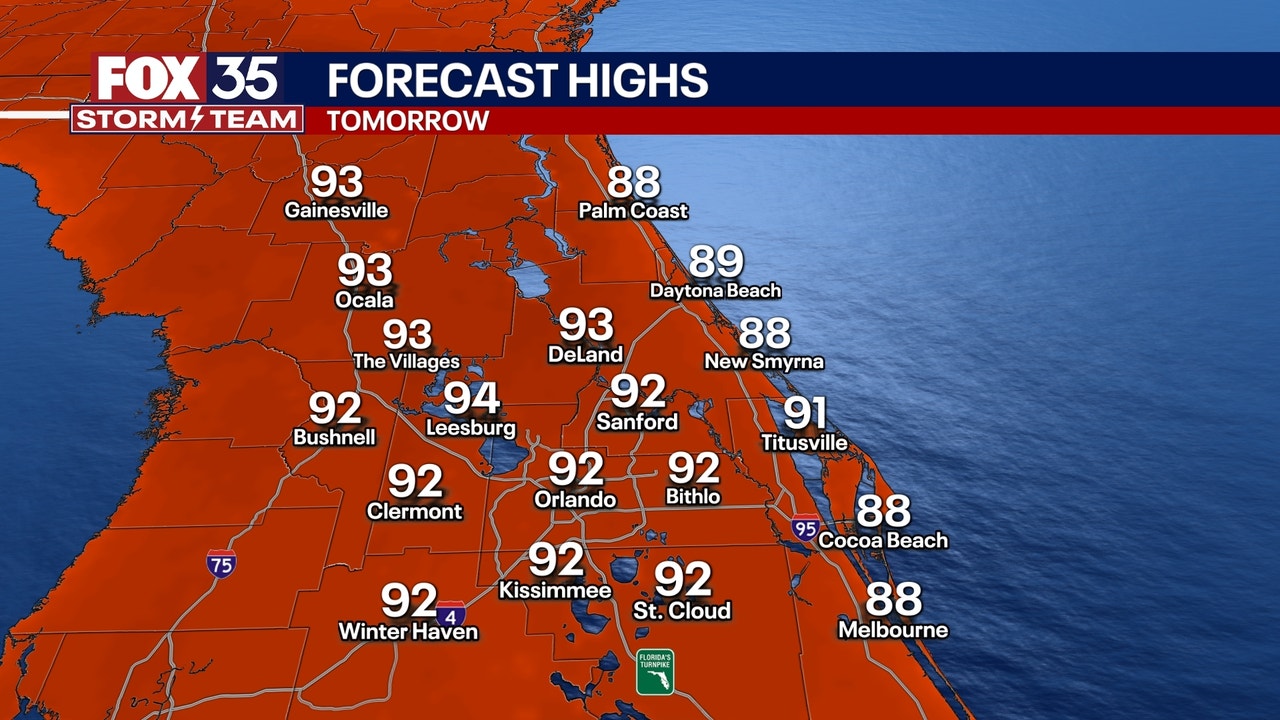

Rising Temperatures And Humidity In Orlando Midweek Storm Outlook

May 27, 2025

Rising Temperatures And Humidity In Orlando Midweek Storm Outlook

May 27, 2025 -

Core Weave Crwv Investment Outlook Citizens Jmps Cautious Stance

May 27, 2025

Core Weave Crwv Investment Outlook Citizens Jmps Cautious Stance

May 27, 2025 -

Analyst Outlook Uber Technologies Future Growth Potential And Price Targets

May 27, 2025

Analyst Outlook Uber Technologies Future Growth Potential And Price Targets

May 27, 2025